CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

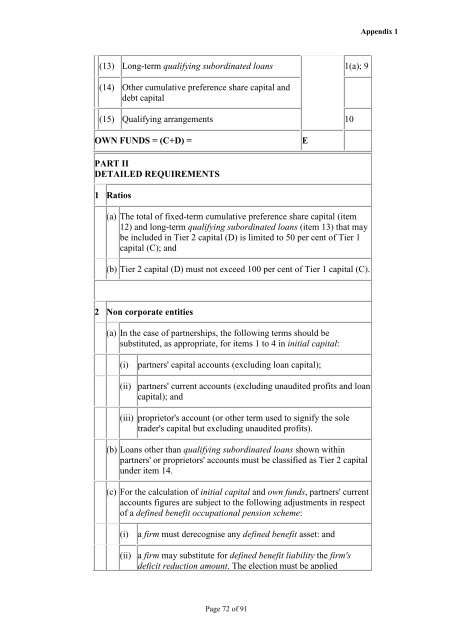

(13) Long-term qualifying subordinated loans 1(a); 9<br />

(14) O<strong>the</strong>r cumulative preference share capital and<br />

debt capital<br />

(15) Qualifying arrangements 10<br />

OWN FUNDS = (C+D) = E<br />

PART II<br />

DETAILED REQUIREMENTS<br />

1 Ratios<br />

(a) The total <strong>of</strong> fixed-term cumulative preference share capital (item<br />

12) and long-term qualifying subordinated loans (item 13) that may<br />

be included in Tier 2 capital (D) is limited to 50 per cent <strong>of</strong> Tier 1<br />

capital (C); and<br />

(b) Tier 2 capital (D) must not exceed 100 per cent <strong>of</strong> Tier 1 capital (C).<br />

2 Non corporate entities<br />

(a) In <strong>the</strong> case <strong>of</strong> partnerships, <strong>the</strong> following terms should be<br />

substituted, as appropriate, for items 1 to 4 in initial capital:<br />

(i) partners' capital accounts (excluding loan capital);<br />

(ii) partners' current accounts (excluding unaudited pr<strong>of</strong>its and loan<br />

capital); and<br />

(iii) proprietor's account (or o<strong>the</strong>r term used to signify <strong>the</strong> sole<br />

trader's capital but excluding unaudited pr<strong>of</strong>its).<br />

(b) Loans o<strong>the</strong>r than qualifying subordinated loans shown within<br />

partners' or proprietors' accounts must be classified as Tier 2 capital<br />

under item 14.<br />

(c) For <strong>the</strong> calculation <strong>of</strong> initial capital and own funds, partners' current<br />

accounts figures are subject to <strong>the</strong> following adjustments in respect<br />

<strong>of</strong> a defined benefit occupational pension scheme:<br />

(i) a firm must derecognise any defined benefit asset: and<br />

(ii) a firm may substitute for defined benefit liability <strong>the</strong> firm's<br />

deficit reduction amount. The election must be applied<br />

Page 72 <strong>of</strong> 91<br />

Appendix 1