CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

esources only at excessive cost.<br />

Page 43 <strong>of</strong> 91<br />

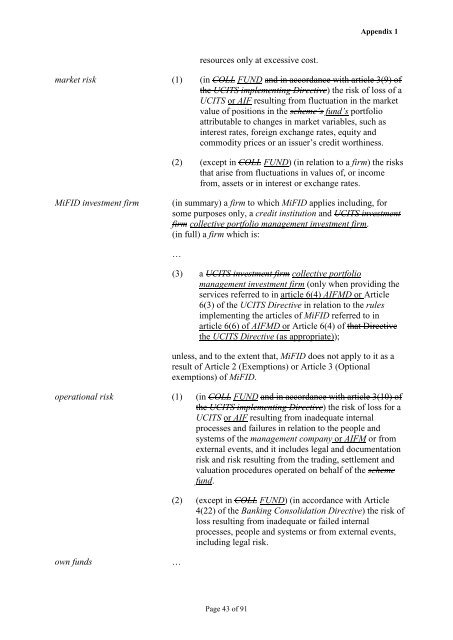

Appendix 1<br />

market risk (1) (in COLL FUND and in accordance with article 3(9) <strong>of</strong><br />

<strong>the</strong> UCITS implementing Directive) <strong>the</strong> risk <strong>of</strong> loss <strong>of</strong> a<br />

UCITS or AIF resulting from fluctuation in <strong>the</strong> market<br />

value <strong>of</strong> positions in <strong>the</strong> scheme’s fund’s portfolio<br />

attributable to changes in market variables, such as<br />

interest rates, foreign exchange rates, equity and<br />

commodity prices or an issuer’s credit worthiness.<br />

(2) (except in COLL FUND) (in relation to a firm) <strong>the</strong> risks<br />

that arise from fluctuations in values <strong>of</strong>, or income<br />

from, assets or in interest or exchange rates.<br />

MiFID investment firm (in summary) a firm to which MiFID applies including, for<br />

some purposes only, a credit institution and UCITS investment<br />

firm collective portfolio management investment firm.<br />

(in full) a firm which is:<br />

…<br />

(3) a UCITS investment firm collective portfolio<br />

management investment firm (only when providing <strong>the</strong><br />

services referred to in article 6(4) AIFMD or Article<br />

6(3) <strong>of</strong> <strong>the</strong> UCITS Directive in relation to <strong>the</strong> rules<br />

implementing <strong>the</strong> articles <strong>of</strong> MiFID referred to in<br />

article 6(6) <strong>of</strong> AIFMD or Article 6(4) <strong>of</strong> that Directive<br />

<strong>the</strong> UCITS Directive (as appropriate));<br />

unless, and to <strong>the</strong> extent that, MiFID does not apply to it as a<br />

result <strong>of</strong> Article 2 (Exemptions) or Article 3 (Optional<br />

exemptions) <strong>of</strong> MiFID.<br />

operational risk (1) (in COLL FUND and in accordance with article 3(10) <strong>of</strong><br />

<strong>the</strong> UCITS implementing Directive) <strong>the</strong> risk <strong>of</strong> loss for a<br />

UCITS or AIF resulting from inadequate internal<br />

processes and failures in relation to <strong>the</strong> people and<br />

systems <strong>of</strong> <strong>the</strong> management company or AIFM or from<br />

external events, and it includes legal and documentation<br />

risk and risk resulting from <strong>the</strong> trading, settlement and<br />

valuation procedures operated on behalf <strong>of</strong> <strong>the</strong> scheme<br />

fund.<br />

own funds …<br />

(2) (except in COLL FUND) (in accordance with Article<br />

4(22) <strong>of</strong> <strong>the</strong> Banking Consolidation Directive) <strong>the</strong> risk <strong>of</strong><br />

loss resulting from inadequate or failed internal<br />

processes, people and systems or from external events,<br />

including legal risk.