will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

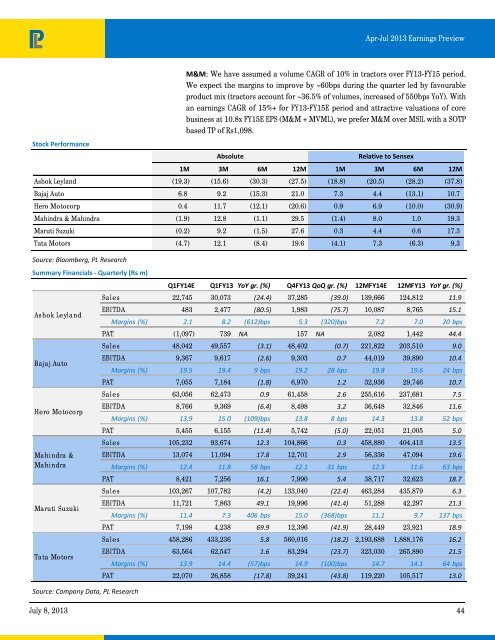

Apr-Jul 2013 Earn<strong>in</strong>gs Preview<br />

Stock Performance<br />

M&M: We have assumed a volume CAGR of 10% <strong>in</strong> tractors over FY13-FY15 period.<br />

We expect the marg<strong>in</strong>s to improve by ~60bps dur<strong>in</strong>g the quarter led by favourable<br />

product mix (tractors account for ~36.5% of volumes, <strong>in</strong>creased of 550bps YoY). With<br />

an earn<strong>in</strong>gs CAGR of 15%+ for FY13-FY15E period and attractive valuations of core<br />

bus<strong>in</strong>ess at 10.8x FY15E EPS (M&M + MVML), we prefer M&M over MSIL with a SOTP<br />

based TP of Rs1,098.<br />

Absolute<br />

Relative to Sensex<br />

1M 3M 6M 12M 1M 3M 6M 12M<br />

Ashok Leyland (19.3) (15.6) (30.3) (27.5) (18.8) (20.5) (28.2) (37.8)<br />

Bajaj Auto 6.8 9.2 (15.3) 21.0 7.3 4.4 (13.1) 10.7<br />

Hero Motocorp 0.4 11.7 (12.1) (20.6) 0.9 6.9 (10.0) (30.9)<br />

Mah<strong>in</strong>dra & Mah<strong>in</strong>dra (1.9) 12.8 (1.1) 29.5 (1.4) 8.0 1.0 19.3<br />

Maruti Suzuki (0.2) 9.2 (1.5) 27.6 0.3 4.4 0.6 17.3<br />

Tata Motors (4.7) 12.1 (8.4) 19.6 (4.1) 7.3 (6.3) 9.3<br />

Source: Bloomberg, PL Research<br />

Summary F<strong>in</strong>ancials ‐ Quarterly (Rs m)<br />

Ashok Leyland<br />

Bajaj Auto<br />

Hero Motocorp<br />

Mah<strong>in</strong>dra &<br />

Mah<strong>in</strong>dra<br />

Ma ruti Suzuki<br />

Tata Motors<br />

Source: Company Data, PL Research<br />

Q1FY14E Q1FY13 YoY gr. (%) Q4FY13 QoQ gr. (%) 12MFY14E 12MFY13 YoY gr. (%)<br />

Sales 22,745 30,073 (24.4) 37,285 (39.0) 139,666 124,812 11.9<br />

EBITDA 483 2,477 (80.5) 1,983 (75.7) 10,087 8,765 15.1<br />

Marg<strong>in</strong>s (%) 2.1 8.2 (612)bps 5.3 (320)bps 7.2 7.0 20 bps<br />

PAT (1,097) 739 NA 157 NA 2,082 1,442 44.4<br />

Sales 48,042 49,557 (3.1) 48,402 (0.7) 221,822 203,510 9.0<br />

EBITDA 9,367 9,617 (2.6) 9,303 0.7 44,019 39,890 10.4<br />

Marg<strong>in</strong>s (%) 19.5 19.4 9bps 19.2 28 bps 19.8 19.6 24 bps<br />

PAT 7,055 7,184 (1.8) 6,970 1.2 32,936 29,746 10.7<br />

Sales 63,056 62,473 0.9 61,458 2.6 255,616 237,681 7.5<br />

EBITDA 8,766 9,369 (6.4) 8,498 3.2 36,648 32,846 11.6<br />

Marg<strong>in</strong>s (%) 13.9 15.0 (109)bps 13.8 8bps 14.3 13.8 52 bps<br />

PAT 5,455 6,155 (11.4) 5,742 (5.0) 22,051 21,005 5.0<br />

Sales 105,232 93,674 12.3 104,866 0.3 458,880 404,413 13.5<br />

EBITDA 13,074 11,094 17.8 12,701 2.9 56,336 47,094 19.6<br />

Marg<strong>in</strong>s (%) 12.4 11.8 58 bps 12.1 31 bps 12.3 11.6 63 bps<br />

PAT 8,421 7,256 16.1 7,990 5.4 38,717 32,623 18.7<br />

Sales 103,267 107,782 (4.2) 133,040 (22.4) 463,284 435,879 6.3<br />

EBITDA 11,721 7,863 49.1 19,996 (41.4) 51,288 42,297 21.3<br />

Marg<strong>in</strong>s (%) 11.4 7.3 406 bps 15.0 (368)bps 11.1 9.7 137 bps<br />

PAT 7,198 4,238 69.9 12,396 (41.9) 28,449 23,921 18.9<br />

Sales 458,286 433,236 5.8 560,016 (18.2) 2,193,688 1,888,176 16.2<br />

EBITDA 63,564 62,547 1.6 83,294 (23.7) 323,030 265,890 21.5<br />

Marg<strong>in</strong>s (%) 13.9 14.4 (57)bps 14.9 (100)bps 14.7 14.1 64 bps<br />

PAT 22,070 26,858 (17.8) 39,241 (43.8) 119,220 105,517 13.0<br />

July 8, 2013 44