CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

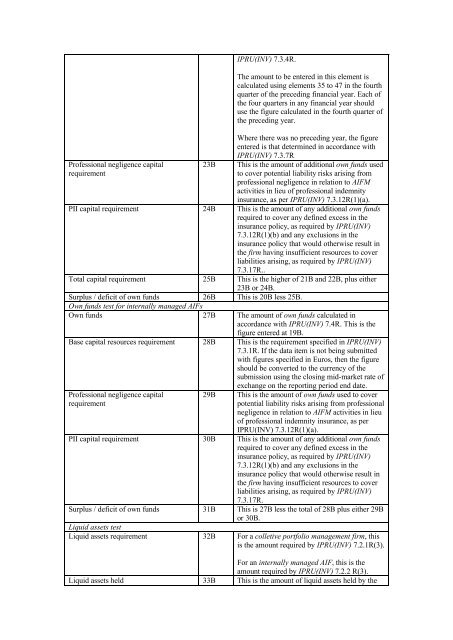

Pr<strong>of</strong>essional negligence capital<br />

requirement<br />

IPRU(INV) 7.3.4R.<br />

The amount to be entered in this element is<br />

calculated using elements 35 to 47 in <strong>the</strong> fourth<br />

quarter <strong>of</strong> <strong>the</strong> preceding financial year. Each <strong>of</strong><br />

<strong>the</strong> four quarters in any financial year should<br />

use <strong>the</strong> figure calculated in <strong>the</strong> fourth quarter <strong>of</strong><br />

<strong>the</strong> preceding year.<br />

Where <strong>the</strong>re was no preceding year, <strong>the</strong> figure<br />

entered is that determined in accordance with<br />

IPRU(INV) 7.3.7R<br />

23B This is <strong>the</strong> amount <strong>of</strong> additional own funds used<br />

to cover potential liability risks arising from<br />

pr<strong>of</strong>essional negligence in relation to AIFM<br />

activities in lieu <strong>of</strong> pr<strong>of</strong>essional indemnity<br />

insurance, as per IPRU(INV) 7.3.12R(1)(a).<br />

PII capital requirement 24B This is <strong>the</strong> amount <strong>of</strong> any additional own funds<br />

required to cover any defined excess in <strong>the</strong><br />

insurance policy, as required by IPRU(INV)<br />

7.3.12R(1)(b) and any exclusions in <strong>the</strong><br />

insurance policy that would o<strong>the</strong>rwise result in<br />

<strong>the</strong> firm having insufficient resources to cover<br />

liabilities arising, as required by IPRU(INV)<br />

7.3.17R..<br />

Total capital requirement 25B This is <strong>the</strong> higher <strong>of</strong> 21B and 22B, plus ei<strong>the</strong>r<br />

23B or 24B.<br />

Surplus / deficit <strong>of</strong> own funds 26B This is 20B less 25B.<br />

Own funds test for internally managed AIFs<br />

Own funds 27B The amount <strong>of</strong> own funds calculated in<br />

accordance with IPRU(INV) 7.4R. This is <strong>the</strong><br />

figure entered at 19B.<br />

Base capital resources requirement 28B This is <strong>the</strong> requirement specified in IPRU(INV)<br />

7.3.1R. If <strong>the</strong> data item is not being submitted<br />

with figures specified in Euros, <strong>the</strong>n <strong>the</strong> figure<br />

should be converted to <strong>the</strong> currency <strong>of</strong> <strong>the</strong><br />

submission using <strong>the</strong> closing mid-market rate <strong>of</strong><br />

Pr<strong>of</strong>essional negligence capital<br />

requirement<br />

exchange on <strong>the</strong> reporting period end date.<br />

29B This is <strong>the</strong> amount <strong>of</strong> own funds used to cover<br />

potential liability risks arising from pr<strong>of</strong>essional<br />

negligence in relation to AIFM activities in lieu<br />

<strong>of</strong> pr<strong>of</strong>essional indemnity insurance, as per<br />

IPRU(INV) 7.3.12R(1)(a).<br />

PII capital requirement 30B This is <strong>the</strong> amount <strong>of</strong> any additional own funds<br />

required to cover any defined excess in <strong>the</strong><br />

insurance policy, as required by IPRU(INV)<br />

7.3.12R(1)(b) and any exclusions in <strong>the</strong><br />

insurance policy that would o<strong>the</strong>rwise result in<br />

<strong>the</strong> firm having insufficient resources to cover<br />

liabilities arising, as required by IPRU(INV)<br />

7.3.17R.<br />

Surplus / deficit <strong>of</strong> own funds 31B This is 27B less <strong>the</strong> total <strong>of</strong> 28B plus ei<strong>the</strong>r 29B<br />

or 30B.<br />

Liquid assets test<br />

Liquid assets requirement <strong>32</strong>B For a colletive portfolio management firm, this<br />

is <strong>the</strong> amount required by IPRU(INV) 7.2.1R(3).<br />

For an internally managed AIF, this is <strong>the</strong><br />

amount required by IPRU(INV) 7.2.2 R(3).<br />

Liquid assets held 33B This is <strong>the</strong> amount <strong>of</strong> liquid assets held by <strong>the</strong>