Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

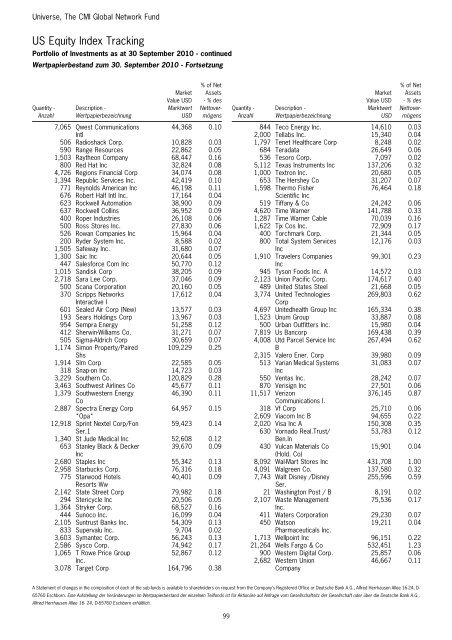

<strong>Universe</strong>, <strong>The</strong> <strong>CMI</strong> <strong>Global</strong> <strong>Network</strong> <strong>Fund</strong><br />

US Equity Index Tracking<br />

Portfolio of Investments as at 30 September 2010 - continued<br />

Wertpapierbestand zum 30. September 2010 - Fortsetzung<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

