pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

The value of the balance sheet item “assets held for sale”<br />

increased by €231 million as a result of the reclassification<br />

of several real estate assets from non-current assets and<br />

renovation-related retroactive capitalisations of real estate<br />

assets already included in assets held for sale. The sale of<br />

real estate assets and an investment resulted in a reduction<br />

of assets held for sale by €49 million.<br />

MeTRo GRoUp assumes that the properties recognised as<br />

“assets held for sale” will be sold during the course of 2012.<br />

non-scheduled depreciation of these properties to their fair<br />

value less cost to sell was not required. They are shown in the<br />

segment reporting item “segment assets” in the amount of<br />

€219 million in the Real estate segment.<br />

31. Equity<br />

In terms of amount and composition, i.e. the ratio of ordinary<br />

to preference shares, subscribed capital has not changed<br />

compared with 31 December 2010 and totals €835,419,052.27.<br />

It is divided as follows:<br />

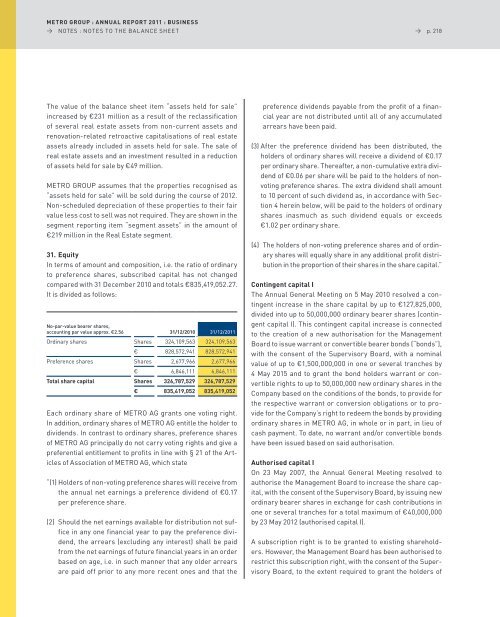

No-par-value bearer shares,<br />

accounting par value approx. €2.56 31/12/2010 31/12/2011<br />

ordinary shares shares 324,109,563 324,109,563<br />

€ 828,572,941 828,572,941<br />

preference shares shares 2,677,966 2,677,966<br />

€ 6,846,111 6,846,111<br />

Total share capital shares 326,787,529 326,787,529<br />

€ 835,419,052 835,419,052<br />

each ordinary share of MeTRo aG grants one voting right.<br />

In addition, ordinary shares of MeTRo aG entitle the holder to<br />

dividends. In contrast to ordinary shares, preference shares<br />

of MeTRo aG principally do not carry voting rights and give a<br />

preferential entitlement to profits in line with § 21 of the articles<br />

of association of MeTRo aG, which state<br />

“(1) Holders of non-voting preference shares will receive from<br />

the annual net earnings a preference dividend of €0.17<br />

per preference share.<br />

(2) should the net earnings available for distribution not suffice<br />

in any one financial year to pay the preference dividend,<br />

the arrears (excluding any interest) shall be paid<br />

from the net earnings of future financial years in an order<br />

based on age, i.e. in such manner that any older arrears<br />

are paid off prior to any more recent ones and that the<br />

→ p. 218<br />

preference dividends payable from the profit of a financial<br />

year are not distributed until all of any accumulated<br />

arrears have been paid.<br />

(3) after the preference dividend has been distributed, the<br />

holders of ordinary shares will receive a dividend of €0.17<br />

per ordinary share. Thereafter, a non-cumulative extra dividend<br />

of €0.06 per share will be paid to the holders of nonvoting<br />

preference shares. The extra dividend shall amount<br />

to 10 percent of such dividend as, in accordance with section<br />

4 herein below, will be paid to the holders of ordinary<br />

shares inasmuch as such dividend equals or exceeds<br />

€1.02 per ordinary share.<br />

(4) The holders of non-voting preference shares and of ordinary<br />

shares will equally share in any additional profit distribution<br />

in the proportion of their shares in the share capital.”<br />

Contingent capital i<br />

The annual General Meeting on 5 May 2010 resolved a contingent<br />

increase in the share capital by up to €127,825,000,<br />

divided into up to 50,000,000 ordinary bearer shares (contingent<br />

capital I). This contingent capital increase is connected<br />

to the creation of a new authorisation for the Management<br />

Board to issue warrant or convertible bearer bonds (“bonds”),<br />

with the consent of the supervisory Board, with a nominal<br />

value of up to €1,500,000,000 in one or several tranches by<br />

4 May 2015 and to grant the bond holders warrant or convertible<br />

rights to up to 50,000,000 new ordinary shares in the<br />

Company based on the conditions of the bonds, to provide for<br />

the respective warrant or conversion obligations or to provide<br />

for the Company’s right to redeem the bonds by providing<br />

ordinary shares in MeTRo aG, in whole or in part, in lieu of<br />

cash payment. To date, no warrant and/or convertible bonds<br />

have been issued based on said authorisation.<br />

Authorised capital i<br />

on 23 May 2007, the annual General Meeting resolved to<br />

authorise the Management Board to increase the share capital,<br />

with the consent of the supervisory Board, by issuing new<br />

ordinary bearer shares in exchange for cash contributions in<br />

one or several tranches for a total maximum of €40,000,000<br />

by 23 May 2012 (authorised capital I).<br />

a subscription right is to be granted to existing shareholders.<br />

However, the Management Board has been authorised to<br />

restrict this subscription right, with the consent of the supervisory<br />

Board, to the extent required to grant the holders of