pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe InCoMe sTaTeMenT<br />

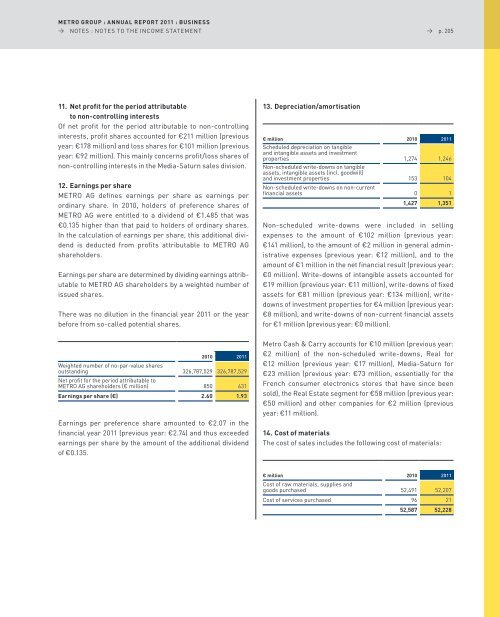

11. Net profit for the period attributable<br />

to non-controlling interests<br />

of net profit for the period attributable to non-controlling<br />

interests, profit shares accounted for €211 million (previous<br />

year: €178 million) and loss shares for €101 million (previous<br />

year: €92 million). This mainly concerns profit/loss shares of<br />

non-controlling interests in the Media-saturn sales division.<br />

12. Earnings per share<br />

MeTRo aG defines earnings per share as earnings per<br />

ordinary share. In 2010, holders of preference shares of<br />

MeTRo aG were entitled to a dividend of €1.485 that was<br />

€0.135 higher than that paid to holders of ordinary shares.<br />

In the calculation of earnings per share, this additional dividend<br />

is deducted from profits attributable to MeTRo aG<br />

shareholders.<br />

earnings per share are determined by dividing earnings attributable<br />

to MeTRo aG shareholders by a weighted number of<br />

issued shares.<br />

There was no dilution in the financial year 2011 or the year<br />

before from so-called potential shares.<br />

2010 2011<br />

Weighted number of no-par-value shares<br />

outstanding<br />

net profit for the period attributable to<br />

326,787,529 326,787,529<br />

MeTRo aG shareholders (€ million) 850 631<br />

Earnings per share (€) 2.60 1.93<br />

earnings per preference share amounted to €2.07 in the<br />

financial year 2011 (previous year: €2.74) and thus exceeded<br />

earnings per share by the amount of the additional dividend<br />

of €0.135.<br />

13. Depreciation/amortisation<br />

→ p. 205<br />

€ million<br />

scheduled depreciation on tangible<br />

and intangible assets and investment<br />

2010 2011<br />

properties<br />

non-scheduled write-downs on tangible<br />

assets, intangible assets (incl. goodwill)<br />

1,274 1,246<br />

and investment properties<br />

non-scheduled write-downs on non-current<br />

153 104<br />

financial assets 0 1<br />

1,427 1,351<br />

non-scheduled write-downs were included in selling<br />

expenses to the amount of €102 million (previous year:<br />

€141 million), to the amount of €2 million in general administrative<br />

expenses (previous year: €12 million), and to the<br />

amount of €1 million in the net financial result (previous year:<br />

€0 million). Write-downs of intangible assets accounted for<br />

€19 million (previous year: €11 million), write-downs of fixed<br />

assets for €81 million (previous year: €134 million), writedowns<br />

of investment properties for €4 million (previous year:<br />

€8 million), and write-downs of non-current financial assets<br />

for €1 million (previous year: €0 million).<br />

Metro Cash & Carry accounts for €10 million (previous year:<br />

€2 million) of the non-scheduled write-downs, Real for<br />

€12 million (previous year: €17 million), Media-saturn for<br />

€23 million (previous year: €73 million, essentially for the<br />

French consumer electronics stores that have since been<br />

sold), the Real estate segment for €58 million (previous year:<br />

€50 million) and other companies for €2 million (previous<br />

year: €11 million).<br />

14. Cost of materials<br />

The cost of sales includes the following cost of materials:<br />

€ million<br />

Cost of raw materials, supplies and<br />

2010 2011<br />

goods purchased 52,491 52,207<br />

Cost of services purchased 96 21<br />

52,587 52,228