Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

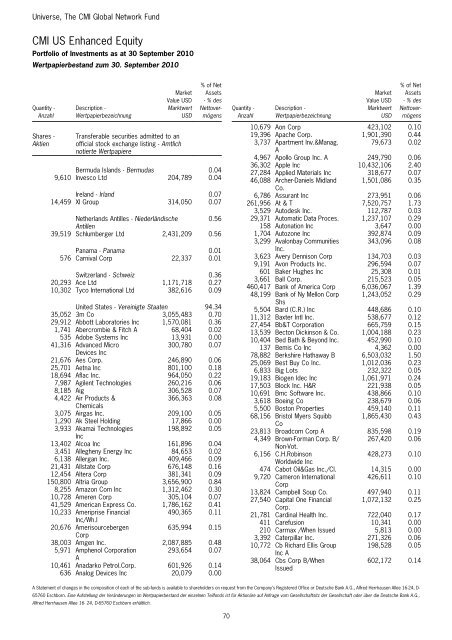

<strong>Universe</strong>, <strong>The</strong> <strong>CMI</strong> <strong>Global</strong> <strong>Network</strong> <strong>Fund</strong><br />

<strong>CMI</strong> US Enhanced Equity<br />

Portfolio of Investments as at 30 September 2010<br />

Wertpapierbestand zum 30. September 2010<br />

Quantity -<br />

Anzahl<br />

Shares -<br />

Aktien<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

Transferable securities admitted to an<br />

official stock exchange listing - Amtlich<br />

notierte Wertpapiere<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

Bermuda Islands - Bermudas 0.04<br />

9,610 Invesco Ltd 204,789 0.04<br />

Ireland - Irland 0.07<br />

14,459 Xl Group 314,050 0.07<br />

Netherlands Antilles - Niederländische<br />

Antillen<br />

0.56<br />

39,519 Schlumberger Ltd 2,431,209 0.56<br />

Panama - Panama 0.01<br />

576 Carnival Corp 22,337 0.01<br />

Switzerland - Schweiz 0.36<br />

20,293 Ace Ltd 1,171,718 0.27<br />

10,302 Tyco International Ltd 382,616 0.09<br />

United States - Vereinigte Staaten 94.34<br />

35,052 3m Co 3,055,483 0.70<br />

29,912 Abbott Laboratories Inc 1,570,081 0.36<br />

1,741 Abercrombie & Fitch A 68,404 0.02<br />

535 Adobe Systems Inc 13,931 0.00<br />

41,316 Advanced Micro<br />

300,780 0.07<br />

Devices Inc<br />

21,676 Aes Corp. 246,890 0.06<br />

25,701 Aetna Inc 801,100 0.18<br />

18,694 Aflac Inc. 964,050 0.22<br />

7,987 Agilent Technologies 260,216 0.06<br />

8,185 Aig 306,528 0.07<br />

4,422 Air Products &<br />

Chemicals<br />

366,363 0.08<br />

3,075 Airgas Inc. 209,100 0.05<br />

1,290 Ak Steel Holding 17,866 0.00<br />

3,933 Akamai Technologies<br />

198,892 0.05<br />

Inc<br />

13,402 Alcoa Inc 161,896 0.04<br />

3,451 Allegheny Energy Inc 84,653 0.02<br />

6,138 Allergan Inc. 409,466 0.09<br />

21,431 Allstate Corp 676,148 0.16<br />

12,454 Altera Corp 381,341 0.09<br />

150,800 Altria Group 3,656,900 0.84<br />

8,255 Amazon Com Inc 1,312,462 0.30<br />

10,728 Ameren Corp 305,104 0.07<br />

41,529 American Express Co. 1,786,162 0.41<br />

10,233 Ameriprise Financial<br />

Inc/Wh.I<br />

490,365 0.11<br />

20,676 Amerisourcebergen<br />

Corp<br />

635,994 0.15<br />

38,003 Amgen Inc. 2,087,885 0.48<br />

5,971 Amphenol Corporation 293,654 0.07<br />

A<br />

10,461 Anadarko Petrol.Corp. 601,926 0.14<br />

636 Analog Devices Inc 20,079 0.00<br />

70<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

10,679 Aon Corp 423,102 0.10<br />

19,396 Apache Corp. 1,901,390 0.44<br />

3,737 Apartment Inv.&Manag.<br />

