Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Universe</strong>, <strong>The</strong> <strong>CMI</strong> <strong>Global</strong> <strong>Network</strong> <strong>Fund</strong><br />

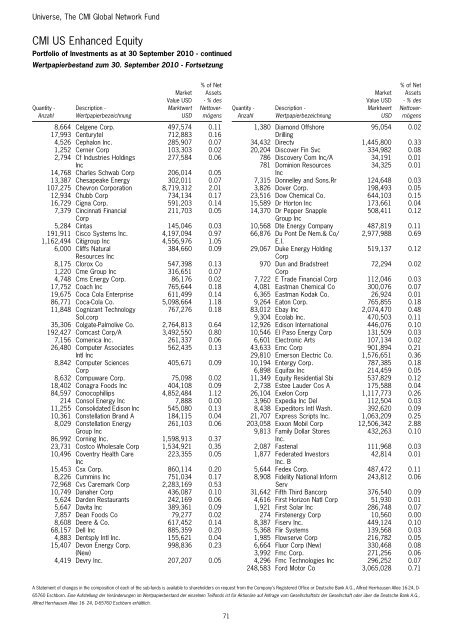

<strong>CMI</strong> US Enhanced Equity<br />

Portfolio of Investments as at 30 September 2010 - continued<br />

Wertpapierbestand zum 30. September 2010 - Fortsetzung<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

