will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

will government's massive surge in investment ... - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Apr-Jun 2013 Earn<strong>in</strong>gs Preview<br />

Transformer/Reactor orders cont<strong>in</strong>ued to be weak, with total orders <strong>in</strong> FY13<br />

stand<strong>in</strong>g at Rs11.2bn v/s FY12 order awards of Rs27.3bn. Ch<strong>in</strong>ese players cont<strong>in</strong>ued<br />

to dom<strong>in</strong>ate transformer market, with market share of 40-45% <strong>in</strong> both, Q4FY13 and<br />

FY13 (Exhibit 5). Dom<strong>in</strong>ance of foreign players <strong>in</strong> 765kv transformer orders<br />

cont<strong>in</strong>ued, with market share of ~48% <strong>in</strong> FY13 (Exhibit 6). Commentary for <strong>in</strong>dustry<br />

players suggest that prices have stabilized at lower levels and not fall<strong>in</strong>g further;<br />

however, we are yet to see any uptick <strong>in</strong> prices. We believe equipment order<strong>in</strong>g<br />

should pick up <strong>in</strong> FY14 and should benefit players like ABB, Siemens and Crompton<br />

Greaves.<br />

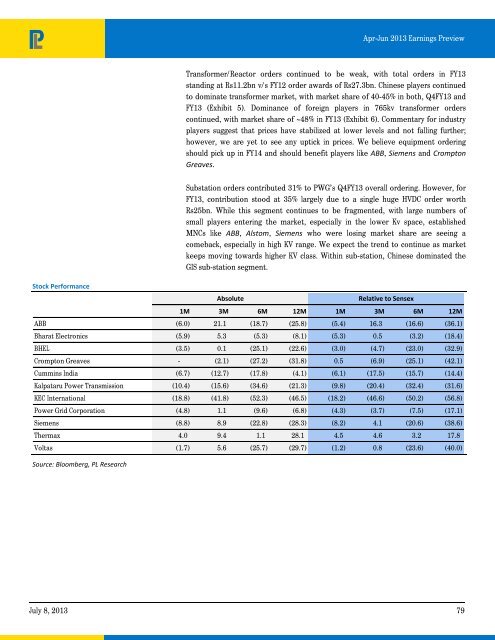

Stock Performance<br />

Substation orders contributed 31% to PWG’s Q4FY13 overall order<strong>in</strong>g. However, for<br />

FY13, contribution stood at 35% largely due to a s<strong>in</strong>gle huge HVDC order worth<br />

Rs25bn. While this segment cont<strong>in</strong>ues to be fragmented, with large numbers of<br />

small players enter<strong>in</strong>g the market, especially <strong>in</strong> the lower Kv space, established<br />

MNCs like ABB, Alstom, Siemens who were los<strong>in</strong>g market share are see<strong>in</strong>g a<br />

<strong>com</strong>eback, especially <strong>in</strong> high KV range. We expect the trend to cont<strong>in</strong>ue as market<br />

keeps mov<strong>in</strong>g towards higher KV class. With<strong>in</strong> sub-station, Ch<strong>in</strong>ese dom<strong>in</strong>ated the<br />

GIS sub-station segment.<br />

1M 3M 6M 12M 1M 3M 6M 12M<br />

ABB (6.0) 21.1 (18.7) (25.8) (5.4) 16.3 (16.6) (36.1)<br />

Bharat Electronics (5.9) 5.3 (5.3) (8.1) (5.3) 0.5 (3.2) (18.4)<br />

BHEL (3.5) 0.1 (25.1) (22.6) (3.0) (4.7) (23.0) (32.9)<br />

Crompton Greaves - (2.1) (27.2) (31.8) 0.5 (6.9) (25.1) (42.1)<br />

Cumm<strong>in</strong>s India (6.7) (12.7) (17.8) (4.1) (6.1) (17.5) (15.7) (14.4)<br />

Kalpataru Power Transmission (10.4) (15.6) (34.6) (21.3) (9.8) (20.4) (32.4) (31.6)<br />

KEC International (18.8) (41.8) (52.3) (46.5) (18.2) (46.6) (50.2) (56.8)<br />

Power Grid Corporation (4.8) 1.1 (9.6) (6.8) (4.3) (3.7) (7.5) (17.1)<br />

Siemens (8.8) 8.9 (22.8) (28.3) (8.2) 4.1 (20.6) (38.6)<br />

Thermax 4.0 9.4 1.1 28.1 4.5 4.6 3.2 17.8<br />

Voltas (1.7) 5.6 (25.7) (29.7) (1.2) 0.8 (23.6) (40.0)<br />

Source: Bloomberg, PL Research<br />

Absolute<br />

Relative to Sensex<br />

July 8, 2013 79