pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 4. FiNANciAl ANd AssET POsiTiON<br />

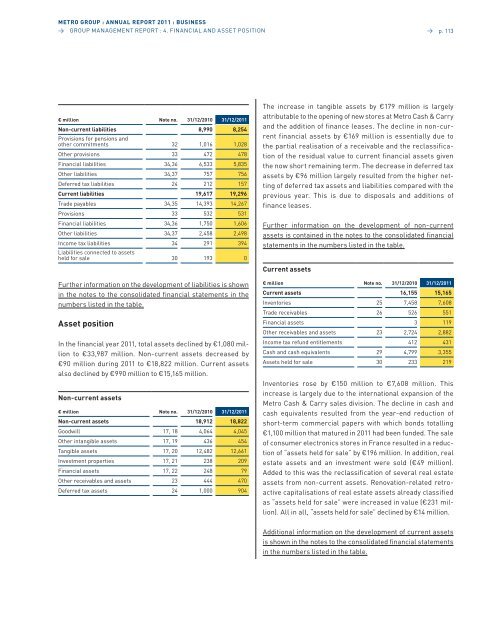

€ million Note no. 31/12/2010 31/12/2011<br />

Non-current liabilities<br />

provisions for pensions and<br />

8,990 8,254<br />

other commitments 32 1,016 1,028<br />

other provisions 33 472 478<br />

Financial liabilities 34,36 6,533 5,835<br />

other liabilities 34,37 757 756<br />

Deferred tax liabilities 24 212 157<br />

Current liabilities 19,617 19,296<br />

Trade payables 34,35 14,393 14,267<br />

provisions 33 532 531<br />

Financial liabilities 34,36 1,750 1,606<br />

other liabilities 34,37 2,458 2,498<br />

Income tax liabilities<br />

liabilities connected to assets<br />

34 291 394<br />

held for sale 30 193 0<br />

Further information on the development of liabilities is shown<br />

in the notes to the consolidated financial statements in the<br />

numbers listed in the table.<br />

Asset position<br />

In the financial year 2011, total assets declined by €1,080 million<br />

to €33,987 million. non-current assets decreased by<br />

€90 million during 2011 to €18,822 million. Current assets<br />

also declined by €990 million to €15,165 million.<br />

Non-current assets<br />

€ million Note no. 31/12/2010 31/12/2011<br />

Non-current assets 18,912 18,822<br />

Goodwill 17, 18 4,064 4,045<br />

other intangible assets 17, 19 436 454<br />

Tangible assets 17, 20 12,482 12,661<br />

Investment properties 17, 21 238 209<br />

Financial assets 17, 22 248 79<br />

other receivables and assets 23 444 470<br />

Deferred tax assets 24 1,000 904<br />

→ p. 113<br />

The increase in tangible assets by €179 million is largely<br />

attributable to the opening of new stores at Metro Cash & Carry<br />

and the addition of finance leases. The decline in non-current<br />

financial assets by €169 million is essentially due to<br />

the partial realisation of a receivable and the reclassification<br />

of the residual value to current financial assets given<br />

the now short remaining term. The decrease in deferred tax<br />

assets by €96 million largely resulted from the higher netting<br />

of deferred tax assets and liabilities compared with the<br />

previous year. This is due to disposals and additions of<br />

finance leases.<br />

Further information on the development of non-current<br />

assets is contained in the notes to the consolidated financial<br />

statements in the numbers listed in the table.<br />

Current assets<br />

€ million Note no. 31/12/2010 31/12/2011<br />

Current assets 16,155 15,165<br />

Inventories 25 7,458 7,608<br />

Trade receivables 26 526 551<br />

Financial assets 3 119<br />

other receivables and assets 23 2,724 2,882<br />

Income tax refund entitlements 412 431<br />

Cash and cash equivalents 29 4,799 3,355<br />

assets held for sale 30 233 219<br />

Inventories rose by €150 million to €7,608 million. This<br />

increase is largely due to the international expansion of the<br />

Metro Cash & Carry sales division. The decline in cash and<br />

cash equivalents resulted from the year-end reduction of<br />

short-term commercial papers with which bonds totalling<br />

€1,100 million that matured in 2011 had been funded. The sale<br />

of consumer electronics stores in France resulted in a reduction<br />

of “assets held for sale” by €196 million. In addition, real<br />

estate assets and an investment were sold (€49 million).<br />

added to this was the reclassification of several real estate<br />

assets from non-current assets. Renovation-related retroactive<br />

capitalisations of real estate assets already classified<br />

as “assets held for sale” were increased in value (€231 million).<br />

all in all, “assets held for sale” declined by €14 million.<br />

additional information on the development of current assets<br />

is shown in the notes to the consolidated financial statements<br />

in the numbers listed in the table.