pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

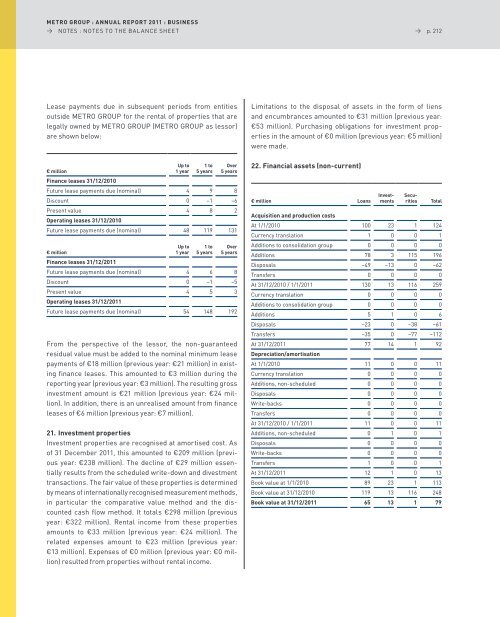

lease payments due in subsequent periods from entities<br />

outside MeTRo GRoUp for the rental of properties that are<br />

legally owned by MeTRo GRoUp (MeTRo GRoUp as lessor)<br />

are shown below:<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2010<br />

1 year 5 years 5 years<br />

Future lease payments due (nominal) 4 9 8<br />

Discount 0 –1 –6<br />

present value<br />

Operating leases 31/12/2010<br />

4 8 2<br />

Future lease payments due (nominal) 48 119 131<br />

Up to 1 to Over<br />

€ million<br />

Finance leases 31/12/2011<br />

1 year 5 years 5 years<br />

Future lease payments due (nominal) 4 6 8<br />

Discount 0 –1 –5<br />

present value<br />

Operating leases 31/12/2011<br />

4 5 3<br />

Future lease payments due (nominal) 54 148 192<br />

From the perspective of the lessor, the non-guaranteed<br />

residual value must be added to the nominal minimum lease<br />

payments of €18 million (previous year: €21 million) in existing<br />

finance leases. This amounted to €3 million during the<br />

reporting year (previous year: €3 million). The resulting gross<br />

investment amount is €21 million (previous year: €24 million).<br />

In addition, there is an unrealised amount from finance<br />

leases of €6 million (previous year: €7 million).<br />

21. investment properties<br />

Investment properties are recognised at amortised cost. as<br />

of 31 December 2011, this amounted to €209 million (previous<br />

year: €238 million). The decline of €29 million essentially<br />

results from the scheduled write-down and divestment<br />

transactions. The fair value of these properties is determined<br />

by means of internationally recognised measurement methods,<br />

in particular the comparative value method and the discounted<br />

cash flow method. It totals €298 million (previous<br />

year: €322 million). Rental income from these properties<br />

amounts to €33 million (previous year: €24 million). The<br />

related expenses amount to €23 million (previous year:<br />

€13 million). expenses of €0 million (previous year: €0 million)<br />

resulted from properties without rental income.<br />

→ p. 212<br />

limitations to the disposal of assets in the form of liens<br />

and encumbrances amounted to €31 million (previous year:<br />

€53 million). purchasing obligations for investment properties<br />

in the amount of €0 million (previous year: €5 million)<br />

were made.<br />

22. Financial assets (non-current)<br />

€ million Loans<br />

investments<br />

securities<br />

Total<br />

Acquisition and production costs<br />

at 1/1/2010 100 23 1 124<br />

Currency translation 1 0 0 1<br />

additions to consolidation group 0 0 0 0<br />

additions 78 3 115 196<br />

Disposals –49 –13 0 –62<br />

Transfers 0 0 0 0<br />

at 31/12/2010 / 1/1/2011 130 13 116 259<br />

Currency translation 0 0 0 0<br />

additions to consolidation group 0 0 0 0<br />

additions 5 1 0 6<br />

Disposals –23 0 –38 –61<br />

Transfers –35 0 –77 –112<br />

at 31/12/2011<br />

Depreciation/amortisation<br />

77 14 1 92<br />

at 1/1/2010 11 0 0 11<br />

Currency translation 0 0 0 0<br />

additions, non-scheduled 0 0 0 0<br />

Disposals 0 0 0 0<br />

Write-backs 0 0 0 0<br />

Transfers 0 0 0 0<br />

at 31/12/2010 / 1/1/2011 11 0 0 11<br />

additions, non-scheduled 0 1 0 1<br />

Disposals 0 0 0 0<br />

Write-backs 0 0 0 0<br />

Transfers 1 0 0 1<br />

at 31/12/2011 12 1 0 13<br />

Book value at 1/1/2010 89 23 1 113<br />

Book value at 31/12/2010 119 13 116 248<br />

Book value at 31/12/2011 65 13 1 79