pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe InCoMe sTaTeMenT<br />

The non-controlling shareholder was granted an offer to<br />

tender his capital interests in the purchase contract. This<br />

tender right was recognised as a financial liability at the present<br />

value of the repurchase amount. accordingly, the acquisition<br />

was presented as though 100 percent of the shares had<br />

been acquired.<br />

The acquisition of Redcoon GmbH including its seven subsidiaries<br />

results in goodwill of €83 million.<br />

The acquisition of the Redcoon group results in subsidiary<br />

acquisition costs of €2 million, which have been recognised<br />

as general administrative expenses in the income<br />

statement.<br />

since its consolidation, the Redcoon group has contributed<br />

€239 million to <strong>Group</strong> sales and €–2 million to net profit for<br />

the period.<br />

assuming the acquisition had been effected as of 1 January<br />

2011, the Redcoon group would have contributed €432 million<br />

to MeTRo GRoUp sales and €–1 million to net profit for the<br />

period.<br />

Notes to the income statement<br />

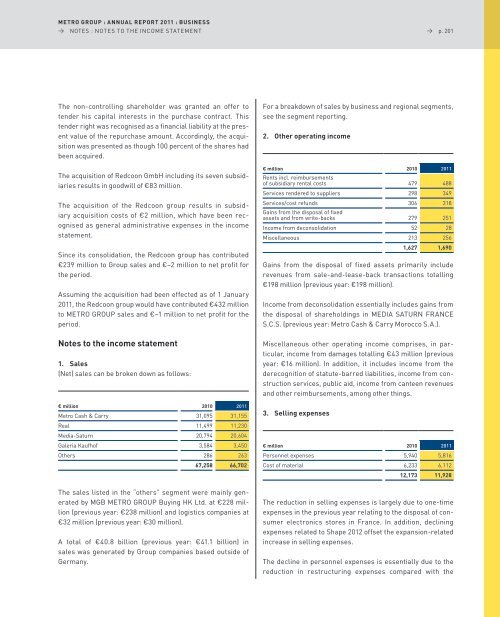

1. sales<br />

(net) sales can be broken down as follows:<br />

€ million 2010 2011<br />

Metro Cash & Carry 31,095 31,155<br />

Real 11,499 11,230<br />

Media-saturn 20,794 20,604<br />

Galeria Kaufhof 3,584 3,450<br />

others 286 263<br />

67,258 66,702<br />

The sales listed in the “others” segment were mainly generated<br />

by MGB MeTRo GRoUp Buying HK ltd. at €228 million<br />

(previous year: €238 million) and logistics companies at<br />

€32 million (previous year: €30 million).<br />

a total of €40.8 billion (previous year: €41.1 billion) in<br />

sales was generated by <strong>Group</strong> companies based outside of<br />

Germany.<br />

→ p. 201<br />

For a breakdown of sales by business and regional segments,<br />

see the segment reporting.<br />

2. Other operating income<br />

€ million<br />

Rents incl. reimbursements<br />

2010 2011<br />

of subsidiary rental costs 479 488<br />

services rendered to suppliers 298 349<br />

services/cost refunds<br />

Gains from the disposal of fixed<br />

306 318<br />

assets and from write-backs 279 251<br />

Income from deconsolidation 52 28<br />

Miscellaneous 213 256<br />

1,627 1,690<br />

Gains from the disposal of fixed assets primarily include<br />

revenues from sale-and-lease-back transactions totalling<br />

€198 million (previous year: €198 million).<br />

Income from deconsolidation essentially includes gains from<br />

the disposal of shareholdings in MeDIa saTURn FRanCe<br />

s.C.s. (previous year: Metro Cash & Carry Morocco s.a.).<br />

Miscellaneous other operating income comprises, in particular,<br />

income from damages totalling €43 million (previous<br />

year: €16 million). In addition, it includes income from the<br />

derecognition of statute-barred liabilities, income from construction<br />

services, public aid, income from canteen revenues<br />

and other reimbursements, among other things.<br />

3. selling expenses<br />

€ million 2010 2011<br />

personnel expenses 5,940 5,816<br />

Cost of material 6,233 6,112<br />

12,173 11,928<br />

The reduction in selling expenses is largely due to one-time<br />

expenses in the previous year relating to the disposal of consumer<br />

electronics stores in France. In addition, declining<br />

expenses related to shape 2012 offset the expansion-related<br />

increase in selling expenses.<br />

The decline in personnel expenses is essentially due to the<br />

reduction in restructuring expenses compared with the