CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annex 7<br />

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Feedback on DP12/1<br />

1. In this paper we make proposals for rules and guidance taking into account responses to<br />

some <strong>of</strong> <strong>the</strong> questions asked in DP12/1. These are tabled below.<br />

2. We posed a number <strong>of</strong> questions in DP12/1 with <strong>the</strong> expectation that some <strong>of</strong> <strong>the</strong><br />

Directive’s implementing measures would be adopted using Level 2 Directives, giving us a<br />

margin <strong>of</strong> discretion as to how we might transpose <strong>the</strong> Level 1 requirements. However, <strong>the</strong><br />

Commission’s decision to implement most <strong>of</strong> <strong>the</strong> Level 2 measures through a directly<br />

applicable Regulation has meant that we now have no national discretion in many areas<br />

where responses to our DP questions would have shaped our approach. For this reason, we<br />

have not given feedback on every question in DP12/1.<br />

3. Some DP questions covered matters relating to domestic UK rules but not pertaining<br />

directly to AIFM implementation. Where we have decided not to take <strong>the</strong>se forward as part<br />

<strong>of</strong> our work on AIFMD implementation, we have indicated this in <strong>the</strong> relevant chapter.<br />

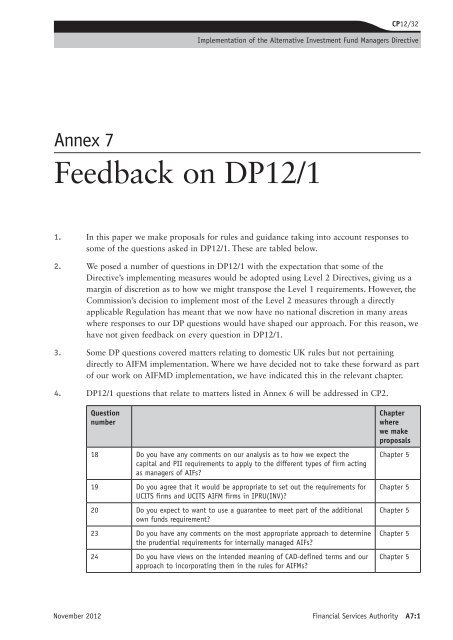

4. DP12/1 questions that relate to matters listed in Annex 6 will be addressed in CP2.<br />

Question<br />

number<br />

18 Do you have any comments on our analysis as to how we expect <strong>the</strong><br />

capital and PII requirements to apply to <strong>the</strong> different types <strong>of</strong> firm acting<br />

as managers <strong>of</strong> AIFs?<br />

19 Do you agree that it would be appropriate to set out <strong>the</strong> requirements for<br />

UCITS firms and UCITS AIFM firms in IPRU(INV)?<br />

20 Do you expect to want to use a guarantee to meet part <strong>of</strong> <strong>the</strong> additional<br />

own funds requirement?<br />

23 Do you have any comments on <strong>the</strong> most appropriate approach to determine<br />

<strong>the</strong> prudential requirements for internally managed AIFs?<br />

24 Do you have views on <strong>the</strong> intended meaning <strong>of</strong> CAD-defined terms and our<br />

approach to incorporating <strong>the</strong>m in <strong>the</strong> rules for AIFMs?<br />

Chapter<br />

where<br />

we make<br />

proposals<br />

Chapter 5<br />

Chapter 5<br />

Chapter 5<br />

Chapter 5<br />

Chapter 5<br />

Financial Services Authority A7:1