pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

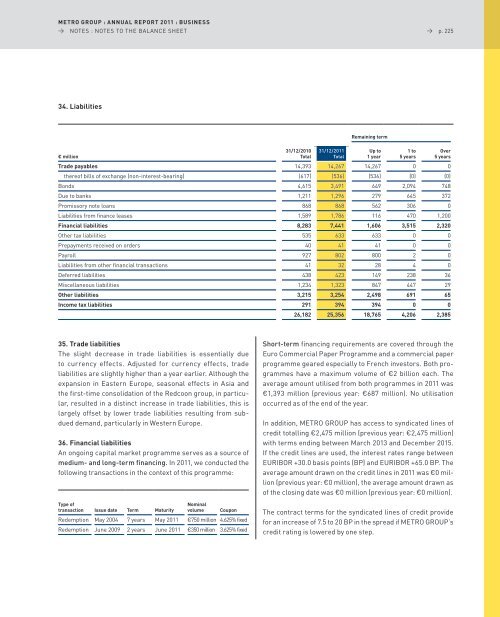

34. Liabilities<br />

35. Trade liabilities<br />

The slight decrease in trade liabilities is essentially due<br />

to currency effects. adjusted for currency effects, trade<br />

li abilities are slightly higher than a year earlier. although the<br />

expansion in eastern europe, seasonal effects in asia and<br />

the first-time consolidation of the Redcoon group, in particular,<br />

resulted in a distinct increase in trade liabilities, this is<br />

largely offset by lower trade liabilities resulting from subdued<br />

demand, particularly in Western europe.<br />

36. Financial liabilities<br />

an ongoing capital market programme serves as a source of<br />

medium- and long-term financing. In 2011, we conducted the<br />

following transactions in the context of this programme:<br />

Type of<br />

transaction issue date Term Maturity<br />

Nominal<br />

volume Coupon<br />

Redemption May 2004 7 years May 2011 €750 million 4.625% fixed<br />

Redemption June 2009 2 years June 2011 €350 million 3.625% fixed<br />

Remaining term<br />

→ p. 225<br />

31/12/2010 31/12/2011<br />

Up to<br />

1 to<br />

Over<br />

€ million<br />

Total Total<br />

1 year 5 years 5 years<br />

Trade payables 14,393 14,267 14,267 0 0<br />

thereof bills of exchange (non-interest-bearing) (617) (536) (536) (0) (0)<br />

Bonds 4,615 3,491 649 2,094 748<br />

Due to banks 1,211 1,296 279 645 372<br />

promissory note loans 868 868 562 306 0<br />

liabilities from finance leases 1,589 1,786 116 470 1,200<br />

Financial liabilities 8,283 7,441 1,606 3,515 2,320<br />

other tax liabilities 535 633 633 0 0<br />

prepayments received on orders 40 41 41 0 0<br />

payroll 927 802 800 2 0<br />

liabilities from other financial transactions 41 32 28 4 0<br />

Deferred liabilities 438 423 149 238 36<br />

Miscellaneous liabilities 1,234 1,323 847 447 29<br />

Other liabilities 3,215 3,254 2,498 691 65<br />

income tax liabilities 291 394 394 0 0<br />

26,182 25,356 18,765 4,206 2,385<br />

Short-term financing requirements are covered through the<br />

euro Commercial paper programme and a commercial paper<br />

programme geared especially to French investors. Both programmes<br />

have a maximum volume of €2 billion each. The<br />

average amount utilised from both programmes in 2011 was<br />

€1,393 million (previous year: €687 million). no utilisation<br />

occurred as of the end of the year.<br />

In addition, MeTRo GRoUp has access to syndicated lines of<br />

credit totalling €2,475 million (previous year: €2,475 million)<br />

with terms ending between March 2013 and December 2015.<br />

If the credit lines are used, the interest rates range between<br />

eURIBoR +30.0 basis points (Bp) and eURIBoR +65.0 Bp. The<br />

average amount drawn on the credit lines in 2011 was €0 million<br />

(previous year: €0 million), the average amount drawn as<br />

of the closing date was €0 million (previous year: €0 million).<br />

The contract terms for the syndicated lines of credit provide<br />

for an increase of 7.5 to 20 Bp in the spread if MeTRo GRoUp’s<br />

credit rating is lowered by one step.