pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

The reporting year includes disposals of real estate assets<br />

in the amount of €297 million (previous year: €193 million).<br />

These essentially concern the reclassification of assets to<br />

“assets held for sale”.<br />

effects of currency translations reduced tangible assets by<br />

€122 million (previous year: increase of €226 million). This<br />

decline stemmed largely from exchange rate developments<br />

in poland, Russia, Turkey, India and Hungary.<br />

limitations to the disposal of assets in the form of liens and<br />

encumbrances amounted to €314 million (previous year:<br />

€346 million).<br />

purchasing obligations for tangible assets in the amount of<br />

€251 million (previous year: €250 million) were made.<br />

assets used by the <strong>Group</strong> under the terms of finance lease<br />

agreements were valued at €1,310 million (previous year:<br />

€1,074 million). The assets involved are mainly leased<br />

buildings.<br />

Finance leases generally have terms of 15 to 25 years with<br />

options under expiration to extend them at least once for five<br />

years. The interest rates in the leases vary by market and<br />

date of signing between 5.1 and 10.9 percent.<br />

In addition to finance leases, MeTRo GRoUp also signed<br />

other types of leases classified as operating leases based on<br />

their economic value. operating leases generally have an initial<br />

term of up to 15 years. The interest rates in the leases are<br />

based partly on variable and partly on fixed rents.<br />

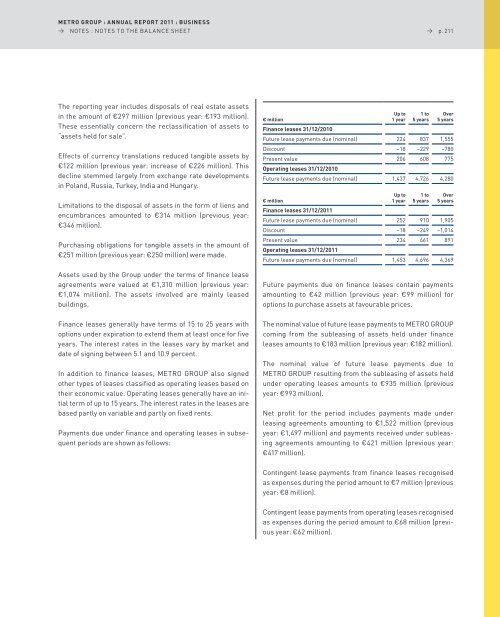

payments due under finance and operating leases in subsequent<br />

periods are shown as follows:<br />

→ p. 211<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2010<br />

1 year 5 years 5 years<br />

Future lease payments due (nominal) 224 837 1,555<br />

Discount –18 –229 –780<br />

present value<br />

Operating leases 31/12/2010<br />

206 608 775<br />

Future lease payments due (nominal) 1,437 4,726 4,280<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2011<br />

1 year 5 years 5 years<br />

Future lease payments due (nominal) 252 910 1,905<br />

Discount –18 –249 –1,014<br />

present value<br />

Operating leases 31/12/2011<br />

234 661 891<br />

Future lease payments due (nominal) 1,453 4,696 4,369<br />

Future payments due on finance leases contain payments<br />

amounting to €42 million (previous year: €99 million) for<br />

options to purchase assets at favourable prices.<br />

The nominal value of future lease payments to MeTRo GRoUp<br />

coming from the subleasing of assets held under finance<br />

leases amounts to €183 million (previous year: €182 million).<br />

The nominal value of future lease payments due to<br />

MeTRo GRoUp resulting from the subleasing of assets held<br />

under operating leases amounts to €935 million (previous<br />

year: €993 million).<br />

net profit for the period includes payments made under<br />

leasing agreements amounting to €1,522 million (previous<br />

year: €1,497 million) and payments received under subleasing<br />

agreements amounting to €421 million (previous year:<br />

€417 million).<br />

Contingent lease payments from finance leases recognised<br />

as expenses during the period amount to €7 million (previous<br />

year: €8 million).<br />

Contingent lease payments from operating leases recognised<br />

as expenses during the period amount to €68 million (previous<br />

year: €62 million).