pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNiNGs POsiTiON<br />

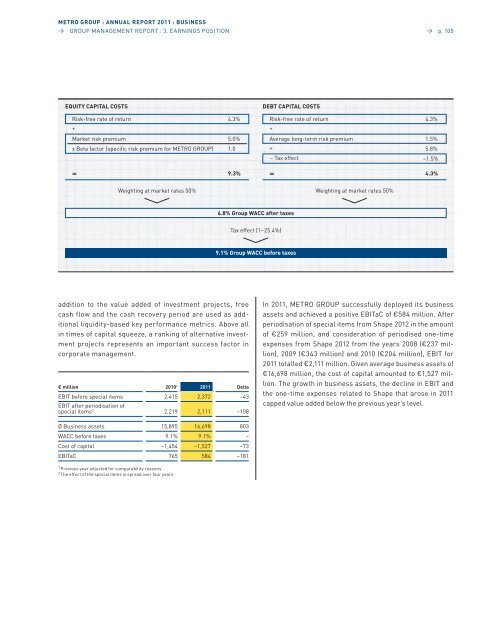

EQUiTy CAPiTAL COsTs<br />

Risk-free rate of return<br />

+<br />

4.3%<br />

Market risk premium 5.0%<br />

x Beta factor (specific risk premium for MeTRo GRoUp) 1.0<br />

= 9.3%<br />

Weighting at market rates 50%<br />

addition to the value added of investment projects, free<br />

cash flow and the cash recovery period are used as additional<br />

liquidity-based key performance metrics. above all<br />

in times of capital squeeze, a ranking of alternative investment<br />

projects represents an important success factor in<br />

corporate management.<br />

€ million 20101 2011 Delta<br />

eBIT before special items 2,415 2,372 –43<br />

eBIT after periodisation of<br />

special items2 2,219 2,111 –108<br />

Ø Business assets 15,895 16,698 803<br />

WaCC before taxes 9.1% 9.1% –<br />

Cost of capital –1,454 –1,527 –73<br />

eBITaC 765 584 –181<br />

1 previous year adjusted for comparability reasons<br />

2 The effect of the special items is spread over four years<br />

DEBT CAPiTAL COsTs<br />

6.8% group wACC after taxes<br />

Tax effect (1–25.4%)<br />

9.1% group wACC before taxes<br />

Risk-free rate of return 4.3%<br />

+<br />

average long-term risk premium 1.5%<br />

= 5.8%<br />

– Tax effect –1.5%<br />

= 4.3%<br />

Weighting at market rates 50%<br />

→ p. 105<br />

In 2011, MeTRo GRoUp successfully deployed its business<br />

assets and achieved a positive eBITaC of €584 million. after<br />

periodisation of special items from shape 2012 in the amount<br />

of €259 million, and consideration of periodised one-time<br />

expenses from shape 2012 from the years 2008 (€237 million),<br />

2009 (€343 million) and 2010 (€204 million), eBIT for<br />

2011 totalled €2,111 million. Given average business assets of<br />

€16,698 million, the cost of capital amounted to €1,527 million.<br />

The growth in business assets, the decline in eBIT and<br />

the one-time expenses related to shape that arose in 2011<br />

capped value added below the previous year’s level.