CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

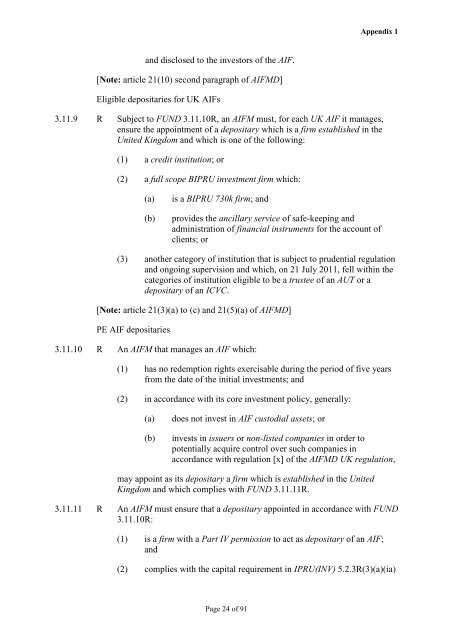

and disclosed to <strong>the</strong> investors <strong>of</strong> <strong>the</strong> AIF.<br />

[Note: article 21(10) second paragraph <strong>of</strong> AIFMD]<br />

Eligible depositaries for UK AIFs<br />

Page 24 <strong>of</strong> 91<br />

Appendix 1<br />

3.11.9 R Subject to FUND 3.11.10R, an AIFM must, for each UK AIF it manages,<br />

ensure <strong>the</strong> appointment <strong>of</strong> a depositary which is a firm established in <strong>the</strong><br />

United Kingdom and which is one <strong>of</strong> <strong>the</strong> following:<br />

(1) a credit institution; or<br />

(2) a full scope BIPRU investment firm which:<br />

(a) is a BIPRU 730k firm; and<br />

(b) provides <strong>the</strong> ancillary service <strong>of</strong> safe-keeping and<br />

<strong>admin</strong>istration <strong>of</strong> financial instruments for <strong>the</strong> account <strong>of</strong><br />

clients; or<br />

(3) ano<strong>the</strong>r category <strong>of</strong> institution that is subject to prudential regulation<br />

and ongoing supervision and which, on 21 July 2011, fell within <strong>the</strong><br />

categories <strong>of</strong> institution eligible to be a trustee <strong>of</strong> an AUT or a<br />

depositary <strong>of</strong> an ICVC.<br />

[Note: article 21(3)(a) to (c) and 21(5)(a) <strong>of</strong> AIFMD]<br />

PE AIF depositaries<br />

3.11.10 R An AIFM that manages an AIF which:<br />

(1) has no redemption rights exercisable during <strong>the</strong> period <strong>of</strong> five years<br />

from <strong>the</strong> date <strong>of</strong> <strong>the</strong> initial investments; and<br />

(2) in accordance with its core investment policy, generally:<br />

(a) does not invest in AIF custodial assets; or<br />

(b) invests in issuers or non-listed companies in order to<br />

potentially acquire control over such companies in<br />

accordance with regulation [x] <strong>of</strong> <strong>the</strong> AIFMD UK regulation,<br />

may appoint as its depositary a firm which is established in <strong>the</strong> United<br />

Kingdom and which complies with FUND 3.11.11R.<br />

3.11.11 R An AIFM must ensure that a depositary appointed in accordance with FUND<br />

3.11.10R:<br />

(1) is a firm with a Part IV permission to act as depositary <strong>of</strong> an AIF;<br />

and<br />

(2) complies with <strong>the</strong> capital requirement in IPRU(INV) 5.2.3R(3)(a)(ia)