A<br />

79,673 0.02<br />

4,967 Apollo Group Inc. A 249,790 0.06<br />

36,302 Apple Inc 10,432,106 2.40<br />

27,284 Applied Materials Inc 318,677 0.07<br />

46,088 Archer-Daniels Midland<br />

Co.<br />

1,501,086 0.35<br />

6,786 Assurant Inc 273,951 0.06<br />

261,956 At & T 7,520,757 1.73<br />

3,529 Autodesk Inc. 112,787 0.03<br />

29,371 Automatic Data Proces. 1,237,107 0.29<br />

158 Autonation Inc 3,647 0.00<br />

1,704 Autozone Inc 392,874 0.09<br />

3,299 Avalonbay Communities<br />

Inc.<br />

343,096 0.08<br />

3,623 Avery Dennison Corp 134,703 0.03<br />

9,191 Avon Products Inc. 296,594 0.07<br />

601 Baker Hughes Inc 25,308 0.01<br />

3,661 Ball Corp. 215,523 0.05<br />

460,417 Bank of America Corp 6,036,067 1.39<br />

48,199 Bank of Ny Mellon Corp<br />

Shs<br />

1,243,052 0.29<br />

5,504 Bard (C.R.) Inc 448,686 0.10<br />

11,312 Baxter Intl Inc. 538,677 0.12<br />

27,454 Bb&T Corporation 665,759 0.15<br />

13,539 Becton Dickinson & Co. 1,004,188 0.23<br />

10,404 Bed Bath & Beyond Inc. 452,990 0.10<br />

137 Bemis Co Inc 4,362 0.00<br />

78,882 Berkshire Hathaway B 6,503,032 1.50<br />

25,069 Best Buy Co Inc. 1,012,036 0.23<br />

6,833 Big Lots 232,322 0.05<br />

19,183 Biogen Idec Inc 1,061,971 0.24<br />

17,503 Block Inc. H&R 221,938 0.05<br />

10,691 Bmc Software Inc. 438,866 0.10<br />

3,618 Boeing Co 238,679 0.06<br />

5,500 Boston Properties 459,140 0.11<br />

68,156 Bristol Myers Squibb<br />

Co<br />

1,865,430 0.43<br />

23,813 Broadcom Corp A 835,598 0.19<br />

4,349 Brown-Forman Corp. B/<br />

Non-Vot.<br />

267,420 0.06<br />

6,156 C.H.Robinson<br />

Worldwide Inc<br />

428,273 0.10<br />

474 Cabot Oil&Gas Inc./Cl. 14,315 0.00<br />

9,720 Cameron International<br />

Corp<br />

426,611 0.10<br />

13,824 Campbell Soup Co. 497,940 0.11<br />

27,540 Capital One Financial<br />

Corp.<br />

1,072,132 0.25<br />

21,781 Cardinal Health Inc. 722,040 0.17<br />

411 Carefusion 10,341 0.00<br />

210 Carmax /When Issued 5,813 0.00<br />

3,392 Caterpillar Inc. 271,326 0.06<br />

10,772 Cb Richard Ellis Group<br />

Inc A<br />

198,528 0.05<br />

38,064 Cbs Corp B/When<br />

Issued<br />

602,172 0.14<br />

A Statement of changes in the composition of each of the sub-funds is available to shareholders on request from the Company’s Registered Office or Deutsche Bank A.G., Alfred Herrhausen Allee 16-24, D-<br />

65760 Eschborn. Eine Aufstellung der Veränderungen im Wertpapierbestand der einzelnen Teilfonds ist für Aktionäre auf Anfrage vom Gesellschaftsitz der Gesellschaft oder über die Deutsche Bank A.G.,<br />

Alfred Herrhausen Allee 16- 24, D-65760 Eschborn erhältlich.