pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

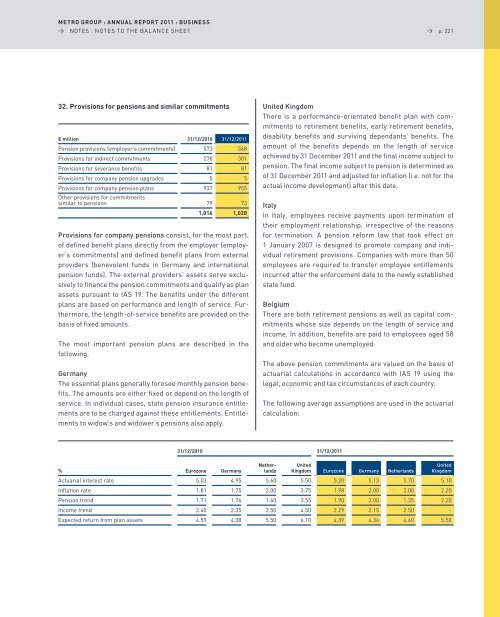

32. Provisions for pensions and similar commitments<br />

€ million 31/12/2010 31/12/2011<br />

pension provisions (employer’s commitments) 573 568<br />

provisions for indirect commitments 278 301<br />

provisions for severance benefits 81 81<br />

provisions for company pension upgrades 5 5<br />

provisions for company pension plans<br />

other provisions for commitments<br />

937 955<br />

similar to pensions 79 73<br />

1,016 1,028<br />

Provisions for company pensions consist, for the most part,<br />

of defined benefit plans directly from the employer (employer’s<br />

commitments) and defined benefit plans from external<br />

providers (benevolent funds in Germany and international<br />

pension funds). The external providers’ assets serve exclusively<br />

to finance the pension commitments and qualify as plan<br />

assets pursuant to Ias 19. The benefits under the different<br />

plans are based on performance and length of service. Furthermore,<br />

the length-of-service benefits are provided on the<br />

basis of fixed amounts.<br />

The most important pension plans are described in the<br />

following.<br />

Germany<br />

The essential plans generally foresee monthly pension benefits.<br />

The amounts are either fixed or depend on the length of<br />

service. In individual cases, state pension insurance entitlements<br />

are to be charged against these entitlements. entitlements<br />

to widow’s and widower’s pensions also apply.<br />

31/12/2010 31/12/2011<br />

→ p. 221<br />

United Kingdom<br />

There is a performance-orientated benefit plan with commitments<br />

to retirement benefits, early retirement benefits,<br />

disability benefits and surviving dependants’ benefits. The<br />

amount of the benefits depends on the length of service<br />

achieved by 31 December 2011 and the final income subject to<br />

pension. The final income subject to pension is determined as<br />

of 31 December 2011 and adjusted for inflation (i.e. not for the<br />

actual income development) after this date.<br />

Italy<br />

In Italy, employees receive payments upon termination of<br />

their employment relationship, irrespective of the reasons<br />

for termination. a pension reform law that took effect on<br />

1 January 2007 is designed to promote company and individual<br />

retirement provisions. Companies with more than 50<br />

employees are required to transfer employee entitlements<br />

incurred after the enforcement date to the newly established<br />

state fund.<br />

Belgium<br />

There are both retirement pensions as well as capital commitments<br />

whose size depends on the length of service and<br />

income. In addition, benefits are paid to employees aged 58<br />

and older who become unemployed.<br />

The above pension commitments are valued on the basis of<br />

actuarial calculations in accordance with Ias 19 using the<br />

legal, economic and tax circumstances of each country.<br />

The following average assumptions are used in the actuarial<br />

calculation:<br />

Nether- United<br />

United<br />

% Eurozone germany lands Kingdom Eurozone germany Netherlands Kingdom<br />

actuarial interest rate 5.03 4.95 5.60 5.50 5.20 5.13 5.70 5.10<br />

Inflation rate 1.81 1.75 2.00 3.75 1.98 2.00 2.00 2.20<br />

pension trend 1.71 1.76 1.60 3.55 1.90 2.00 1.35 2.20<br />

Income trend 2.40 2.35 2.50 4.50 2.29 2.15 2.50 -<br />

expected return from plan assets 4.59 4.08 5.50 6.10 4.39 4.36 4.60 5.50