pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe InCoMe sTaTeMenT<br />

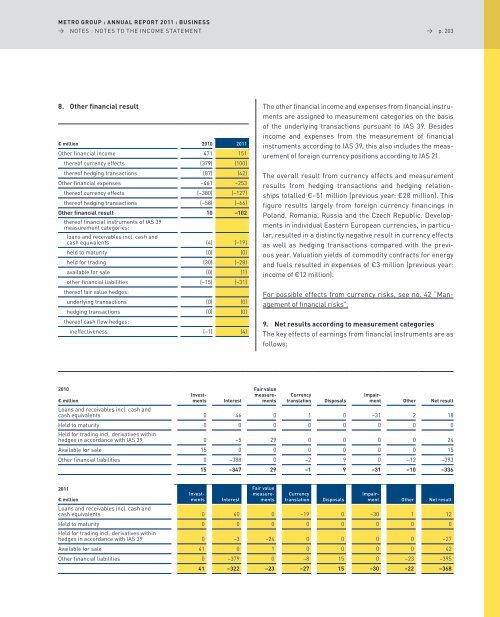

8. Other financial result<br />

€ million 2010 2011<br />

other financial income 471 151<br />

thereof currency effects (379) (100)<br />

thereof hedging transactions (87) (42)<br />

other financial expenses –461 –253<br />

thereof currency effects (–380) (–127)<br />

thereof hedging transactions (–58) (–66)<br />

Other financial result<br />

thereof financial instruments of Ias 39<br />

measurement categories:<br />

loans and receivables incl. cash and<br />

10 –102<br />

cash equivalents (4) (–19)<br />

held to maturity (0) (0)<br />

held for trading (30) (–28)<br />

available for sale (0) (1)<br />

other financial liabilities<br />

thereof fair value hedges:<br />

(–15) (–31)<br />

underlying transactions (0) (0)<br />

hedging transactions<br />

thereof cash flow hedges:<br />

(0) (0)<br />

ineffectiveness (–1) (4)<br />

2010<br />

€ million<br />

investments<br />

interest<br />

→ p. 203<br />

The other financial income and expenses from financial instruments<br />

are assigned to measurement categories on the basis<br />

of the underlying transactions pursuant to Ias 39. Besides<br />

income and expenses from the measurement of financial<br />

instruments according to Ias 39, this also includes the measurement<br />

of foreign currency positions according to Ias 21.<br />

The overall result from currency effects and measurement<br />

results from hedging transactions and hedging relationships<br />

totalled €–51 million (previous year: €28 million). This<br />

figure results largely from foreign currency financings in<br />

poland, Romania, Russia and the Czech Republic. Developments<br />

in individual eastern european currencies, in particular,<br />

resulted in a distinctly negative result in currency effects<br />

as well as hedging transactions compared with the previous<br />

year. valuation yields of commodity contracts for energy<br />

and fuels resulted in expenses of €3 million (previous year:<br />

income of €12 million).<br />

For possible effects from currency risks, see no. 42 “Management<br />

of financial risks”.<br />

9. Net results according to measurement categories<br />

The key effects of earnings from financial instruments are as<br />

follows:<br />

Fair value<br />

measurements<br />

Currency<br />

translation Disposals<br />

impair-<br />

ment<br />

Other Net result<br />

loans and receivables incl. cash and<br />

cash equivalents 0 46 0 1 0 –31 2 18<br />

Held to maturity<br />

Held for trading incl. derivatives within<br />

0 0 0 0 0 0 0 0<br />

hedges in accordance with Ias 39 0 –5 29 0 0 0 0 24<br />

available for sale 15 0 0 0 0 0 0 15<br />

other financial liabilities 0 –388 0 –2 9 0 –12 –393<br />

15 –347 29 –1 9 –31 –10 –336<br />

2011<br />

€ million<br />

investments<br />

interest<br />

Fair value<br />

measurements<br />

Currency<br />

translation<br />

Disposals<br />

impairment<br />

Other Net result<br />

loans and receivables incl. cash and<br />

cash equivalents 0 60 0 –19 0 –30 1 12<br />

Held to maturity<br />

Held for trading incl. derivatives within<br />

0 0 0 0 0 0 0 0<br />

hedges in accordance with Ias 39 0 –3 –24 0 0 0 0 –27<br />

available for sale 41 0 1 0 0 0 0 42<br />

other financial liabilities 0 –379 0 –8 15 0 –23 –395<br />

41 –322 –23 –27 15 –30 –22 –368