pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 4. FiNANciAl ANd AssET POsiTiON<br />

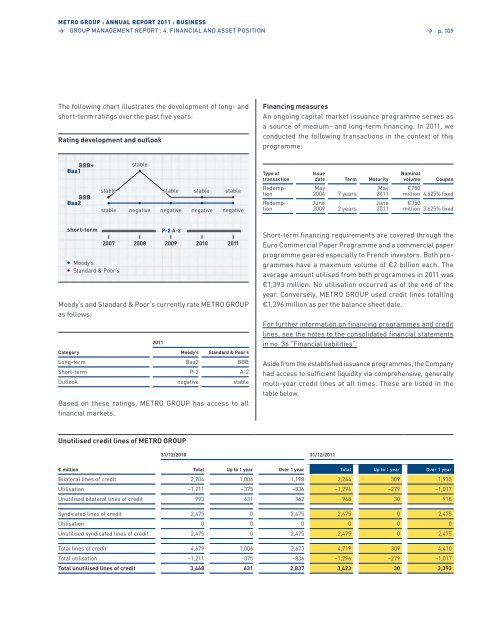

The following chart illustrates the development of long- and<br />

short-term ratings over the past five years:<br />

Rating development and outlook<br />

Baa1 BBB+<br />

Baa2 BBB<br />

stable<br />

short-term P-2 A-2<br />

Moody’s<br />

standard & poor’s<br />

stable<br />

stable stable stable<br />

stable negative negative negative negative<br />

2007 2008 2009 2010 2011<br />

Moody’s and standard & poor’s currently rate MeTRo GRoUp<br />

as follows:<br />

2011<br />

Category Moody’s standard & Poor’s<br />

long-term Baa2 BBB<br />

short-term p-2 a-2<br />

outlook negative stable<br />

Based on these ratings, MeTRo GRoUp has access to all<br />

financial markets.<br />

Unutilised credit lines of <strong>METRO</strong> gROUP<br />

→ p. 109<br />

Financing measures<br />

an ongoing capital market issuance programme serves as<br />

a source of medium- and long-term financing. In 2011, we<br />

conducted the following transactions in the context of this<br />

programme:<br />

Type of<br />

transaction<br />

Redemption<br />

Redemption<br />

issue<br />

date Term Maturity<br />

May<br />

2004 7 years<br />

June<br />

2009 2 years<br />

31/12/2010 31/12/2011<br />

May<br />

2011<br />

June<br />

2011<br />

Nominal<br />

volume Coupon<br />

€750<br />

million 4.625% fixed<br />

€350<br />

million 3.625% fixed<br />

short-term financing requirements are covered through the<br />

euro Commercial paper programme and a commercial paper<br />

programme geared especially to French investors. Both programmes<br />

have a maximum volume of €2 billion each. The<br />

average amount utilised from both programmes in 2011 was<br />

€1,393 million. no utilisation occurred as of the end of the<br />

year. Conversely, MeTRo GRoUp used credit lines totalling<br />

€1,296 million as per the balance sheet date.<br />

For further information on financing programmes and credit<br />

lines, see the notes to the consolidated financial statements<br />

in no. 36 “Financial liabilities”.<br />

aside from the established issuance programmes, the Company<br />

had access to sufficient liquidity via comprehensive, generally<br />

multi-year credit lines at all times. These are listed in the<br />

table below.<br />

€ million Total Up to 1 year Over 1 year Total Up to 1 year Over 1 year<br />

Bilateral lines of credit 2,204 1,006 1,198 2,244 309 1,935<br />

Utilisation –1,211 –375 –836 –1,296 –279 –1,017<br />

Unutilised bilateral lines of credit 993 631 362 948 30 918<br />

syndicated lines of credit 2,475 0 2,475 2,475 0 2,475<br />

Utilisation 0 0 0 0 0 0<br />

Unutilised syndicated lines of credit 2,475 0 2,475 2,475 0 2,475<br />

Total lines of credit 4,679 1,006 3,673 4,719 309 4,410<br />

Total utilisation –1,211 –375 –836 –1,296 –279 –1,017<br />

Total unutilised lines of credit 3,468 631 2,837 3,423 30 3,393