pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

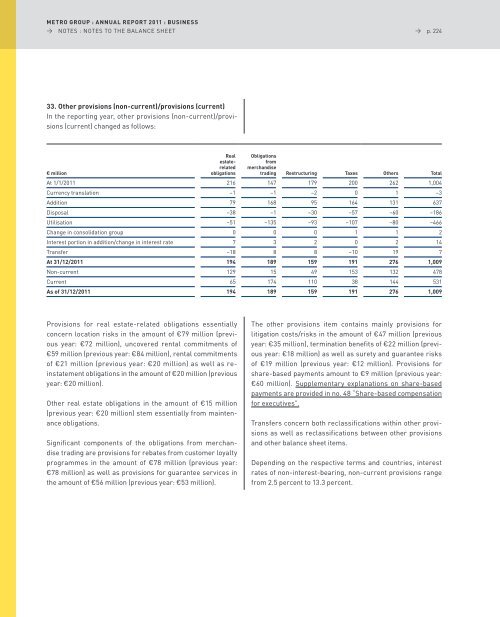

33. Other provisions (non-current)/provisions (current)<br />

In the reporting year, other provisions (non-current)/provisions<br />

(current) changed as follows:<br />

€ million<br />

Real<br />

estate-<br />

related<br />

obligations<br />

provisions for real estate-related obligations essentially<br />

concern location risks in the amount of €79 million (previous<br />

year: €72 million), uncovered rental commitments of<br />

€59 million (previous year: €84 million), rental commitments<br />

of €21 million (previous year: €20 million) as well as re-<br />

ins tatement obligations in the amount of €20 million (previous<br />

year: €20 million).<br />

other real estate obligations in the amount of €15 million<br />

(previous year: €20 million) stem essentially from maintenance<br />

obligations.<br />

significant components of the obligations from merchandise<br />

trading are provisions for rebates from customer loyalty<br />

programmes in the amount of €78 million (previous year:<br />

€78 million) as well as provisions for guarantee services in<br />

the amount of €56 million (previous year: €53 million).<br />

→ p. 224<br />

Obligations<br />

from<br />

merchandise<br />

trading Restructuring Taxes Others Total<br />

at 1/1/2011 216 147 179 200 262 1,004<br />

Currency translation –1 –1 –2 0 1 –3<br />

addition 79 168 95 164 131 637<br />

Disposal –38 –1 –30 –57 –60 –186<br />

Utilisation –51 –135 –93 –107 –80 –466<br />

Change in consolidation group 0 0 0 1 1 2<br />

Interest portion in addition/change in interest rate 7 3 2 0 2 14<br />

Transfer –18 8 8 –10 19 7<br />

At 31/12/2011 194 189 159 191 276 1,009<br />

non-current 129 15 49 153 132 478<br />

Current 65 174 110 38 144 531<br />

As of 31/12/2011 194 189 159 191 276 1,009<br />

The other provisions item contains mainly provisions for<br />

litigation costs/risks in the amount of €47 million (previous<br />

year: €35 million), termination benefits of €22 million (previous<br />

year: €18 million) as well as surety and guarantee risks<br />

of €19 million (previous year: €12 million). provisions for<br />

share-based payments amount to €9 million (previous year:<br />

€60 million). supplementary explanations on share-based<br />

payments are provided in no. 48 “share-based compensation<br />

for executives”.<br />

Transfers concern both reclassifications within other provisions<br />

as well as reclassifications between other provisions<br />

and other balance sheet items.<br />

Depending on the respective terms and countries, interest<br />

rates of non-interest-bearing, non-current provisions range<br />

from 2.5 percent to 13.3 percent.