will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Apr-Jun 2013 Earn<strong>in</strong>gs Preview<br />

Depreciation of INR aga<strong>in</strong>st major currencies to boost topl<strong>in</strong>e but<br />

cast shadow <strong>in</strong> PAT for <strong>com</strong>panies with forex debt<br />

Rupee has depreciated by 6.4% YoY aga<strong>in</strong>st the USD and 3.7% YoY aga<strong>in</strong>st Euro.<br />

This would benefit sales growth for frontl<strong>in</strong>e pharma <strong>com</strong>panies with high exposure<br />

to US and EU exports. The benefits would however limited to <strong>com</strong>panies with lower<br />

hedge of USD/Euro exports. Hence, the benefit would not be available to Dr. Reddy’s<br />

Labs and Ranbaxy as those <strong>com</strong>panies have significant hedge <strong>in</strong> foreign currency.<br />

The <strong>com</strong>panies with limited hedge such as Lup<strong>in</strong>, Sun Pharma, Glenmark, Cadila and<br />

Cipla to benefit vis-à-vis peers as they cover hedge only 20-30% of quarterly sales.<br />

Further, the <strong>com</strong>panies with significant foreign exchange debt such as Aurob<strong>in</strong>do,<br />

Jubilant Life and Zydus Cadila would expect strong MTM loss to erode benefit of<br />

forex at operat<strong>in</strong>g profit.<br />

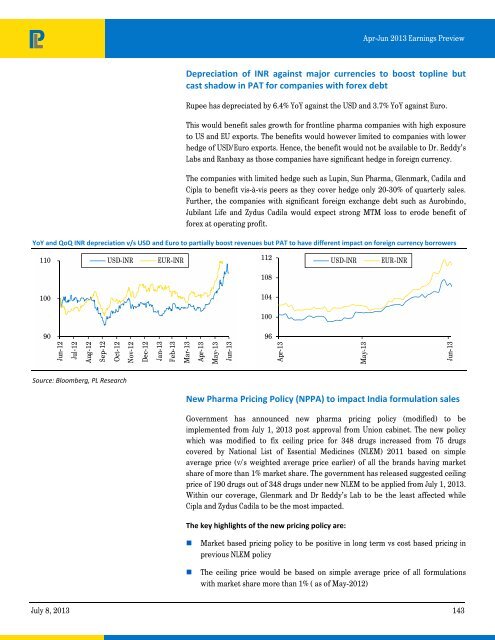

YoY and QoQ INR depreciation v/s USD and Euro to partially boost revenues but PAT to have different impact on foreign currency borrowers<br />

110<br />

USD-INR<br />

EUR-INR<br />

112<br />

USD-INR<br />

EUR-INR<br />

108<br />

100<br />

104<br />

100<br />

90<br />

96<br />

Jun-12<br />

Jul-12<br />

Aug-12<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

Jan-13<br />

Feb-13<br />

Mar-13<br />

Apr-13<br />

May-13<br />

Jun-13<br />

Apr-13<br />

May-13<br />

Jun-13<br />

Source: Bloomberg, PL Research<br />

New Pharma Pric<strong>in</strong>g Policy (NPPA) to impact India formulation sales<br />

Government has announced new pharma pric<strong>in</strong>g policy (modified) to be<br />

implemented from July 1, 2013 post approval from Union cab<strong>in</strong>et. The new policy<br />

which was modified to fix ceil<strong>in</strong>g price for 348 drugs <strong>in</strong>creased from 75 drugs<br />

covered by National List of Essential Medic<strong>in</strong>es (NLEM) 2011 based on simple<br />

average price (v/s weighted average price earlier) of all the brands hav<strong>in</strong>g market<br />

share of more than 1% market share. The government has released suggested ceil<strong>in</strong>g<br />

price of 190 drugs out of 348 drugs under new NLEM to be applied from July 1, 2013.<br />

With<strong>in</strong> our coverage, Glenmark and Dr Reddy’s Lab to be the least affected while<br />

Cipla and Zydus Cadila to be the most impacted.<br />

The key highlights of the new pric<strong>in</strong>g policy are:<br />

! Market based pric<strong>in</strong>g policy to be positive <strong>in</strong> long term vs cost based pric<strong>in</strong>g <strong>in</strong><br />

previous NLEM policy<br />

! The ceil<strong>in</strong>g price would be based on simple average price of all formulations<br />

with market share more than 1% ( as of May-2012)<br />

July 8, 2013 143