pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> GROUP : ANNUAL REPORT 2011 : BUSINESS<br />

→ GROUP MANAGEMENT REPORT : 3. EARNiNGs POsiTiON<br />

eBIT declined by €11 million to €94 million. eBIT before<br />

special items, in turn, rose by €2 million to €134 million. In<br />

Germany, the slight decline in eBIT compared with the previous<br />

year’s level was largely due to the Christmas business.<br />

Meanwhile, the positive eBIT trend in eastern europe<br />

continued, based on cost savings related to shape 2012. In<br />

particular, Russia and poland posted better results.<br />

Media-saturn<br />

Media-saturn reaffirmed its leading market position in europe<br />

in 2011. Despite a challenging economic environment, sales<br />

fell by just 0.9 percent to €20.6 billion in the financial year 2011<br />

(in local currencies: –1.0 percent). This decline in sales is also<br />

attributable to the divestment of the French saturn consumer<br />

electronics stores as of 30 June 2011. like-for-like sales fell<br />

by 4.3 percent. The online retailer Redcoon, which was consolidated<br />

from the third quarter, contributed positively to<br />

sales developments. In 2011, Internet sales including Redcoon<br />

amounted to €348 million.<br />

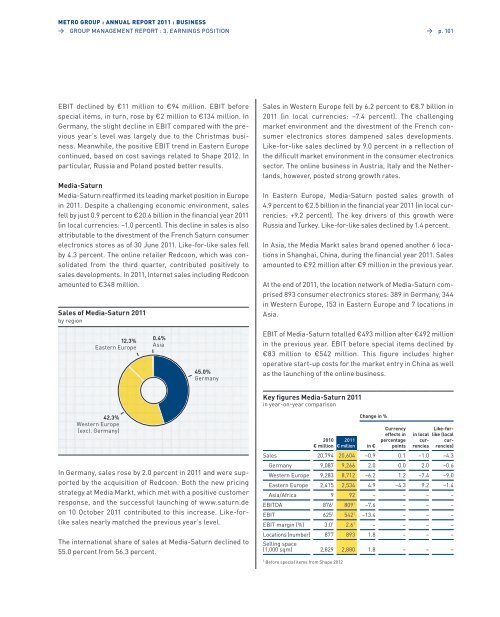

sales of Media-saturn 2011<br />

by region<br />

12.3%<br />

eastern europe<br />

42.3%<br />

Western europe<br />

(excl. Germany)<br />

0.4%<br />

asia<br />

45.0%<br />

Germany<br />

In Germany, sales rose by 2.0 percent in 2011 and were supported<br />

by the acquisition of Redcoon. Both the new pricing<br />

strategy at Media Markt, which met with a positive customer<br />

response, and the successful launching of www.saturn.de<br />

on 10 october 2011 contributed to this increase. like-forlike<br />

sales nearly matched the previous year’s level.<br />

The international share of sales at Media-saturn declined to<br />

55.0 percent from 56.3 percent.<br />

→ p. 101<br />

sales in Western europe fell by 6.2 percent to €8.7 billion in<br />

2011 (in local currencies: –7.4 percent). The challenging<br />

market environment and the divestment of the French consumer<br />

electronics stores dampened sales developments.<br />

like-for-like sales declined by 9.0 percent in a reflection of<br />

the difficult market environment in the consumer electronics<br />

sector. The online business in austria, Italy and the netherlands,<br />

however, posted strong growth rates.<br />

In eastern europe, Media-saturn posted sales growth of<br />

4.9 percent to €2.5 billion in the financial year 2011 (in local currencies:<br />

+9.2 percent). The key drivers of this growth were<br />

Russia and Turkey. like-for-like sales declined by 1.4 percent.<br />

In asia, the Media Markt sales brand opened another 6 locations<br />

in shanghai, China, during the financial year 2011. sales<br />

amounted to €92 million after €9 million in the previous year.<br />

at the end of 2011, the location network of Media-saturn comprised<br />

893 consumer electronics stores: 389 in Germany, 344<br />

in Western europe, 153 in eastern europe and 7 locations in<br />

asia.<br />

eBIT of Media-saturn totalled €493 million after €492 million<br />

in the previous year. eBIT before special items declined by<br />

€83 million to €542 million. This figure includes higher<br />

op erative start-up costs for the market entry in China as well<br />

as the launching of the online business.<br />

Key figures Media-saturn 2011<br />

in year-on-year comparison<br />

Change in %<br />

2010<br />

€ million<br />

2011<br />

€ million in €<br />

Currency<br />

effects in<br />

percentage<br />

points<br />

Like-for-<br />

in local like (local<br />

curcurrenciesrencies) sales 20,794 20,604 –0.9 0.1 –1.0 –4.3<br />

Germany 9,087 9,266 2.0 0.0 2.0 –0.6<br />

Western europe 9,283 8,712 –6.2 1.2 –7.4 –9.0<br />

eastern europe 2,415 2,534 4.9 –4.3 9.2 –1.4<br />

asia/africa 9 92 – – – –<br />

eBITDa 8761 8091 –7.6 – – –<br />

eBIT 6251 5421 –13.4 – – –<br />

eBIT margin (%) 3.01 2.61 – – – –<br />

locations (number)<br />

selling space<br />

877 893 1.8 – – –<br />

(1,000 sqm) 2,829 2,880 1.8 – – –<br />

1 Before special items from shape 2012