The role of informal microfinance institutions in saving

The role of informal microfinance institutions in saving

The role of informal microfinance institutions in saving

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In the future, respondents who operate semi-subsistence or commercial farms are most likely<br />

go<strong>in</strong>g to borrow money to facilitate purchase <strong>of</strong> farm <strong>in</strong>puts and hir<strong>in</strong>g <strong>of</strong> temporary<br />

employees. Members with small-scale non-farm bus<strong>in</strong>esses are most likely go<strong>in</strong>g to borrow<br />

funds to facilitate purchase <strong>of</strong> stocks, <strong>in</strong>ventories, and raw materials. This means that SACCOs<br />

should be prepared to provide relatively small loans, with repayment plans that accommodate<br />

the needs <strong>of</strong> farmers and small-scale bus<strong>in</strong>essmen. Special repayment terms may need to apply<br />

to farm loans s<strong>in</strong>ce farmers receive the bulk <strong>of</strong> their <strong>in</strong>come <strong>in</strong> lump sum payments at harvest<br />

time, rather than at regular monthly <strong>in</strong>tervals.<br />

When asked “What is the one most important new service that you th<strong>in</strong>k your SACCOs should<br />

<strong>of</strong>fer <strong>in</strong> the future?’’, one-third <strong>of</strong> the 2008 respondents suggested that SACCOs <strong>of</strong>fer bigger<br />

longer term loans <strong>in</strong>clud<strong>in</strong>g mortgages, home construction loans and home improvement<br />

loans. Another 15% would like SACCOs to <strong>of</strong>fer loans on tools, mach<strong>in</strong>es, bicycles, vehicles<br />

and household items us<strong>in</strong>g the item as collateral rather than sav<strong>in</strong>gs.<br />

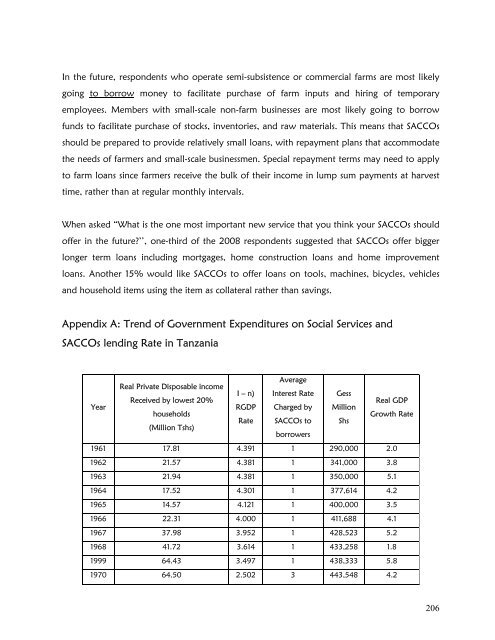

Appendix A: Trend <strong>of</strong> Government Expenditures on Social Services and<br />

SACCOs lend<strong>in</strong>g Rate <strong>in</strong> Tanzania<br />

Year<br />

Real Private Disposable <strong>in</strong>come<br />

Received by lowest 20%<br />

households<br />

(Million Tshs)<br />

I – n)<br />

RGDP<br />

Rate<br />

Average<br />

Interest Rate<br />

Charged by<br />

SACCOs to<br />

borrowers<br />

Gess<br />

Million<br />

Shs<br />

Real GDP<br />

Growth Rate<br />

1961 17.81 4.391 1 290,000 2.0<br />

1962 21.57 4.381 1 341,000 3.8<br />

1963 21.94 4.381 1 350,000 5.1<br />

1964 17.52 4.301 1 377,614 4.2<br />

1965 14.57 4.121 1 400,000 3.5<br />

1966 22.31 4.000 1 411,688 4.1<br />

1967 37.98 3.952 1 428,523 5.2<br />

1968 41.72 3.614 1 433,258 1.8<br />

1999 64.43 3.497 1 438,333 5.8<br />

1970 64.50 2.502 3 443,548 4.2<br />

206