pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe InCoMe sTaTeMenT<br />

previous year as well as lower performance-based one-time<br />

payments. In addition, savings were generated from store<br />

closures in the Real segment.<br />

The decline in the cost of material is mostly due to lower<br />

impairments as prior-year figures were dampened by<br />

the decision to dispose of the French consumer electronics<br />

stores. as a result, lower impairments as well as lower<br />

expenses on provisions were recorded during the reporting<br />

year compared to the previous year. In addition, lower advertising<br />

volumes and increased special conditions, particularly<br />

at Media-saturn in Germany, in the area of advertising costs,<br />

offset the expansion-related increase in the cost of material.<br />

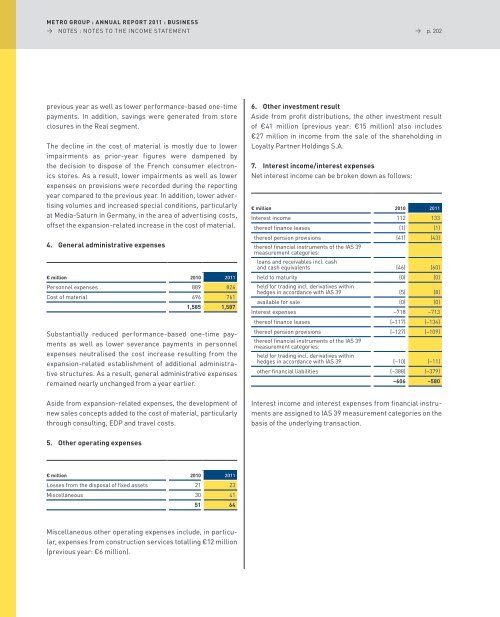

4. general administrative expenses<br />

€ million 2010 2011<br />

personnel expenses 889 826<br />

Cost of material 696 761<br />

1,585 1,587<br />

substantially reduced performance-based one-time payments<br />

as well as lower severance payments in personnel<br />

expenses neutralised the cost increase resulting from the<br />

expansion-related establishment of additional administrative<br />

structures. as a result, general administrative expenses<br />

remained nearly unchanged from a year earlier.<br />

aside from expansion-related expenses, the development of<br />

new sales concepts added to the cost of material, particularly<br />

through consulting, eDp and travel costs.<br />

5. Other operating expenses<br />

€ million 2010 2011<br />

losses from the disposal of fixed assets 21 23<br />

Miscellaneous 30 41<br />

51 64<br />

Miscellaneous other operating expenses include, in particular,<br />

expenses from construction services totalling €12 million<br />

(previous year: €6 million).<br />

→ p. 202<br />

6. Other investment result<br />

aside from profit distributions, the other investment result<br />

of €41 million (previous year: €15 million) also includes<br />

€27 million in income from the sale of the shareholding in<br />

loyalty partner Holdings s.a.<br />

7. interest income/interest expenses<br />

net interest income can be broken down as follows:<br />

€ million 2010 2011<br />

Interest income 112 133<br />

thereof finance leases (1) (1)<br />

thereof pension provisions<br />

thereof financial instruments of the Ias 39<br />

measurement categories:<br />

loans and receivables incl. cash<br />

(41) (43)<br />

and cash equivalents (46) (60)<br />

held to maturity<br />

held for trading incl. derivatives within<br />

(0) (0)<br />

hedges in accordance with Ias 39 (5) (8)<br />

available for sale (0) (0)<br />

Interest expenses –718 –713<br />

thereof finance leases (–117) (–134)<br />

thereof pension provisions<br />

thereof financial instruments of the Ias 39<br />

measurement categories:<br />

held for trading incl. derivatives within<br />

(–127) (–109)<br />

hedges in accordance with Ias 39 (–10) (–11)<br />

other financial liabilities (–388) (–379)<br />

–606 –580<br />

Interest income and interest expenses from financial instruments<br />

are assigned to Ias 39 measurement categories on the<br />

basis of the underlying transaction.