CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annex 1<br />

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

as <strong>the</strong> risks addressed are <strong>the</strong> same. As UCITS firms are currently subject under UPRU to<br />

a similar requirement to deduct illiquid assets (which we propose to remove as part <strong>of</strong> this<br />

consultation), we expect that this requirement will not result in significant additional costs<br />

to firms.<br />

Valuation requirements<br />

40. AIFMD and <strong>the</strong> proposed implementing measures introduce requirements relating to <strong>the</strong><br />

valuation <strong>of</strong> AIF assets and <strong>the</strong> calculation <strong>of</strong> net asset value (NAV) per unit or share <strong>of</strong> an<br />

AIF. 12 In addition, <strong>the</strong> legislation details a number <strong>of</strong> requirements relating to <strong>the</strong><br />

appointment <strong>of</strong> an external valuer. 13<br />

41. Some AIFMs or AIFs may incur costs from <strong>the</strong>se requirements, particularly associated<br />

with <strong>the</strong> requirement to appoint an external valuer (where appropriate) and ensure that it<br />

continues to meet <strong>the</strong> Directive requirements, including obtaining a written statement <strong>of</strong> <strong>the</strong><br />

pr<strong>of</strong>essional guarantees where valuation is performed. 14<br />

42. Approximately 55% <strong>of</strong> respondents to our survey said <strong>the</strong>y are likely to incur more than<br />

minimal costs. This is consistent with <strong>the</strong> fact that <strong>the</strong> majority <strong>of</strong> respondents to <strong>the</strong> Deloitte<br />

survey indicated that <strong>the</strong> current valuation arrangements in <strong>the</strong>ir firms are satisfactory. Firms,<br />

however, noted that <strong>the</strong>re is still uncertainty about <strong>the</strong> definition <strong>of</strong> an external valuer, so it is<br />

difficult to estimate <strong>the</strong> costs. One firm even estimated valuation fees around £20,000-£30,000<br />

per asset. Table 6 summarises <strong>the</strong> results.<br />

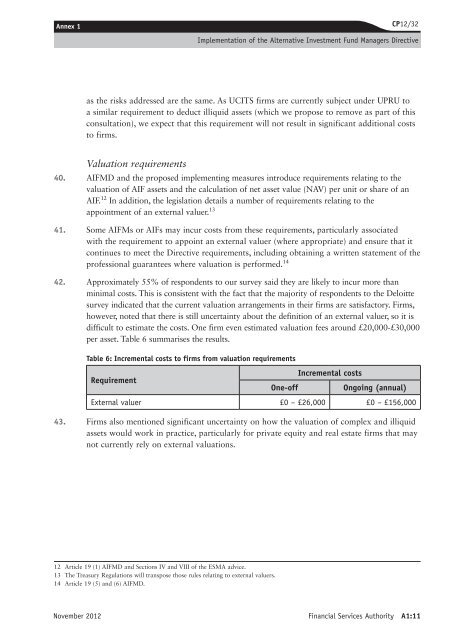

Table 6: Incremental costs to firms from valuation requirements<br />

Requirement<br />

Incremental costs<br />

One-<strong>of</strong>f Ongoing (annual)<br />

External valuer £0 – £26,000 £0 – £156,000<br />

43. Firms also mentioned significant uncertainty on how <strong>the</strong> valuation <strong>of</strong> complex and illiquid<br />

assets would work in practice, particularly for private equity and real estate firms that may<br />

not currently rely on external valuations.<br />

12 Article 19 (1) AIFMD and Sections IV and VIII <strong>of</strong> <strong>the</strong> ESMA advice.<br />

13 The Treasury Regulations will transpose those rules relating to external valuers.<br />

14 Article 19 (5) and (6) AIFMD.<br />

Financial Services Authority A1:11