pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

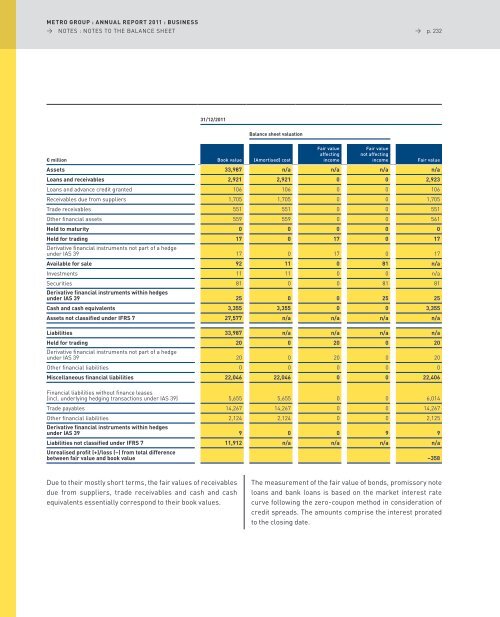

31/12/2011<br />

Due to their mostly short terms, the fair values of receiv ables<br />

due from suppliers, trade receivables and cash and cash<br />

equivalents essentially correspond to their book values.<br />

Balance sheet valuation<br />

→ p. 232<br />

Fair value<br />

Fair value<br />

affecting not affecting<br />

€ million<br />

Book value (Amortised) cost<br />

income<br />

income Fair value<br />

Assets 33,987 n/a n/a n/a n/a<br />

Loans and receivables 2,921 2,921 0 0 2,923<br />

loans and advance credit granted 106 106 0 0 106<br />

Receivables due from suppliers 1,705 1,705 0 0 1,705<br />

Trade receivables 551 551 0 0 551<br />

other financial assets 559 559 0 0 561<br />

held to maturity 0 0 0 0 0<br />

held for trading<br />

Derivative financial instruments not part of a hedge<br />

17 0 17 0 17<br />

under Ias 39 17 0 17 0 17<br />

Available for sale 92 11 0 81 n/a<br />

Investments 11 11 0 0 n/a<br />

securities<br />

Derivative financial instruments within hedges<br />

81 0 0 81 81<br />

under iAs 39 25 0 0 25 25<br />

Cash and cash equivalents 3,355 3,355 0 0 3,355<br />

Assets not classified under iFRs 7 27,577 n/a n/a n/a n/a<br />

Liabilities 33,987 n/a n/a n/a n/a<br />

held for trading<br />

Derivative financial instruments not part of a hedge<br />

20 0 20 0 20<br />

under Ias 39 20 0 20 0 20<br />

other financial liabilities 0 0 0 0 0<br />

Miscellaneous financial liabilities 22,046 22,046 0 0 22,406<br />

Financial liabilities without finance leases<br />

(incl. underlying hedging transactions under Ias 39) 5,655 5,655 0 0 6,014<br />

Trade payables 14,267 14,267 0 0 14,267<br />

other financial liabilities<br />

Derivative financial instruments within hedges<br />

2,124 2,124 0 0 2,125<br />

under iAs 39 9 0 0 9 9<br />

Liabilities not classified under iFRs 7 11,912 n/a n/a n/a n/a<br />

Unrealised profit (+)/loss (–) from total difference<br />

between fair value and book value<br />

–358<br />

The measurement of the fair value of bonds, promissory note<br />

loans and bank loans is based on the market interest rate<br />

curve following the zero-coupon method in consideration of<br />

credit spreads. The amounts comprise the interest prorated<br />

to the closing date.