CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Annex 1<br />

X<br />

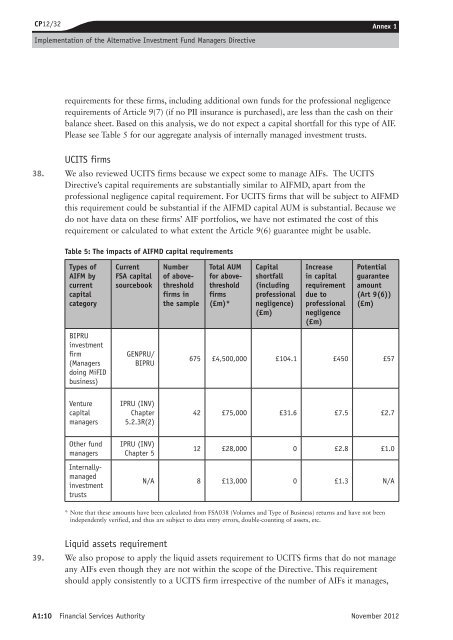

requirements for <strong>the</strong>se firms, including additional own funds for <strong>the</strong> pr<strong>of</strong>essional negligence<br />

requirements <strong>of</strong> Article 9(7) (if no PII insurance is purchased), are less than <strong>the</strong> cash on <strong>the</strong>ir<br />

balance sheet. Based on this analysis, we do not expect a capital shortfall for this type <strong>of</strong> AIF.<br />

Please see Table 5 for our aggregate analysis <strong>of</strong> internally managed investment trusts.<br />

UCITS firms<br />

38. We also reviewed UCITS firms because we expect some to manage AIFs. The UCITS<br />

Directive’s capital requirements are substantially similar to AIFMD, apart from <strong>the</strong><br />

pr<strong>of</strong>essional negligence capital requirement. For UCITS firms that will be subject to AIFMD<br />

this requirement could be substantial if <strong>the</strong> AIFMD capital AUM is substantial. Because we<br />

do not have data on <strong>the</strong>se firms’ AIF portfolios, we have not estimated <strong>the</strong> cost <strong>of</strong> this<br />

requirement or calculated to what extent <strong>the</strong> Article 9(6) guarantee might be usable.<br />

Table 5: The impacts <strong>of</strong> AIFMD capital requirements<br />

Types <strong>of</strong><br />

AIFM by<br />

current<br />

capital<br />

category<br />

BIPRU<br />

investment<br />

firm<br />

(Managers<br />

doing MiFID<br />

business)<br />

Venture<br />

capital<br />

managers<br />

O<strong>the</strong>r fund<br />

managers<br />

Internallymanaged<br />

investment<br />

trusts<br />

Current<br />

FSA capital<br />

sourcebook<br />

GENPRU/<br />

BIPRU<br />

IPRU (INV)<br />

Chapter<br />

5.2.3R(2)<br />

IPRU (INV)<br />

Chapter 5<br />

Number<br />

<strong>of</strong> abovethreshold<br />

firms in<br />

<strong>the</strong> sample<br />

Total AUM<br />

for abovethreshold<br />

firms<br />

(£m)*<br />

Capital<br />

shortfall<br />

(including<br />

pr<strong>of</strong>essional<br />

negligence)<br />

(£m)<br />

Increase<br />

in capital<br />

requirement<br />

due to<br />

pr<strong>of</strong>essional<br />

negligence<br />

(£m)<br />

Potential<br />

guarantee<br />

amount<br />

(Art 9(6))<br />

(£m)<br />

675 £4,500,000 £104.1 £450 £57<br />

42 £75,000 £31.6 £7.5 £2.7<br />

12 £28,000 0 £2.8 £1.0<br />

N/A 8 £13,000 0 £1.3 N/A<br />

* Note that <strong>the</strong>se amounts have been calculated from FSA038 (Volumes and Type <strong>of</strong> Business) returns and have not been<br />

independently verified, and thus are subject to data entry errors, double-counting <strong>of</strong> assets, etc.<br />

Liquid assets requirement<br />

39. We also propose to apply <strong>the</strong> liquid assets requirement to UCITS firms that do not manage<br />

any AIFs even though <strong>the</strong>y are not within <strong>the</strong> scope <strong>of</strong> <strong>the</strong> Directive. This requirement<br />

should apply consistently to a UCITS firm irrespective <strong>of</strong> <strong>the</strong> number <strong>of</strong> AIFs it manages,<br />

A1:10 Financial Services Authority November 2012