pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : oTHeR noTes<br />

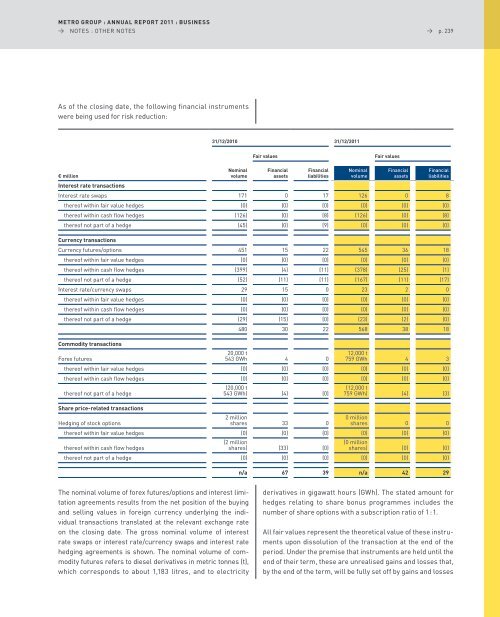

as of the closing date, the following financial instruments<br />

were being used for risk reduction:<br />

The nominal volume of forex futures/options and interest limitation<br />

agreements results from the net position of the buying<br />

and selling values in foreign currency underlying the individual<br />

transactions translated at the relevant exchange rate<br />

on the closing date. The gross nominal volume of interest<br />

rate swaps or interest rate/currency swaps and interest rate<br />

hedging agreements is shown. The nominal volume of commodity<br />

futures refers to diesel derivatives in metric tonnes (t),<br />

which corresponds to about 1,183 litres, and to electricity<br />

31/12/2010 31/12/2011<br />

Fair values<br />

Fair values<br />

→ p. 239<br />

Nominal Financial Financial Nominal Financial Financial<br />

€ million<br />

interest rate transactions<br />

volume<br />

assets liabilities volume<br />

assets liabilities<br />

Interest rate swaps 171 0 17 126 0 8<br />

thereof within fair value hedges (0) (0) (0) (0) (0) (0)<br />

thereof within cash flow hedges (126) (0) (8) (126) (0) (8)<br />

thereof not part of a hedge (45) (0) (9) (0) (0) (0)<br />

Currency transactions<br />

Currency futures/options 451 15 22 545 36 18<br />

thereof within fair value hedges (0) (0) (0) (0) (0) (0)<br />

thereof within cash flow hedges (399) (4) (11) (378) (25) (1)<br />

thereof not part of a hedge (52) (11) (11) (167) (11) (17)<br />

Interest rate/currency swaps 29 15 0 23 2 0<br />

thereof within fair value hedges (0) (0) (0) (0) (0) (0)<br />

thereof within cash flow hedges (0) (0) (0) (0) (0) (0)<br />

thereof not part of a hedge (29) (15) (0) (23) (2) (0)<br />

480 30 22 568 38 18<br />

Commodity transactions<br />

20,000 t<br />

12,000 t<br />

Forex futures<br />

543 GWh 4 0 759 GWh 4 3<br />

thereof within fair value hedges (0) (0) (0) (0) (0) (0)<br />

thereof within cash flow hedges (0) (0) (0) (0) (0) (0)<br />

(20,000 t<br />

(12,000 t<br />

thereof not part of a hedge<br />

543 GWh) (4) (0) 759 GWh) (4) (3)<br />

share price-related transactions<br />

2 million<br />

0 million<br />

Hedging of stock options<br />

shares 33 0 shares 0 0<br />

thereof within fair value hedges (0) (0) (0) (0) (0) (0)<br />

(2 million<br />

(0 million<br />

thereof within cash flow hedges<br />

shares) (33) (0) shares) (0) (0)<br />

thereof not part of a hedge (0) (0) (0) (0) (0) (0)<br />

n/a 67 39 n/a 42 29<br />

derivatives in gigawatt hours (GWh). The stated amount for<br />

hedges relating to share bonus programmes includes the<br />

number of share options with a subscription ratio of 1 : 1.<br />

all fair values represent the theoretical value of these instruments<br />

upon dissolution of the transaction at the end of the<br />

period. Under the premise that instruments are held until the<br />

end of their term, these are unrealised gains and losses that,<br />

by the end of the term, will be fully set off by gains and losses