pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : oTHeR noTes<br />

47. Notes on related parties<br />

In 2011, MeTRo GRoUp maintained the following business<br />

relations to related companies:<br />

€ million 2010 2011<br />

Goods/services provided 3 3<br />

Goods/services received 108 60<br />

Receivables from goods/services provided 1 0<br />

liabilities from goods/services received 0 3<br />

In the financial year 2011, MeTRo GRoUp companies provided<br />

goods/services totalling €3 million to companies included in<br />

the group of related companies. This concerns primarily the<br />

granting of energy and lease rights.<br />

The goods/services totalling €60 million that MeTRo GRoUp<br />

companies received from related companies in the financial<br />

year 2011 consist primarily of property leases. The decline in<br />

goods/services received is essentially due to the termination<br />

of leases with related parties or rent adjustments in existing<br />

leases.<br />

The basic principles of the remuneration system and the<br />

amount of Management and supervisory Board compensation<br />

are included in the remuneration report, which is part of<br />

the management report.<br />

Business relations with related parties are based on contractual<br />

agreements providing for arm’s length prices. as in<br />

2010, MeTRo GRoUp had no business relations with related<br />

natur al persons in the financial year 2011.<br />

48. share-based compensation for executives<br />

MeTRo aG has been implementing share-based payments<br />

programmes since 1999 to enable executives to participate in<br />

the Company’s value development and reward their contribution<br />

to the sustained success of MeTRo GRoUp compared<br />

with its competitors. The members of the Management Board<br />

and other executives of MeTRo aG as well as managing directors<br />

and executives of the other operating MeTRo GRoUp<br />

companies are eligible.<br />

Share bonus programme (2004–2008)<br />

The final tranche of the share bonus programme, which<br />

MeTRo aG introduced in 2004, was granted in 2008. The<br />

programme entitles executives to cash bonuses whose size<br />

→ p. 244<br />

depends on the performance of the Metro share and the parallel<br />

consideration of benchmark indices. The programme is<br />

divided into a tranche for each year, with the target parameters<br />

being calculated separately for each tranche. The full<br />

share bonus is paid out when the target share price and a socalled<br />

equal performance of the share with benchmark indices<br />

are attained. The maturity of each tranche is three years.<br />

The payment of the share bonus may be limited to the amount<br />

of the gross fixed salary. The conditions for the tranches 2004<br />

to 2008 are shown in the following table:<br />

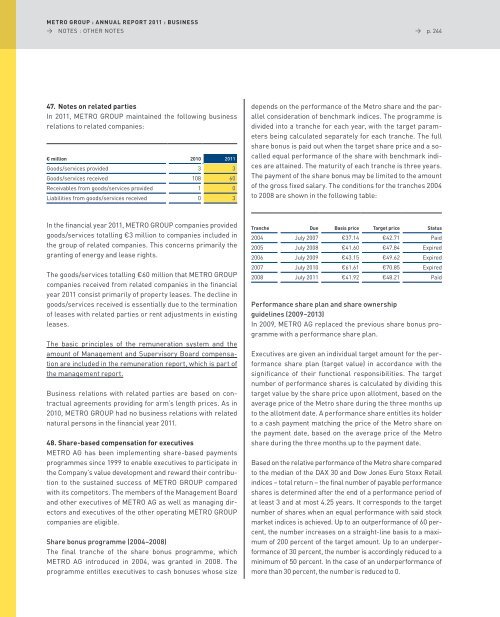

Tranche Due Basis price Target price status<br />

2004 July 2007 €37.14 €42.71 paid<br />

2005 July 2008 €41.60 €47.84 expired<br />

2006 July 2009 €43.15 €49.62 expired<br />

2007 July 2010 €61.61 €70.85 expired<br />

2008 July 2011 €41.92 €48.21 paid<br />

Performance share plan and share ownership<br />

guidelines (2009–2013)<br />

In 2009, MeTRo aG replaced the previous share bonus programme<br />

with a performance share plan.<br />

executives are given an individual target amount for the performance<br />

share plan (target value) in accordance with the<br />

significance of their functional responsibilities. The target<br />

number of performance shares is calculated by dividing this<br />

target value by the share price upon allotment, based on the<br />

average price of the Metro share during the three months up<br />

to the allotment date. a performance share entitles its holder<br />

to a cash payment matching the price of the Metro share on<br />

the payment date, based on the average price of the Metro<br />

share during the three months up to the payment date.<br />

Based on the relative performance of the Metro share compared<br />

to the median of the DaX 30 and Dow Jones euro stoxx Retail<br />

indices – total return – the final number of payable performance<br />

shares is determined after the end of a performance period of<br />

at least 3 and at most 4.25 years. It corresponds to the target<br />

number of shares when an equal performance with said stock<br />

market indices is achieved. Up to an outperformance of 60 percent,<br />

the number increases on a straight-line basis to a maximum<br />

of 200 percent of the target amount. Up to an underperformance<br />

of 30 percent, the number is accordingly reduced to a<br />

minimum of 50 percent. In the case of an underperformance of<br />

more than 30 percent, the number is reduced to 0.