will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Apr-Jun 2013 Earn<strong>in</strong>gs Preview<br />

Nifty PAT Growth (YoY)<br />

(%)<br />

70.0<br />

60.0<br />

50.0<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0.0<br />

-10.0<br />

-20.0<br />

-30.0<br />

Q1FY09<br />

Q2FY09<br />

Q3FY09<br />

Q4FY09<br />

Q1FY10<br />

Q2FY10<br />

Q3FY10<br />

Q4FY10<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

Q2FY12<br />

Q3FY12<br />

Q4FY12<br />

Q1FY13<br />

Q2FY13<br />

Q3FY13<br />

Q4FY13<br />

Q1FY14E<br />

12.6<br />

5.3<br />

1.2<br />

15.4<br />

-12.5<br />

-19.1<br />

2.4<br />

15.7<br />

30.1<br />

60.4<br />

42.7<br />

30.7<br />

10.2<br />

2.5<br />

10.2<br />

21.0<br />

2.3<br />

26.4<br />

2.2<br />

1.5<br />

7.9<br />

Source: PL Research<br />

PL’s Coverage Universe – Revenue &<br />

EBITDA is expected to grow 3.7% & 2.9%<br />

respectively on YoY basis. PAT is expected<br />

to fall by 6.2% YoY<br />

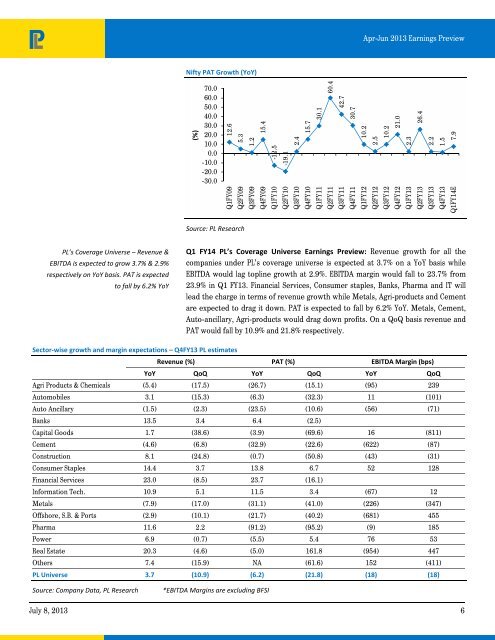

Q1 FY14 PL’s Coverage Universe Earn<strong>in</strong>gs Preview: Revenue growth for all the<br />

<strong>com</strong>panies under PL’s coverage universe is expected at 3.7% on a YoY basis while<br />

EBITDA would lag topl<strong>in</strong>e growth at 2.9%. EBITDA marg<strong>in</strong> would fall to 23.7% from<br />

23.9% <strong>in</strong> Q1 FY13. F<strong>in</strong>ancial Services, Consumer staples, Banks, Pharma and IT <strong>will</strong><br />

lead the charge <strong>in</strong> terms of revenue growth while Metals, Agri-products and Cement<br />

are expected to drag it down. PAT is expected to fall by 6.2% YoY. Metals, Cement,<br />

Auto-ancillary, Agri-products would drag down profits. On a QoQ basis revenue and<br />

PAT would fall by 10.9% and 21.8% respectively.<br />

Sector‐wise growth and marg<strong>in</strong> expectations – Q4FY13 PL estimates<br />

Revenue (%) PAT (%) EBITDA Marg<strong>in</strong> (bps)<br />

YoY QoQ YoY QoQ YoY QoQ<br />

Agri Products & Chemicals (5.4) (17.5) (26.7) (15.1) (95) 239<br />

Automobiles 3.1 (15.3) (6.3) (32.3) 11 (101)<br />

Auto Ancillary (1.5) (2.3) (23.5) (10.6) (56) (71)<br />

Banks 13.5 3.4 6.4 (2.5)<br />

Capital Goods 1.7 (38.6) (3.9) (69.6) 16 (811)<br />

Cement (4.6) (6.8) (32.9) (22.6) (622) (87)<br />

Construction 8.1 (24.8) (0.7) (50.8) (43) (31)<br />

Consumer Staples 14.4 3.7 13.8 6.7 52 128<br />

F<strong>in</strong>ancial Services 23.0 (8.5) 23.7 (16.1)<br />

Information Tech. 10.9 5.1 11.5 3.4 (67) 12<br />

Metals (7.9) (17.0) (31.1) (41.0) (226) (347)<br />

Offshore, S.B. & Ports (2.9) (10.1) (21.7) (40.2) (681) 455<br />

Pharma 11.6 2.2 (91.2) (95.2) (9) 185<br />

Power 6.9 (0.7) (5.5) 5.4 76 53<br />

Real Estate 20.3 (4.6) (5.0) 161.8 (954) 447<br />

Others 7.4 (15.9) NA (61.6) 152 (411)<br />

PL Universe 3.7 (10.9) (6.2) (21.8) (18) (18)<br />

Source: Company Data, PL Research<br />

*EBITDA Marg<strong>in</strong>s are exclud<strong>in</strong>g BFSI<br />

July 8, 2013 6