Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Universe, The CMI Global Network Fund - Clerical Medical

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Universe</strong>, <strong>The</strong> <strong>CMI</strong> <strong>Global</strong> <strong>Network</strong> <strong>Fund</strong><br />

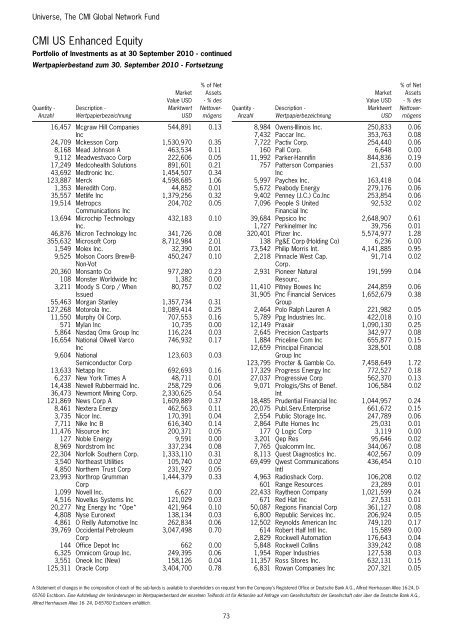

<strong>CMI</strong> US Enhanced Equity<br />

Portfolio of Investments as at 30 September 2010 - continued<br />

Wertpapierbestand zum 30. September 2010 - Fortsetzung<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

