pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNiNGs POsiTiON<br />

margin improvements related to shape 2012. In addition, the<br />

higher sales proportion of own brands had a positive impact<br />

on margin developments. With an improved eBIT margin,<br />

Metro Cash & Carry managed to improve its return again in a<br />

difficult environment.<br />

Key figures Metro Cash & Carry 2011<br />

in year-on-year comparison<br />

2010<br />

€ million<br />

Change in %<br />

2011<br />

€ million in €<br />

Currency<br />

effects in<br />

percentage<br />

points<br />

Like-for-<br />

in local like (local<br />

curcurrenciesrencies) sales 31,095 31,155 0.2 –1.2 1.4 0.1<br />

Germany 5,302 5,152 –2.8 0.0 –2.8 0.1<br />

Western europe 11,912 11,805 –0.9 –0.1 –0.8 –1.0<br />

eastern europe 11,407 11,492 0.7 –2.5 3.2 –1.2<br />

asia/africa 2,474 2,706 9.4 –3.3 12.7 12.7<br />

eBITDa 1,3741 1,4081 2.4 – – –<br />

eBIT 1,1041 1,1481 4.0 – – –<br />

eBIT margin (%) 3.61 3.71 – – – –<br />

locations (number) 687 7282 selling space<br />

6.0 – – –<br />

(1,000 sqm) 5,355 5,517 3.0 – – –<br />

1 Before special items from shape 2012<br />

2 Including first-time inclusien of satellite stores opend in 2009/2010 (total of 14)<br />

Real<br />

Due partly to store divestments, Real’s sales declined by<br />

2.3 percent to €11.2 billion in 2011 (in local currencies:<br />

–1.4 percent). The challenging nonfood business and the disappointing<br />

Christmas business, in particular, continued to weigh<br />

on developments. like-for-like sales declined by 0.8 percent.<br />

In Germany, sales fell by 1.6 percent to €8.3 billion in 2011.<br />

This development is largely due to store divestments: likefor-like<br />

sales remained stable at the previous year’s level.<br />

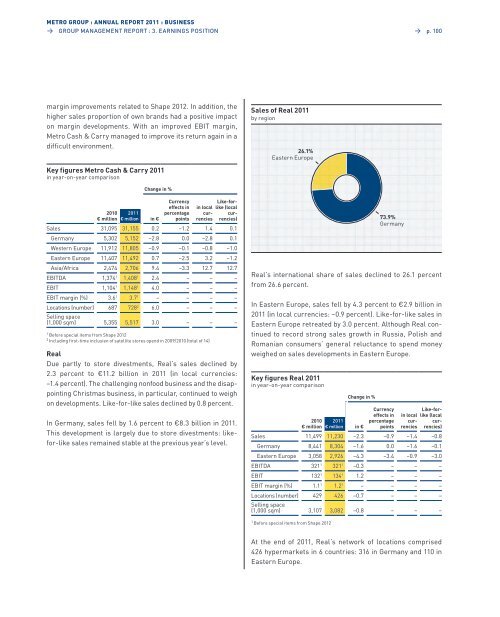

sales of Real 2011<br />

by region<br />

26.1%<br />

eastern europe<br />

→ p. 100<br />

Real’s international share of sales declined to 26.1 percent<br />

from 26.6 percent.<br />

In eastern europe, sales fell by 4.3 percent to €2.9 billion in<br />

2011 (in local currencies: –0.9 percent). like-for-like sales in<br />

eastern europe retreated by 3.0 percent. although Real continued<br />

to record strong sales growth in Russia, polish and<br />

Romanian consumers’ general reluctance to spend money<br />

weighed on sales developments in eastern europe.<br />

Key figures Real 2011<br />

in year-on-year comparison<br />

2010<br />

€ million<br />

Change in %<br />

2011<br />

€ million in €<br />

Currency<br />

effects in<br />

percentage<br />

points<br />

Like-for-<br />

in local like (local<br />

curcurrenciesrencies) sales 11,499 11,230 –2.3 –0.9 –1.4 –0.8<br />

Germany 8,441 8,304 –1.6 0.0 –1.6 –0.1<br />

eastern europe 3,058 2,926 –4.3 –3.4 –0.9 –3.0<br />

eBITDa 3211 3211 –0.3 – – –<br />

eBIT 1321 1341 1.2 – – –<br />

eBIT margin (%) 1.11 1.21 – – – –<br />

locations (number)<br />

selling space<br />

429 426 –0.7 – – –<br />

(1,000 sqm) 3,107 3,082 –0.8 – – –<br />

1 Before special items from shape 2012<br />

73.9%<br />

Germany<br />

at the end of 2011, Real’s network of locations comprised<br />

426 hypermarkets in 6 countries: 316 in Germany and 110 in<br />

eastern europe.