7,065 Qwest Communications<br />

Intl<br />

44,368 0.10<br />

506 Radioshack Corp. 10,828 0.03<br />

590 Range Resources 22,862 0.05<br />

1,503 Raytheon Company 68,447 0.16<br />

800 Red Hat Inc 32,824 0.08<br />

4,726 Regions Financial Corp 34,074 0.08<br />

1,394 Republic Services Inc. 42,419 0.10<br />

771 Reynolds American Inc 46,198 0.11<br />

676 Robert Half Intl Inc. 17,164 0.04<br />

623 Rockwell Automation 38,900 0.09<br />

637 Rockwell Collins 36,952 0.09<br />

400 Roper Industries 26,108 0.06<br />

500 Ross Stores Inc. 27,830 0.06<br />

526 Rowan Companies Inc 15,964 0.04<br />

200 Ryder System Inc. 8,588 0.02<br />

1,505 Safeway Inc. 31,680 0.07<br />

1,300 Saic Inc 20,644 0.05<br />

447 Salesforce Com Inc 50,770 0.12<br />

1,015 Sandisk Corp 38,205 0.09<br />

2,718 Sara Lee Corp. 37,046 0.09<br />

500 Scana Corporation 20,160 0.05<br />

370 Scripps <strong>Network</strong>s<br />

Interactive I<br />

17,612 0.04<br />

601 Sealed Air Corp (New) 13,577 0.03<br />

193 Sears Holdings Corp 13,967 0.03<br />

954 Sempra Energy 51,258 0.12<br />

412 Sherwin-Williams Co. 31,271 0.07<br />

505 Sigma-Aldrich Corp 30,659 0.07<br />

1,174 Simon Property/Paired<br />

Shs<br />

109,229 0.25<br />

1,914 Slm Corp 22,585 0.05<br />

318 Snap-on Inc 14,723 0.03<br />

3,229 Southern Co. 120,829 0.28<br />

3,463 Southwest Airlines Co 45,677 0.11<br />

1,379 Southwestern Energy<br />

Co<br />

46,390 0.11<br />

2,887 Spectra Energy Corp<br />

*Opa*<br />

64,957 0.15<br />

12,918 Sprint Nextel Corp/Fon<br />

Ser.1<br />

59,423 0.14<br />

1,340 St Jude <strong>Medical</strong> Inc 52,608 0.12<br />

653 Stanley Black & Decker<br />

Inc<br />

39,670 0.09<br />

2,680 Staples Inc 55,342 0.13<br />

2,958 Starbucks Corp. 76,316 0.18<br />

775 Starwood Hotels<br />

Resorts Ww<br />

40,401 0.09<br />

2,142 State Street Corp 79,982 0.18<br />

294 Stericycle Inc 20,506 0.05<br />

1,364 Stryker Corp. 68,527 0.16<br />

444 Sunoco Inc. 16,099 0.04<br />

2,105 Suntrust Banks Inc. 54,309 0.13<br />

833 Supervalu Inc. 9,704 0.02<br />

3,603 Symantec Corp. 56,243 0.13<br />

2,586 Sysco Corp. 74,942 0.17<br />

1,065 T Rowe Price Group<br />

Inc.<br />

52,867 0.12<br />

3,078 Target Corp 164,796 0.38<br />

99<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

844 Teco Energy Inc. 14,610 0.03<br />

2,000 Tellabs Inc. 15,340 0.04<br />

1,797 Tenet Healthcare Corp 8,248 0.02<br />

684 Teradata 26,649 0.06<br />

536 Tesoro Corp. 7,097 0.02<br />

5,112 Texas Instruments Inc 137,206 0.32<br />

1,000 Textron Inc. 20,680 0.05<br />

653 <strong>The</strong> Hershey Co 31,207 0.07<br />

1,598 <strong>The</strong>rmo Fisher<br />

76,464 0.18<br />

Scientific Inc<br />

519 Tiffany & Co 24,242 0.06<br />

4,620 Time Warner 141,788 0.33<br />

1,287 Time Warner Cable 70,039 0.16<br />

1,622 Tjx Cos Inc. 72,909 0.17<br />

400 Torchmark Corp. 21,344 0.05<br />

800 Total System Services<br />

Inc<br />

12,176 0.03<br />

1,910 Travelers Companies<br />

99,301 0.23<br />

Inc<br />

945 Tyson Foods Inc. A 14,572 0.03<br />

2,123 Union Pacific Corp. 174,617 0.40<br />

489 United States Steel 21,668 0.05<br />

3,774 United Technologies<br />

269,803 0.62<br />

Corp<br />

4,697 Unitedhealth Group Inc 165,334 0.38<br />

1,523 Unum Group 33,887 0.08<br />

500 Urban Outfitters Inc. 15,980 0.04<br />

7,819 Us Bancorp 169,438 0.39<br />

4,008 Utd Parcel Service Inc<br />

B<br />

267,494 0.62<br />

2,315 Valero Ener. Corp 39,980 0.09<br />

513 Varian <strong>Medical</strong> Systems<br />

Inc<br />

31,083 0.07<br />

550 Ventas Inc. 28,242 0.07<br />

870 Verisign Inc 27,501 0.06<br />

11,517 Verizon<br />

376,145 0.87<br />

Communications I.<br />

318 Vf Corp 25,710 0.06<br />

2,609 Viacom Inc B 94,655 0.22<br />

2,020 Visa Inc A 150,308 0.35<br />

630 Vornado Real.Trust/<br />

Ben.In<br />

53,783 0.12<br />

430 Vulcan Materials Co<br />

(Hold. Co)<br />

15,901 0.04<br />

8,092 Wal-Mart Stores Inc 431,708 1.00<br />

4,091 Walgreen Co. 137,580 0.32<br />

7,743 Walt Disney /Disney<br />

Ser.<br />

255,596 0.59<br />

21 Washington Post / B 8,191 0.02<br />

2,107 Waste Management<br />

Inc.<br />

75,536 0.17<br />

411 Waters Corporation 29,230 0.07<br />

450 Watson<br />

19,211 0.04<br />

Pharmaceuticals Inc.<br />

1,713 Wellpoint Inc 96,151 0.22<br />

21,264 Wells Fargo & Co 532,451 1.23<br />

900 Western Digital Corp. 25,857 0.06<br />

2,682 Western Union<br />

Company<br />

46,667 0.11<br />

A Statement of changes in the composition of each of the sub-funds is available to shareholders on request from the Company’s Registered Office or Deutsche Bank A.G., Alfred Herrhausen Allee 16-24, D-<br />

65760 Eschborn. Eine Aufstellung der Veränderungen im Wertpapierbestand der einzelnen Teilfonds ist für Aktionäre auf Anfrage vom Gesellschaftsitz der Gesellschaft oder über die Deutsche Bank A.G.,<br />

Alfred Herrhausen Allee 16- 24, D-65760 Eschborn erhältlich.