pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 11. Risk REPORT<br />

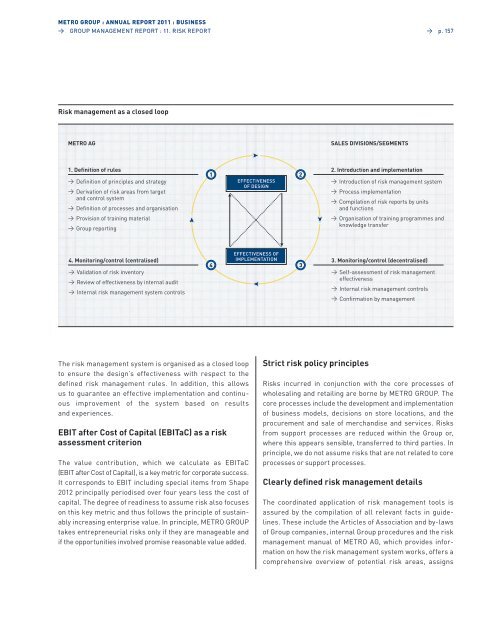

Risk management as a closed loop<br />

<strong>METRO</strong> Ag sALEs DiVisiONs/sEgMENTs<br />

1. Definition of rules<br />

→ Definition of principles and strategy<br />

→ Derivation of risk areas from target<br />

and control system<br />

→ Definition of processes and organisation<br />

→ provision of training material<br />

→ <strong>Group</strong> reporting<br />

4. Monitoring/control (centralised)<br />

→ validation of risk inventory<br />

→ Review of effectiveness by internal audit<br />

→ Internal risk management system controls<br />

The risk management system is organised as a closed loop<br />

to ensure the design’s effectiveness with respect to the<br />

defined risk management rules. In addition, this allows<br />

us to guarantee an effective implementation and continuous<br />

improvement of the system based on results<br />

and experiences.<br />

EBiT after Cost of Capital (EBiTaC) as a risk<br />

assessment criterion<br />

The value contribution, which we calculate as eBITaC<br />

(eBIT after Cost of Capital), is a key metric for corporate success.<br />

It corresponds to eBIT including special items from shape<br />

2012 principally periodised over four years less the cost of<br />

capital. The degree of readiness to assume risk also focuses<br />

on this key metric and thus follows the principle of sustainably<br />

increasing enterprise value. In principle, MeTRo GRoUp<br />

takes entrepreneurial risks only if they are manageable and<br />

if the opportunities involved promise reasonable value added.<br />

1 2<br />

EFFECTiVENEss<br />

OF DEsigN<br />

4<br />

EFFECTiVENEss OF<br />

iMPLEMENTATiON<br />

3<br />

strict risk policy principles<br />

→ p. 157<br />

2. introduction and implementation<br />

→ Introduction of risk management system<br />

→ process implementation<br />

→ Compilation of risk reports by units<br />

and functions<br />

→ organisation of training programmes and<br />

knowledge transfer<br />

3. Monitoring/control (decentralised)<br />

→ self-assessment of risk management<br />

effectiveness<br />

→ Internal risk management controls<br />

→ Confirmation by management<br />

Risks incurred in conjunction with the core processes of<br />

wholesaling and retailing are borne by MeTRo GRoUp. The<br />

core processes include the development and implementation<br />

of business models, decisions on store locations, and the<br />

procurement and sale of merchandise and services. Risks<br />

from support processes are reduced within the <strong>Group</strong> or,<br />

where this appears sensible, transferred to third parties. In<br />

principle, we do not assume risks that are not related to core<br />

processes or support processes.<br />

Clearly defined risk management details<br />

The coordinated application of risk management tools is<br />

assured by the compilation of all relevant facts in guidelines.<br />

These include the articles of association and by-laws<br />

of <strong>Group</strong> companies, internal <strong>Group</strong> procedures and the risk<br />

management manual of MeTRo aG, which provides information<br />

on how the risk management system works, offers a<br />

comprehensive overview of potential risk areas, assigns