pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

loans and receivables due within the last 90 days largely<br />

result from standard business payment transactions without<br />

or with short-term payment targets. For non-adjusted loans<br />

and receivables over 90 days overdue, there is no indication<br />

as of the closing date that debtors will not fulfil their payment<br />

obligations. This is also the case for all capitalised financial<br />

instruments that are not overdue and not adjusted for bad debt.<br />

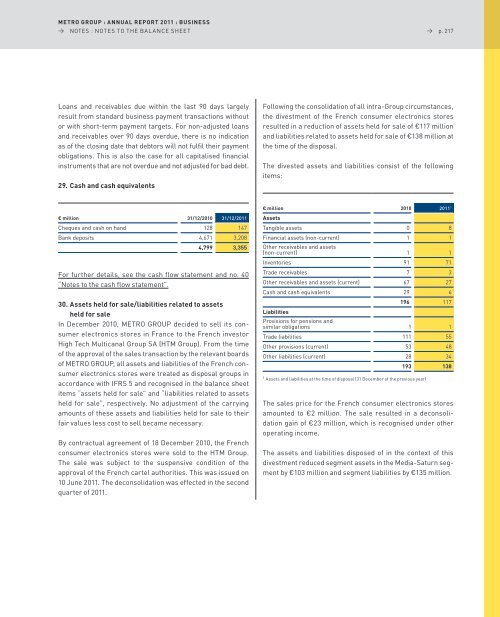

29. Cash and cash equivalents<br />

€ million 31/12/2010 31/12/2011<br />

Cheques and cash on hand 128 147<br />

Bank deposits 4,671 3,208<br />

4,799 3,355<br />

For further details, see the cash flow statement and no. 40<br />

“notes to the cash flow statement”.<br />

30. Assets held for sale/liabilities related to assets<br />

held for sale<br />

In December 2010, MeTRo GRoUp decided to sell its consumer<br />

electronics stores in France to the French investor<br />

High Tech Multicanal <strong>Group</strong> sa (HTM <strong>Group</strong>). From the time<br />

of the approval of the sales transaction by the relevant boards<br />

of MeTRo GRoUp, all assets and liabilities of the French consumer<br />

electronics stores were treated as disposal groups in<br />

accordance with IFRs 5 and recognised in the balance sheet<br />

items “assets held for sale” and “liabilities related to assets<br />

held for sale”, respectively. no adjustment of the carrying<br />

amounts of these assets and liabilities held for sale to their<br />

fair values less cost to sell became necessary.<br />

By contractual agreement of 18 December 2010, the French<br />

consumer electronics stores were sold to the HTM <strong>Group</strong>.<br />

The sale was subject to the suspensive condition of the<br />

approval of the French cartel authorities. This was issued on<br />

10 June 2011. The deconsolidation was effected in the second<br />

quarter of 2011.<br />

→ p. 217<br />

Following the consolidation of all intra-<strong>Group</strong> circumstances,<br />

the divestment of the French consumer electronics stores<br />

resulted in a reduction of assets held for sale of €117 million<br />

and liabilities related to assets held for sale of €138 million at<br />

the time of the disposal.<br />

The divested assets and liabilities consist of the following<br />

items:<br />

€ million 2010 20111 Assets<br />

Tangible assets 0 8<br />

Financial assets (non-current)<br />

other receivables and assets<br />

1 1<br />

(non-current)<br />

1<br />

1<br />

Inventories 91 71<br />

Trade receivables 7 3<br />

other receivables and assets (current) 67 27<br />

Cash and cash equivalents 29 6<br />

Liabilities<br />

provisions for pensions and<br />

196 117<br />

similar obligations<br />

1<br />

1<br />

Trade liabilities 111 55<br />

other provisions (current) 53 48<br />

other liabilities (current) 28 34<br />

193 138<br />

1 assets and liabilities at the time of disposal (31 December of the previous year)<br />

The sales price for the French consumer electronics stores<br />

amounted to €2 million. The sale resulted in a deconsolidation<br />

gain of €23 million, which is recognised under other<br />

operating income.<br />

The assets and liabilities disposed of in the context of this<br />

divestment reduced segment assets in the Media-saturn segment<br />

by €103 million and segment liabilities by €135 million.