CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 34 <strong>of</strong> 91<br />

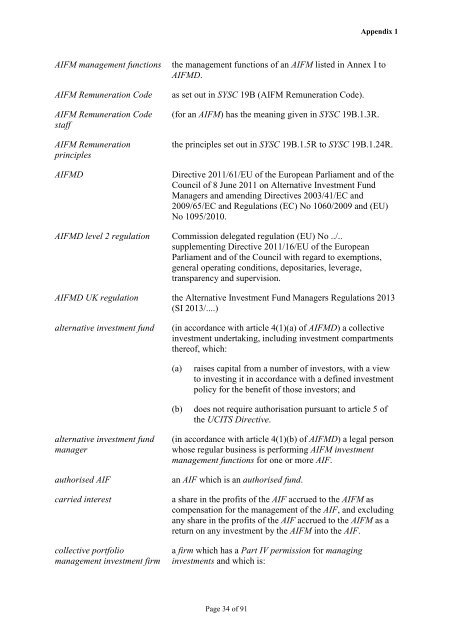

Appendix 1<br />

AIFM management functions <strong>the</strong> management functions <strong>of</strong> an AIFM listed in Annex I to<br />

AIFMD.<br />

AIFM Remuneration Code as set out in SYSC 19B (AIFM Remuneration Code).<br />

AIFM Remuneration Code<br />

staff<br />

AIFM Remuneration<br />

principles<br />

(for an AIFM) has <strong>the</strong> meaning given in SYSC 19B.1.3R.<br />

<strong>the</strong> principles set out in SYSC 19B.1.5R to SYSC 19B.1.24R.<br />

AIFMD Directive 2011/61/EU <strong>of</strong> <strong>the</strong> European Parliament and <strong>of</strong> <strong>the</strong><br />

Council <strong>of</strong> 8 June 2011 on <strong>Alternative</strong> Investment Fund<br />

Managers and amending Directives 2003/41/EC and<br />

2009/65/EC and Regulations (EC) No 1060/2009 and (EU)<br />

No 1095/2010.<br />

AIFMD level 2 regulation Commission delegated regulation (EU) No ../..<br />

supplementing Directive 2011/16/EU <strong>of</strong> <strong>the</strong> European<br />

Parliament and <strong>of</strong> <strong>the</strong> Council with regard to exemptions,<br />

general operating conditions, depositaries, leverage,<br />

transparency and supervision.<br />

AIFMD UK regulation <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Regulations 2013<br />

(SI 2013/....)<br />

alternative investment fund (in accordance with article 4(1)(a) <strong>of</strong> AIFMD) a collective<br />

investment undertaking, including investment compartments<br />

<strong>the</strong>re<strong>of</strong>, which:<br />

alternative investment fund<br />

manager<br />

(a) raises capital from a number <strong>of</strong> investors, with a view<br />

to investing it in accordance with a defined investment<br />

policy for <strong>the</strong> benefit <strong>of</strong> those investors; and<br />

(b) does not require authorisation pursuant to article 5 <strong>of</strong><br />

<strong>the</strong> UCITS Directive.<br />

(in accordance with article 4(1)(b) <strong>of</strong> AIFMD) a legal person<br />

whose regular business is performing AIFM investment<br />

management functions for one or more AIF.<br />

authorised AIF an AIF which is an authorised fund.<br />

carried interest a share in <strong>the</strong> pr<strong>of</strong>its <strong>of</strong> <strong>the</strong> AIF accrued to <strong>the</strong> AIFM as<br />

compensation for <strong>the</strong> management <strong>of</strong> <strong>the</strong> AIF, and excluding<br />

any share in <strong>the</strong> pr<strong>of</strong>its <strong>of</strong> <strong>the</strong> AIF accrued to <strong>the</strong> AIFM as a<br />

return on any investment by <strong>the</strong> AIFM into <strong>the</strong> AIF.<br />

collective portfolio<br />

management investment firm<br />

a firm which has a Part IV permission for managing<br />

investments and which is: