will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Apr-Jun 2013 Earn<strong>in</strong>gs Preview<br />

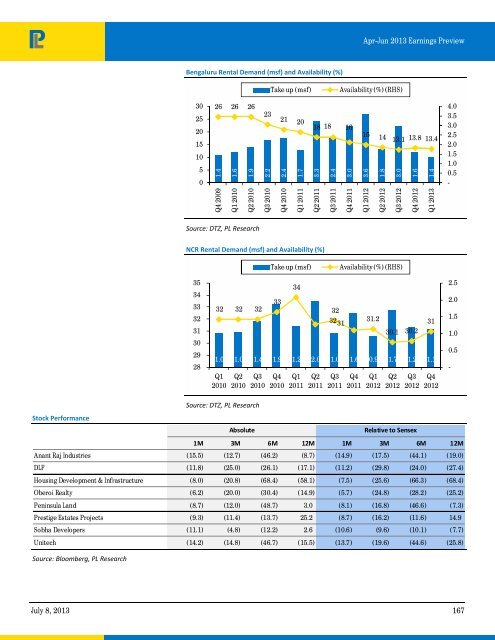

Bengaluru Rental Demand (msf) and Availability (%)<br />

Take up (msf)<br />

Availability (%) (RHS)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

26 26 26<br />

1.4<br />

1.6<br />

1.9<br />

23<br />

2.2<br />

21 20<br />

2.4<br />

1.7<br />

18 18 16<br />

3.3<br />

2.4<br />

3.0<br />

15 14 13.1 13.8 13.4<br />

3.6<br />

1.8<br />

3.0<br />

1.6<br />

1.4<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

-<br />

Q4 2009<br />

Q1 2010<br />

Q2 2010<br />

Q3 2010<br />

Q4 2010<br />

Q1 2011<br />

Q2 2011<br />

Q3 2011<br />

Q4 2011<br />

Q1 2012<br />

Q2 2012<br />

Q3 2012<br />

Q4 2012<br />

Q1 2013<br />

Source: DTZ, PL Research<br />

NCR Rental Demand (msf) and Availability (%)<br />

Take up (msf)<br />

Availability (%) (RHS)<br />

35<br />

34<br />

33<br />

32<br />

31<br />

30<br />

29<br />

28<br />

32 32 32<br />

33<br />

34<br />

32<br />

3231<br />

31.2<br />

30.1 30.2<br />

1.0 1.0 1.4 1.9 1.2 2.0 1.0 1.6 0.9 1.7 1.2 1.1<br />

Q1<br />

2010<br />

Q2<br />

2010<br />

Q3<br />

2010<br />

Q4<br />

2010<br />

Q1<br />

2011<br />

Q2<br />

2011<br />

Q3<br />

2011<br />

Q4<br />

2011<br />

Q1<br />

2012<br />

Q2<br />

2012<br />

Q3<br />

2012<br />

31<br />

Q4<br />

2012<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

-<br />

Source: DTZ, PL Research<br />

Stock Performance<br />

Absolute<br />

Relative to Sensex<br />

1M 3M 6M 12M 1M 3M 6M 12M<br />

Anant Raj Industries (15.5) (12.7) (46.2) (8.7) (14.9) (17.5) (44.1) (19.0)<br />

DLF (11.8) (25.0) (26.1) (17.1) (11.2) (29.8) (24.0) (27.4)<br />

Hous<strong>in</strong>g Development & Infrastructure (8.0) (20.8) (68.4) (58.1) (7.5) (25.6) (66.3) (68.4)<br />

Oberoi Realty (6.2) (20.0) (30.4) (14.9) (5.7) (24.8) (28.2) (25.2)<br />

Pen<strong>in</strong>sula Land (8.7) (12.0) (48.7) 3.0 (8.1) (16.8) (46.6) (7.3)<br />

Prestige Estates Projects (9.3) (11.4) (13.7) 25.2 (8.7) (16.2) (11.6) 14.9<br />

Sobha Developers (11.1) (4.8) (12.2) 2.6 (10.6) (9.6) (10.1) (7.7)<br />

Unitech (14.2) (14.8) (46.7) (15.5) (13.7) (19.6) (44.6) (25.8)<br />

Source: Bloomberg, PL Research<br />

July 8, 2013 167