pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNiNGs POsiTiON<br />

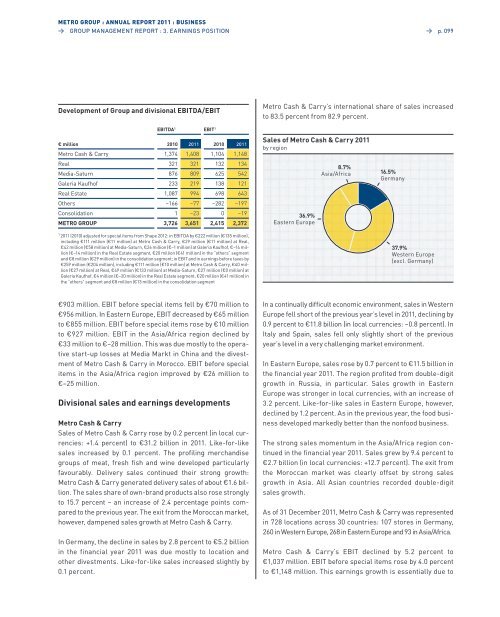

Development of group and divisional EBiTDA/EBiT<br />

EBiTDA 1 EBiT 1<br />

€ million 2010 2011 2010 2011<br />

Metro Cash & Carry 1,374 1,408 1,104 1,148<br />

Real 321 321 132 134<br />

Media-saturn 876 809 625 542<br />

Galeria Kaufhof 233 219 138 121<br />

Real estate 1,087 994 698 643<br />

others –166 –77 –282 –197<br />

Consolidation 1 –23 0 –19<br />

<strong>METRO</strong> gROUP 3,726 3,651 2,415 2,372<br />

1 2011 (2010) adjusted for special items from shape 2012: in eBITDa by €222 million (€135 million),<br />

including €111 million (€11 million) at Metro Cash & Carry, €29 million (€11 million) at Real,<br />

€42 million (€58 million) at Media-saturn, €26 million (€–1 million) at Galeria Kaufhof, €–14 million<br />

(€–14 million) in the Real estate segment, €20 million (€41 million) in the “others” segment<br />

and €8 million (€29 million) in the consolidation segment; in eBIT and in earnings before taxes by<br />

€259 million (€204 million), including €111 million (€10 million) at Metro Cash & Carry, €40 million<br />

(€27 million) at Real, €49 million (€133 million) at Media-saturn, €27 million (€0 million) at<br />

Galeria Kaufhof, €4 million (€–20 million) in the Real estate segment, €20 million (€41 million) in<br />

the “others” segment and €8 million (€13 million) in the consolidation segment<br />

€903 million. eBIT before special items fell by €70 million to<br />

€956 million. In eastern europe, eBIT decreased by €65 million<br />

to €855 million. eBIT before special items rose by €10 million<br />

to €927 million. eBIT in the asia/africa region declined by<br />

€33 million to €–28 million. This was due mostly to the operative<br />

start-up losses at Media Markt in China and the divestment<br />

of Metro Cash & Carry in Morocco. eBIT before special<br />

items in the asia/africa region improved by €26 million to<br />

€–25 million.<br />

Divisional sales and earnings developments<br />

Metro Cash & Carry<br />

sales of Metro Cash & Carry rose by 0.2 percent (in local currencies:<br />

+1.4 percent) to €31.2 billion in 2011. like-for-like<br />

sales increased by 0.1 percent. The profiling merchandise<br />

groups of meat, fresh fish and wine developed particularly<br />

favourably. Delivery sales continued their strong growth:<br />

Metro Cash & Carry generated delivery sales of about €1.6 billion.<br />

The sales share of own-brand products also rose strongly<br />

to 15.7 percent – an increase of 2.4 percentage points compared<br />

to the previous year. The exit from the Moroccan market,<br />

however, dampened sales growth at Metro Cash & Carry.<br />

In Germany, the decline in sales by 2.8 percent to €5.2 billion<br />

in the financial year 2011 was due mostly to location and<br />

other divestments. like-for-like sales increased slightly by<br />

0.1 percent.<br />

→ p. 099<br />

Metro Cash & Carry’s international share of sales increased<br />

to 83.5 percent from 82.9 percent.<br />

sales of Metro Cash & Carry 2011<br />

by region<br />

36.9%<br />

eastern europe<br />

8.7%<br />

asia/africa<br />

16.5%<br />

Germany<br />

37.9%<br />

Western europe<br />

(excl. Germany)<br />

In a continually difficult economic environment, sales in Western<br />

europe fell short of the previous year’s level in 2011, declining by<br />

0.9 percent to €11.8 billion (in local currencies: –0.8 percent). In<br />

Italy and spain, sales fell only slightly short of the previous<br />

year’s level in a very challenging market environment.<br />

In eastern europe, sales rose by 0.7 percent to €11.5 billion in<br />

the financial year 2011. The region profited from double-digit<br />

growth in Russia, in particular. sales growth in eastern<br />

europe was stronger in local currencies, with an increase of<br />

3.2 percent. like-for-like sales in eastern europe, however,<br />

declined by 1.2 percent. as in the previous year, the food business<br />

developed markedly better than the nonfood business.<br />

The strong sales momentum in the asia/africa region continued<br />

in the financial year 2011. sales grew by 9.4 percent to<br />

€2.7 billion (in local currencies: +12.7 percent). The exit from<br />

the Moroccan market was clearly offset by strong sales<br />

growth in asia. all asian countries recorded double-digit<br />

sales growth.<br />

as of 31 December 2011, Metro Cash & Carry was represented<br />

in 728 locations across 30 countries: 107 stores in Germany,<br />

260 in Western europe, 268 in eastern europe and 93 in asia/africa.<br />

Metro Cash & Carry’s eBIT declined by 5.2 percent to<br />

€1,037 million. eBIT before special items rose by 4.0 percent<br />

to €1,148 million. This earnings growth is essentially due to