8,664 Celgene Corp. 497,574 0.11<br />

17,993 Centurytel 712,883 0.16<br />

4,526 Cephalon Inc. 285,907 0.07<br />

1,252 Cerner Corp 103,303 0.02<br />

2,794 Cf Industries Holdings<br />

277,584 0.06<br />

Inc<br />

14,768 Charles Schwab Corp 206,014 0.05<br />

13,387 Chesapeake Energy 302,011 0.07<br />

107,275 Chevron Corporation 8,719,312 2.01<br />

12,934 Chubb Corp 734,134 0.17<br />

16,729 Cigna Corp. 591,203 0.14<br />

7,379 Cincinnati Financial<br />

211,703 0.05<br />

Corp<br />

5,284 Cintas 145,046 0.03<br />

191,911 Cisco Systems Inc. 4,197,094 0.97<br />

1,162,494 Citigroup Inc 4,556,976 1.05<br />

6,000 Cliffs Natural<br />

384,660 0.09<br />

Resources Inc<br />

8,175 Clorox Co 547,398 0.13<br />

1,220 Cme Group Inc 316,651 0.07<br />

4,748 Cms Energy Corp. 86,176 0.02<br />

17,752 Coach Inc 765,644 0.18<br />

19,675 Coca Cola Enterprise 611,499 0.14<br />

86,771 Coca-Cola Co. 5,098,664 1.18<br />

11,848 Cognizant Technology<br />

767,276 0.18<br />

Sol.corp<br />

35,306 Colgate-Palmolive Co. 2,764,813 0.64<br />

192,427 Comcast Corp/A 3,492,550 0.80<br />

7,156 Comerica Inc. 261,337 0.06<br />

26,480 Computer Associates<br />

Intl Inc<br />

562,435 0.13<br />

8,842 Computer Sciences<br />

405,671 0.09<br />

Corp<br />

8,632 Compuware Corp. 75,098 0.02<br />

18,402 Conagra Foods Inc 404,108 0.09<br />

84,597 Conocophillips 4,852,484 1.12<br />

214 Consol Energy Inc 7,888 0.00<br />

11,255 Consolidated Edison Inc 545,080 0.13<br />

10,361 Constellation Brand A 184,115 0.04<br />

8,029 Constellation Energy<br />

Group Inc<br />

261,103 0.06<br />

86,992 Corning Inc. 1,598,913 0.37<br />

23,731 Costco Wholesale Corp 1,534,921 0.35<br />

10,496 Coventry Health Care<br />

223,355 0.05<br />

Inc<br />

15,453 Csx Corp. 860,114 0.20<br />

8,226 Cummins Inc 751,034 0.17<br />

72,968 Cvs Caremark Corp 2,283,169 0.53<br />

10,749 Danaher Corp 436,087 0.10<br />

5,624 Darden Restaurants 242,169 0.06<br />

5,647 Davita Inc 389,361 0.09<br />

7,857 Dean Foods Co 79,277 0.02<br />

8,608 Deere & Co. 617,452 0.14<br />

68,157 Dell Inc 885,359 0.20<br />

4,883 Dentsply Intl Inc. 155,621 0.04<br />

15,407 Devon Energy Corp.<br />

(New)<br />

998,836 0.23<br />

4,419 Devry Inc. 207,207 0.05<br />

71<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

1,380 Diamond Offshore<br />

Drilling<br />

95,054 0.02<br />

34,432 Directv 1,445,800 0.33<br />

20,204 Discover Fin Svc 334,982 0.08<br />

786 Discovery Com Inc/A 34,191 0.01<br />

781 Dominion Resources<br />

Inc<br />

34,325 0.01<br />

7,315 Donnelley and Sons.Rr 124,648 0.03<br />

3,826 Dover Corp. 198,493 0.05<br />

23,516 Dow Chemical Co. 644,103 0.15<br />

15,589 Dr Horton Inc 173,661 0.04<br />

14,370 Dr Pepper Snapple<br />

Group Inc<br />

508,411 0.12<br />

10,568 Dte Energy Company 487,819 0.11<br />

66,876 Du Pont De Nem.& Co/<br />

E.I.<br />

2,977,988 0.69<br />

29,067 Duke Energy Holding<br />

Corp<br />

519,137 0.12<br />

970 Dun and Bradstreet<br />

Corp<br />

72,294 0.02<br />

7,722 E Trade Financial Corp 112,046 0.03<br />

4,081 Eastman Chemical Co 300,076 0.07<br />

6,365 Eastman Kodak Co. 26,924 0.01<br />

9,264 Eaton Corp. 765,855 0.18<br />

83,012 Ebay Inc 2,074,470 0.48<br />

9,304 Ecolab Inc. 470,503 0.11<br />

12,926 Edison International 446,076 0.10<br />

10,546 El Paso Energy Corp 131,509 0.03<br />

6,601 Electronic Arts 107,134 0.02<br />

43,633 Emc Corp 901,894 0.21<br />

29,810 Emerson Electric Co. 1,576,651 0.36<br />

10,194 Entergy Corp. 787,385 0.18<br />

6,898 Equifax Inc 214,459 0.05<br />

11,349 Equity Residential Sbi 537,829 0.12<br />

2,738 Estee Lauder Cos A 175,588 0.04<br />

26,104 Exelon Corp 1,117,773 0.26<br />

3,960 Expedia Inc Del 112,504 0.03<br />

8,438 Expeditors Intl Wash. 392,620 0.09<br />

21,707 Express Scripts Inc. 1,063,209 0.25<br />

203,058 Exxon Mobil Corp 12,506,342 2.88<br />

9,813 Family Dollar Stores<br />

Inc.<br />

432,263 0.10<br />

2,087 Fastenal 111,968 0.03<br />

1,877 Federated Investors<br />

Inc. B<br />

42,814 0.01<br />

5,644 Fedex Corp. 487,472 0.11<br />

8,908 Fidelity National Inform<br />

Serv<br />

243,812 0.06<br />

31,642 Fifth Third Bancorp 376,540 0.09<br />

4,616 First Horizon Natl Corp 51,930 0.01<br />

1,921 First Solar Inc 286,748 0.07<br />

274 Firstenergy Corp 10,560 0.00<br />

8,387 Fiserv Inc. 449,124 0.10<br />

5,368 Flir Systems 139,568 0.03<br />

1,985 Flowserve Corp 216,782 0.05<br />

6,664 Fluor Corp (New) 330,468 0.08<br />

3,992 Fmc Corp. 271,256 0.06<br />

4,296 Fmc Technologies Inc 296,252 0.07<br />

248,583 Ford Motor Co 3,065,028 0.71<br />

A Statement of changes in the composition of each of the sub-funds is available to shareholders on request from the Company’s Registered Office or Deutsche Bank A.G., Alfred Herrhausen Allee 16-24, D-<br />

65760 Eschborn. Eine Aufstellung der Veränderungen im Wertpapierbestand der einzelnen Teilfonds ist für Aktionäre auf Anfrage vom Gesellschaftsitz der Gesellschaft oder über die Deutsche Bank A.G.,<br />

Alfred Herrhausen Allee 16- 24, D-65760 Eschborn erhältlich.