pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

acting on behalf of the Company or of any company controlled<br />

or majority-owned by the Company has exercised this<br />

authorisation.<br />

Capital reserve<br />

The capital reserve amounts to €2,544 million (previous year:<br />

€2,544 million).<br />

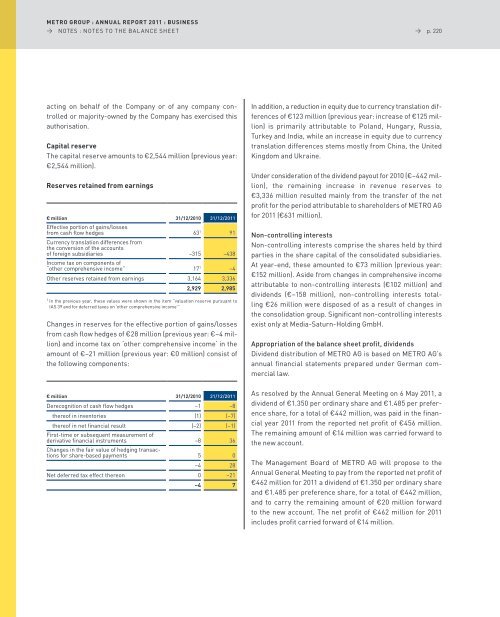

Reserves retained from earnings<br />

€ million<br />

effective portion of gains/losses<br />

31/12/2010 31/12/2011<br />

from cash flow hedges 631 Currency translation differences from<br />

the conversion of the accounts<br />

91<br />

of foreign subsidiaries –315 –438<br />

Income tax on components of<br />

“other comprehensive income” 171 –4<br />

other reserves retained from earnings 3,164 3,336<br />

2,929 2,985<br />

1 In the previous year, these values were shown in the item “valuation reserve pursuant to<br />

Ias 39 and for deferred taxes on ‘other comprehensive incomeʼ”<br />

Changes in reserves for the effective portion of gains/losses<br />

from cash flow hedges of €28 million (previous year: €–4 million)<br />

and income tax on ‘other comprehensive income‘ in the<br />

amount of €–21 million (previous year: €0 million) consist of<br />

the following components:<br />

€ million 31/12/2010 31/12/2011<br />

Derecognition of cash flow hedges –1 –8<br />

thereof in inventories (1) (–7)<br />

thereof in net financial result (–2) (–1)<br />

First-time or subsequent measurement of<br />

derivative financial instruments<br />

Changes in the fair value of hedging transac-<br />

–8 36<br />

tions for share-based payments 5 0<br />

–4 28<br />

net deferred tax effect thereon 0 –21<br />

–4 7<br />

→ p. 220<br />

In addition, a reduction in equity due to currency translation differences<br />

of €123 million (previous year: increase of €125 million)<br />

is primarily attributable to poland, Hungary, Russia,<br />

Turkey and India, while an increase in equity due to currency<br />

translation differences stems mostly from China, the United<br />

Kingdom and Ukraine.<br />

Under consideration of the dividend payout for 2010 (€–442 million),<br />

the remaining increase in revenue reserves to<br />

€3,336 million resulted mainly from the transfer of the net<br />

profit for the period attributable to shareholders of MeTRo aG<br />

for 2011 (€631 million).<br />

Non-controlling interests<br />

non-controlling interests comprise the shares held by third<br />

parties in the share capital of the consolidated subsidiaries.<br />

at year-end, these amounted to €73 million (previous year:<br />

€152 million). aside from changes in comprehensive income<br />

attributable to non-controlling interests (€102 million) and<br />

dividends (€–158 million), non-controlling interests totalling<br />

€26 million were disposed of as a result of changes in<br />

the consolidation group. significant non-controlling interests<br />

exist only at Media-saturn-Holding GmbH.<br />

Appropriation of the balance sheet profit, dividends<br />

Dividend distribution of MeTRo aG is based on MeTRo aG’s<br />

annual financial statements prepared under German commercial<br />

law.<br />

as resolved by the annual General Meeting on 6 May 2011, a<br />

dividend of €1.350 per ordinary share and €1.485 per preference<br />

share, for a total of €442 million, was paid in the financial<br />

year 2011 from the reported net profit of €456 million.<br />

The remaining amount of €14 million was carried forward to<br />

the new account.<br />

The Management Board of MeTRo aG will propose to the<br />

annual General Meeting to pay from the reported net profit of<br />

€462 million for 2011 a dividend of €1.350 per ordinary share<br />

and €1.485 per preference share, for a total of €442 million,<br />

and to carry the remaining amount of €20 million forward<br />

to the new account. The net profit of €462 million for 2011<br />

includes profit carried forward of €14 million.