CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Liquidity management requirements<br />

Annex 1<br />

X<br />

44. AIFMD and <strong>the</strong> Level 2 Regulation, once adopted, include requirements on liquidity<br />

management for all open-ended AIFs and those AIFs which use leverage, for example, funds<br />

implementing global macro or commodity trading adviser (CTA) strategies. 15 Additionally,<br />

<strong>the</strong>re is a general requirement that AIFMs ensure consistency <strong>of</strong> <strong>the</strong> investment strategy,<br />

liquidity pr<strong>of</strong>ile and redemption policy <strong>of</strong> each AIF. 16 The requirements include:<br />

• Implementing and maintaining systems and procedures to manage and monitor<br />

liquidity risk within <strong>the</strong> AIF and ensure that <strong>the</strong> liquidity pr<strong>of</strong>ile <strong>of</strong> investments <strong>of</strong> <strong>the</strong><br />

AIF complies with its underlying obligations.<br />

• Regularly (at least annually) conducting stress tests, under both normal and exceptional<br />

liquidity conditions.<br />

• Identifying and disclosing to investors <strong>the</strong> types <strong>of</strong> circumstances where liquidity<br />

management tools and arrangements (e.g. gates, suspensions, side pockets) will be used<br />

in both normal and exceptional circumstances.<br />

45. 57% <strong>of</strong> survey respondents suggested that <strong>the</strong>y will incur more than minimal costs<br />

because <strong>of</strong> this requirement (Table 7). Those firms that will not incur additional significant<br />

costs ei<strong>the</strong>r already have compliant systems in place or were not affected due to <strong>the</strong>ir<br />

investment strategies.<br />

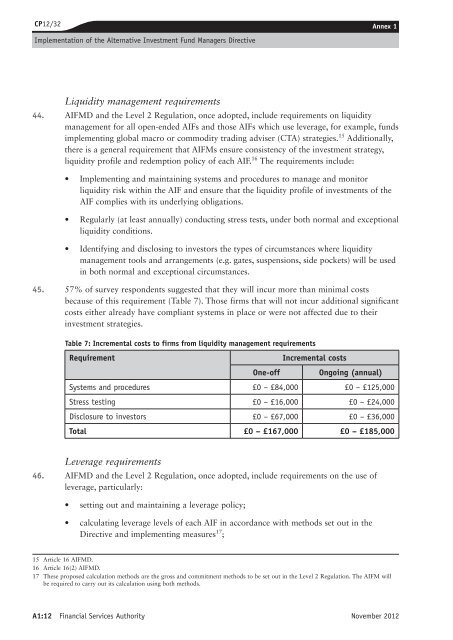

Table 7: Incremental costs to firms from liquidity management requirements<br />

Requirement Incremental costs<br />

One-<strong>of</strong>f Ongoing (annual)<br />

Systems and procedures £0 – £84,000 £0 – £125,000<br />

Stress testing £0 – £16,000 £0 – £24,000<br />

Disclosure to investors £0 – £67,000 £0 – £36,000<br />

Total £0 – £167,000 £0 – £185,000<br />

Leverage requirements<br />

46. AIFMD and <strong>the</strong> Level 2 Regulation, once adopted, include requirements on <strong>the</strong> use <strong>of</strong><br />

leverage, particularly:<br />

• setting out and maintaining a leverage policy;<br />

• calculating leverage levels <strong>of</strong> each AIF in accordance with methods set out in <strong>the</strong><br />

Directive and implementing measures 17 ;<br />

15 Article 16 AIFMD.<br />

16 Article 16(2) AIFMD.<br />

17 These proposed calculation methods are <strong>the</strong> gross and commitment methods to be set out in <strong>the</strong> Level 2 Regulation. The AIFM will<br />

be required to carry out its calculation using both methods.<br />

A1:12 Financial Services Authority November 2012