CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

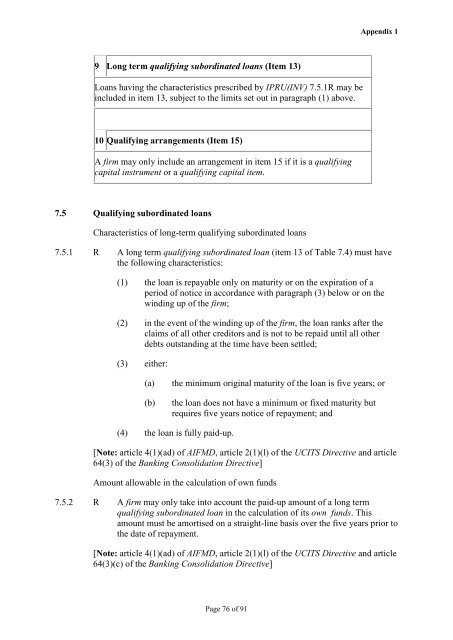

9 Long term qualifying subordinated loans (Item 13)<br />

Loans having <strong>the</strong> characteristics prescribed by IPRU(INV) 7.5.1R may be<br />

included in item 13, subject to <strong>the</strong> limits set out in paragraph (1) above.<br />

10 Qualifying arrangements (Item 15)<br />

A firm may only include an arrangement in item 15 if it is a qualifying<br />

capital instrument or a qualifying capital item.<br />

7.5 Qualifying subordinated loans<br />

Characteristics <strong>of</strong> long-term qualifying subordinated loans<br />

Page 76 <strong>of</strong> 91<br />

Appendix 1<br />

7.5.1 R A long term qualifying subordinated loan (item 13 <strong>of</strong> Table 7.4) must have<br />

<strong>the</strong> following characteristics:<br />

(1) <strong>the</strong> loan is repayable only on maturity or on <strong>the</strong> expiration <strong>of</strong> a<br />

period <strong>of</strong> notice in accordance with paragraph (3) below or on <strong>the</strong><br />

winding up <strong>of</strong> <strong>the</strong> firm;<br />

(2) in <strong>the</strong> event <strong>of</strong> <strong>the</strong> winding up <strong>of</strong> <strong>the</strong> firm, <strong>the</strong> loan ranks after <strong>the</strong><br />

claims <strong>of</strong> all o<strong>the</strong>r creditors and is not to be repaid until all o<strong>the</strong>r<br />

debts outstanding at <strong>the</strong> time have been settled;<br />

(3) ei<strong>the</strong>r:<br />

(a) <strong>the</strong> minimum original maturity <strong>of</strong> <strong>the</strong> loan is five years; or<br />

(b) <strong>the</strong> loan does not have a minimum or fixed maturity but<br />

requires five years notice <strong>of</strong> repayment; and<br />

(4) <strong>the</strong> loan is fully paid-up.<br />

[Note: article 4(1)(ad) <strong>of</strong> AIFMD, article 2(1)(l) <strong>of</strong> <strong>the</strong> UCITS Directive and article<br />

64(3) <strong>of</strong> <strong>the</strong> Banking Consolidation Directive]<br />

Amount allowable in <strong>the</strong> calculation <strong>of</strong> own funds<br />

7.5.2 R A firm may only take into account <strong>the</strong> paid-up amount <strong>of</strong> a long term<br />

qualifying subordinated loan in <strong>the</strong> calculation <strong>of</strong> its own funds. This<br />

amount must be amortised on a straight-line basis over <strong>the</strong> five years prior to<br />

<strong>the</strong> date <strong>of</strong> repayment.<br />

[Note: article 4(1)(ad) <strong>of</strong> AIFMD, article 2(1)(l) <strong>of</strong> <strong>the</strong> UCITS Directive and article<br />

64(3)(c) <strong>of</strong> <strong>the</strong> Banking Consolidation Directive]