16,457 Mcgraw Hill Companies<br />

Inc<br />

544,891 0.13<br />

24,709 Mckesson Corp 1,530,970 0.35<br />

8,168 Mead Johnson A 463,534 0.11<br />

9,112 Meadwestvaco Corp 222,606 0.05<br />

17,249 Medcohealth Solutions 891,601 0.21<br />

43,692 Medtronic Inc. 1,454,507 0.34<br />

123,887 Merck 4,598,685 1.06<br />

1,353 Meredith Corp. 44,852 0.01<br />

35,557 Metlife Inc 1,379,256 0.32<br />

19,514 Metropcs<br />

Communications Inc<br />

204,702 0.05<br />

13,694 Microchip Technology<br />

Inc.<br />

432,183 0.10<br />

46,876 Micron Technology Inc 341,726 0.08<br />

355,632 Microsoft Corp 8,712,984 2.01<br />

1,549 Molex Inc. 32,390 0.01<br />

9,525 Molson Coors Brew-B-<br />

Non-Vot<br />

450,247 0.10<br />

20,360 Monsanto Co 977,280 0.23<br />

108 Monster Worldwide Inc 1,382 0.00<br />

3,211 Moody S Corp / When<br />

Issued<br />

80,757 0.02<br />

55,463 Morgan Stanley 1,357,734 0.31<br />

127,268 Motorola Inc. 1,089,414 0.25<br />

11,550 Murphy Oil Corp. 707,553 0.16<br />

571 Mylan Inc 10,735 0.00<br />

5,864 Nasdaq Omx Group Inc 116,224 0.03<br />

16,654 National Oilwell Varco<br />

Inc<br />

746,932 0.17<br />

9,604 National<br />

Semiconductor Corp<br />

123,603 0.03<br />

13,633 Netapp Inc 692,693 0.16<br />

6,237 New York Times A 48,711 0.01<br />

14,438 Newell Rubbermaid Inc. 258,729 0.06<br />

36,473 Newmont Mining Corp. 2,330,625 0.54<br />

121,869 News Corp A 1,609,889 0.37<br />

8,461 Nextera Energy 462,563 0.11<br />

3,735 Nicor Inc. 170,391 0.04<br />

7,711 Nike Inc B 616,340 0.14<br />

11,476 Nisource Inc 200,371 0.05<br />

127 Noble Energy 9,591 0.00<br />

8,969 Nordstrom Inc 337,234 0.08<br />

22,304 Norfolk Southern Corp. 1,333,110 0.31<br />

3,540 Northeast Utilities 105,740 0.02<br />

4,850 Northern Trust Corp 231,927 0.05<br />

23,993 Northrop Grumman<br />

Corp<br />

1,444,379 0.33<br />

1,099 Novell Inc. 6,627 0.00<br />

4,516 Novellus Systems Inc 121,029 0.03<br />

20,277 Nrg Energy Inc *Ope* 421,964 0.10<br />

4,808 Nyse Euronext 138,134 0.03<br />

4,861 O Reilly Automotive Inc 262,834 0.06<br />

39,769 Occidental Petroleum<br />

Corp<br />

3,047,498 0.70<br />

144 Office Depot Inc 662 0.00<br />

6,325 Omnicom Group Inc. 249,395 0.06<br />

3,551 Oneok Inc (New) 158,126 0.04<br />

125,311 Oracle Corp 3,404,700 0.78<br />

73<br />

Quantity -<br />

Anzahl<br />

Description -<br />

Wertpapierbezeichnung<br />

Market<br />

Value USD<br />

Marktwert<br />

USD<br />

% of Net<br />

Assets<br />

- % des<br />

Nettovermögens<br />

8,984 Owens-Illinois Inc. 250,833 0.06<br />

7,432 Paccar Inc. 353,763 0.08<br />

7,722 Pactiv Corp. 254,440 0.06<br />

160 Pall Corp. 6,648 0.00<br />

11,992 Parker-Hannifin 844,836 0.19<br />

757 Patterson Companies<br />

21,537 0.00<br />

Inc<br />

5,997 Paychex Inc. 163,418 0.04<br />

5,672 Peabody Energy 279,176 0.06<br />

9,402 Penney (J.C.) Co.Inc 253,854 0.06<br />

7,096 People S United<br />

92,532 0.02<br />

Financial Inc<br />

39,684 Pepsico Inc 2,648,907 0.61<br />

1,727 Perkinelmer Inc 39,756 0.01<br />

320,401 Pfizer Inc. 5,574,977 1.28<br />

138 Pg&E Corp (Holding Co) 6,236 0.00<br />

73,542 Philip Morris Int. 4,141,885 0.95<br />

2,218 Pinnacle West Cap.<br />

Corp.<br />

91,714 0.02<br />

2,931 Pioneer Natural<br />

Resourc.<br />

191,599 0.04<br />

11,410 Pitney Bowes Inc 244,859 0.06<br />

31,905 Pnc Financial Services 1,652,679 0.38<br />

Group<br />

2,464 Polo Ralph Lauren A 221,982 0.05<br />

5,789 Ppg Industries Inc. 422,018 0.10<br />

12,149 Praxair 1,090,130 0.25<br />

2,645 Precision Castparts 342,977 0.08<br />

1,884 Priceline Com Inc 655,877 0.15<br />

12,659 Principal Financial<br />

328,501 0.08<br />

Group Inc<br />

123,795 Procter & Gamble Co. 7,458,649 1.72<br />

17,329 Progress Energy Inc 772,527 0.18<br />

27,037 Progressive Corp 562,370 0.13<br />

9,071 Prologis/Shs of Benef. 106,584 0.02<br />

Int<br />

18,485 Prudential Financial Inc 1,044,957 0.24<br />

20,075 Publ.Serv.Enterprise 661,672 0.15<br />

2,554 Public Storage Inc. 247,789 0.06<br />

2,864 Pulte Homes Inc 25,031 0.01<br />

177 Q Logic Corp 3,119 0.00<br />

3,201 Qep Res 95,646 0.02<br />

7,765 Qualcomm Inc. 344,067 0.08<br />

8,113 Quest Diagnostics Inc. 402,567 0.09<br />

69,499 Qwest Communications 436,454 0.10<br />

Intl<br />

4,963 Radioshack Corp. 106,208 0.02<br />

601 Range Resources 23,289 0.01<br />

22,433 Raytheon Company 1,021,599 0.24<br />

671 Red Hat Inc 27,531 0.01<br />

50,087 Regions Financial Corp 361,127 0.08<br />

6,800 Republic Services Inc. 206,924 0.05<br />

12,502 Reynolds American Inc 749,120 0.17<br />

614 Robert Half Intl Inc. 15,589 0.00<br />

2,829 Rockwell Automation 176,643 0.04<br />

5,848 Rockwell Collins 339,242 0.08<br />

1,954 Roper Industries 127,538 0.03<br />

11,357 Ross Stores Inc. 632,131 0.15<br />

6,831 Rowan Companies Inc 207,321 0.05<br />

A Statement of changes in the composition of each of the sub-funds is available to shareholders on request from the Company’s Registered Office or Deutsche Bank A.G., Alfred Herrhausen Allee 16-24, D-<br />

65760 Eschborn. Eine Aufstellung der Veränderungen im Wertpapierbestand der einzelnen Teilfonds ist für Aktionäre auf Anfrage vom Gesellschaftsitz der Gesellschaft oder über die Deutsche Bank A.G.,<br />

Alfred Herrhausen Allee 16- 24, D-65760 Eschborn erhältlich.