pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 4. FiNANciAl ANd AssET POsiTiON<br />

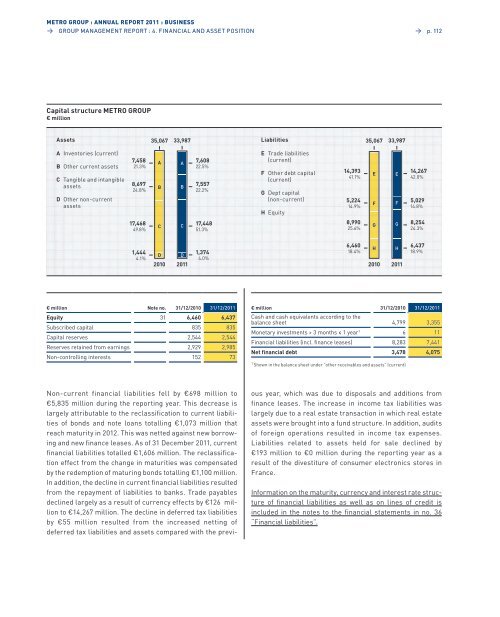

Capital structure <strong>METRO</strong> gROUP<br />

€ million<br />

Assets<br />

A Inventories (current)<br />

B other current assets<br />

C Tangible and intangible<br />

assets<br />

D other non-current<br />

assets<br />

7,458<br />

21.3%<br />

8,697<br />

24.8%<br />

17,468<br />

49.8%<br />

1,444<br />

4.1%<br />

35,067<br />

D<br />

2010<br />

non-current financial liabilities fell by €698 million to<br />

€5,835 million during the reporting year. This decrease is<br />

largely attributable to the reclassification to current liabilities<br />

of bonds and note loans totalling €1,073 million that<br />

reach maturity in 2012. This was netted against new borrowing<br />

and new finance leases. as of 31 December 2011, current<br />

financial liabilities totalled €1,606 million. The reclassification<br />

effect from the change in maturities was compensated<br />

by the redemption of maturing bonds totalling €1,100 million.<br />

In addition, the decline in current financial liabilities resulted<br />

from the repayment of liabilities to banks. Trade payables<br />

declined largely as a result of currency effects by €126 million<br />

to €14,267 million. The decline in deferred tax liabilities<br />

by €55 million resulted from the increased netting of<br />

deferred tax liabilities and assets compared with the previ-<br />

A<br />

B<br />

C<br />

33,987<br />

A<br />

B<br />

C<br />

D<br />

2011<br />

7,608<br />

22.5%<br />

7,557<br />

22.2%<br />

17,448<br />

51.3%<br />

1,374<br />

4.0%<br />

€ million Note no. 31/12/2010 31/12/2011<br />

Equity 31 6,460 6,437<br />

subscribed capital 835 835<br />

Capital reserves 2,544 2,544<br />

Reserves retained from earnings 2,929 2,985<br />

non-controlling interests 152 73<br />

Liabilities<br />

E Trade liabilities<br />

(current)<br />

F other debt capital<br />

(current)<br />

g Dept capital<br />

(non-current)<br />

h equity<br />

14,393<br />

41.1%<br />

5,224<br />

14.9%<br />

8,990<br />

25.6%<br />

6,460<br />

18.4%<br />

35,067<br />

2010<br />

→ p. 112<br />

ous year, which was due to disposals and additions from<br />

finance leases. The increase in income tax liabilities was<br />

largely due to a real estate transaction in which real estate<br />

assets were brought into a fund structure. In addition, audits<br />

of foreign operations resulted in income tax expenses.<br />

liabilities related to assets held for sale declined by<br />

€193 million to €0 million during the reporting year as a<br />

result of the divestiture of consumer electronics stores in<br />

France.<br />

Information on the maturity, currency and interest rate structure<br />

of financial liabilities as well as on lines of credit is<br />

included in the notes to the financial statements in no. 36<br />

“Financial liabilities”.<br />

E<br />

F<br />

G<br />

H<br />

33,987<br />

E<br />

F<br />

G<br />

H<br />

2011<br />

14,267<br />

42.0%<br />

5,029<br />

14.8%<br />

8,254<br />

24.3%<br />

6,437<br />

18.9%<br />

€ million<br />

Cash and cash equivalents according to the<br />

31/12/2010 31/12/2011<br />

balance sheet 4,799 3,355<br />

Monetary investments > 3 months ≤ 1 year1 6 11<br />

Financial liabilities (incl. finance leases) 8,283 7,441<br />

Net financial debt 3,478 4,075<br />

1 shown in the balance sheet under “other receivables and assets” (current)