CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Transparency requirements<br />

Annex 1 X<br />

51. AIFMs will be required to provide or make available specified information to investors<br />

and regulators. These disclosure requirements fall into three categories: prior disclosure<br />

to investors, annual reporting to investors and reporting obligations to <strong>the</strong> FCA. 20<br />

Disclosure requirements regarding liquidity management, use <strong>of</strong> leverage and risk<br />

management are covered in <strong>the</strong> respective parts <strong>of</strong> this CBA.<br />

52. AIFMs will have to disclose certain information to investors before <strong>the</strong>y invest in <strong>the</strong> AIF<br />

(or if any material changes have been made). Many firms will have to update <strong>the</strong> contents <strong>of</strong><br />

<strong>the</strong>ir information for investors. However, because no particular format <strong>of</strong> disclosure is<br />

prescribed and firms will be able to carry on with <strong>the</strong>ir current business practice, we do not<br />

expect <strong>the</strong> requirement to impose significant costs on most firms. The cost ranges that firms<br />

identified in our survey are summarised below (Table 9).<br />

53. AIFMs will also be required to report to <strong>the</strong> FCA regularly on each AIF under <strong>the</strong>ir<br />

management. The frequency <strong>of</strong> reporting is based on a number <strong>of</strong> criteria such as <strong>the</strong><br />

AIFM’s assets in AIF portfolios, <strong>the</strong> size <strong>of</strong> particular AIFs, and <strong>the</strong> investment strategy<br />

<strong>of</strong> <strong>the</strong> AIFM.<br />

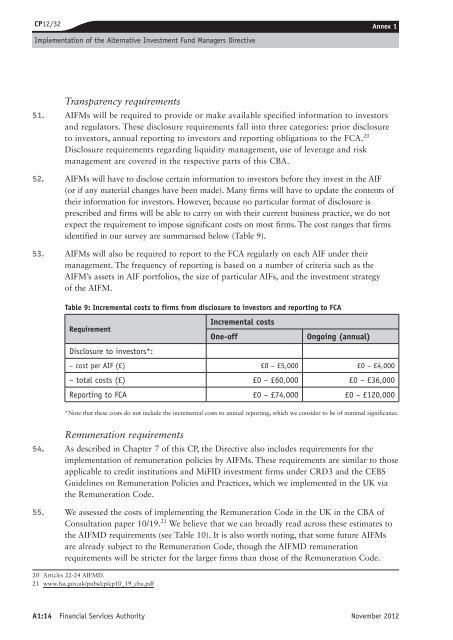

Table 9: Incremental costs to firms from disclosure to investors and reporting to FCA<br />

Requirement<br />

Disclosure to investors*:<br />

Incremental costs<br />

One-<strong>of</strong>f Ongoing (annual)<br />

– cost per AIF (£) £0 – £5,000 £0 – £4,000<br />

– total costs (£) £0 – £60,000 £0 – £36,000<br />

Reporting to FCA £0 – £74,000 £0 – £120,000<br />

*Note that <strong>the</strong>se costs do not include <strong>the</strong> incremental costs to annual reporting, which we consider to be <strong>of</strong> minimal significance.<br />

Remuneration requirements<br />

54. As described in Chapter 7 <strong>of</strong> this CP, <strong>the</strong> Directive also includes requirements for <strong>the</strong><br />

implementation <strong>of</strong> remuneration policies by AIFMs. These requirements are similar to those<br />

applicable to credit institutions and MiFID investment firms under CRD3 and <strong>the</strong> CEBS<br />

Guidelines on Remuneration Policies and Practices, which we implemented in <strong>the</strong> UK via<br />

<strong>the</strong> Remuneration Code.<br />

55. We assessed <strong>the</strong> costs <strong>of</strong> implementing <strong>the</strong> Remuneration Code in <strong>the</strong> UK in <strong>the</strong> CBA <strong>of</strong><br />

Consultation paper 10/19. 21 We believe that we can broadly read across <strong>the</strong>se estimates to<br />

<strong>the</strong> AIFMD requirements (see Table 10). It is also worth noting, that some future AIFMs<br />

are already subject to <strong>the</strong> Remuneration Code, though <strong>the</strong> AIFMD remuneration<br />

requirements will be stricter for <strong>the</strong> larger firms than those <strong>of</strong> <strong>the</strong> Remuneration Code.<br />

20 Articles 22-24 AIFMD.<br />

21 www.fsa.gov.uk/pubs/cp/cp10_19_cba.pdf<br />

A1:14 Financial Services Authority November 2012