will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Apr-Jun 2013 Earn<strong>in</strong>gs Preview<br />

NIFTY: Earn<strong>in</strong>gs growth and valuations<br />

Nifty EPS at Rs356.6, Rs391.4 and Rs457.0<br />

to grow at 1.4%, 9.7% and 16.8%<br />

respectively for FY13, FY14 & FY15<br />

NIFTY is currently trad<strong>in</strong>g at 16.3x FY13,<br />

14.8xFY14 and 12.7x FY15 estimated<br />

free‐float earn<strong>in</strong>gs<br />

Nifty trad<strong>in</strong>g at 1.0% discount to its tenyear<br />

average of one‐year forward multiple<br />

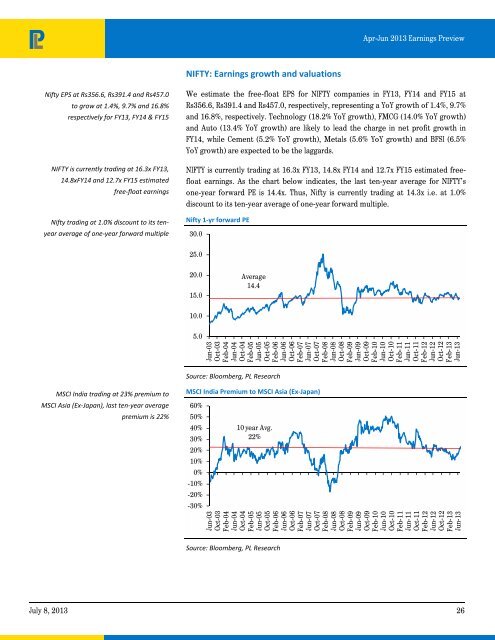

We estimate the free-float EPS for NIFTY <strong>com</strong>panies <strong>in</strong> FY13, FY14 and FY15 at<br />

Rs356.6, Rs391.4 and Rs457.0, respectively, represent<strong>in</strong>g a YoY growth of 1.4%, 9.7%<br />

and 16.8%, respectively. Technology (18.2% YoY growth), FMCG (14.0% YoY growth)<br />

and Auto (13.4% YoY growth) are likely to lead the charge <strong>in</strong> net profit growth <strong>in</strong><br />

FY14, while Cement (5.2% YoY growth), Metals (5.6% YoY growth) and BFSI (6.5%<br />

YoY growth) are expected to be the laggards.<br />

NIFTY is currently trad<strong>in</strong>g at 16.3x FY13, 14.8x FY14 and 12.7x FY15 estimated freefloat<br />

earn<strong>in</strong>gs. As the chart below <strong>in</strong>dicates, the last ten-year average for NIFTY’s<br />

one-year forward PE is 14.4x. Thus, Nifty is currently trad<strong>in</strong>g at 14.3x i.e. at 1.0%<br />

discount to its ten-year average of one-year forward multiple.<br />

Nifty 1‐yr forward PE<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

Average<br />

14.4<br />

10.0<br />

5.0<br />

Jun-03<br />

Oct-03<br />

Feb-04<br />

Jun-04<br />

Oct-04<br />

Feb-05<br />

Jun-05<br />

Oct-05<br />

Feb-06<br />

Jun-06<br />

Oct-06<br />

Feb-07<br />

Jun-07<br />

Oct-07<br />

Feb-08<br />

Jun-08<br />

Oct-08<br />

Feb-09<br />

Jun-09<br />

Oct-09<br />

Feb-10<br />

Jun-10<br />

Oct-10<br />

Feb-11<br />

Jun-11<br />

Oct-11<br />

Feb-12<br />

Jun-12<br />

Oct-12<br />

Feb-13<br />

Jun-13<br />

Source: Bloomberg, PL Research<br />

MSCI India trad<strong>in</strong>g at 23% premium to<br />

MSCI Asia (Ex‐Japan), last ten‐year average<br />

premium is 22%<br />

MSCI India Premium to MSCI Asia (Ex‐Japan)<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

10 year Avg.<br />

22%<br />

Jun-03<br />

Oct-03<br />

Feb-04<br />

Jun-04<br />

Oct-04<br />

Feb-05<br />

Jun-05<br />

Oct-05<br />

Feb-06<br />

Jun-06<br />

Oct-06<br />

Feb-07<br />

Jun-07<br />

Oct-07<br />

Feb-08<br />

Jun-08<br />

Oct-08<br />

Feb-09<br />

Jun-09<br />

Oct-09<br />

Feb-10<br />

Jun-10<br />

Oct-10<br />

Feb-11<br />

Jun-11<br />

Oct-11<br />

Feb-12<br />

Jun-12<br />

Oct-12<br />

Feb-13<br />

Jun-13<br />

Source: Bloomberg, PL Research<br />

July 8, 2013 26