pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe GRoUp aCCoUnTInG pRInCIples anD MeTHoDs<br />

Accounting for share-based payments<br />

The share bonuses granted under the share-based payments<br />

system are classified as “cash-settled share-based<br />

payments” pursuant to IFRs 2 (share-based payment). proportionate<br />

provisions measured at the fair value of the obligations<br />

entered into are formed for these payments. The<br />

proportionate formation of the provisions is prorated over<br />

the underlying blocking period and recognised in income as<br />

personnel expenses. The fair value is remeasured at each<br />

balance sheet date during the blocking period until exercise<br />

based on an option pricing model. provisions are adjusted<br />

accordingly in profit or loss.<br />

Where granted share-based payments is hedged through<br />

corresponding hedging transactions, the hedging transactions<br />

are measured at fair value and shown under other<br />

receivables and assets. The portion of the hedges’ value<br />

fluctuation that corresponds to the value of fluctuation of the<br />

share-based payments is recognised in personnel expenses.<br />

The surplus amount of value fluctuations is recognised in<br />

equity without being reported as a profit or loss.<br />

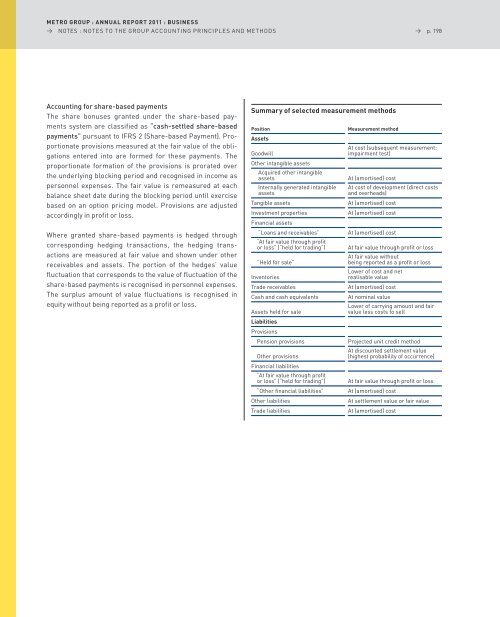

summary of selected measurement methods<br />

→ p. 198<br />

Position Measurement method<br />

Assets<br />

at cost (subsequent measurement:<br />

Goodwill<br />

impairment test)<br />

other intangible assets<br />

acquired other intangible<br />

assets at (amortised) cost<br />

Internally generated intangible at cost of development (direct costs<br />

assets<br />

and overheads)<br />

Tangible assets at (amortised) cost<br />

Investment properties at (amortised) cost<br />

Financial assets<br />

“ loans and receivables” at (amortised) cost<br />

“at fair value through profit<br />

or loss” (“held for trading”) at fair value through profit or loss<br />

at fair value without<br />

“Held for sale”<br />

being reported as a profit or loss<br />

lower of cost and net<br />

Inventories<br />

realisable value<br />

Trade receivables at (amortised) cost<br />

Cash and cash equivalents at nominal value<br />

lower of carrying amount and fair<br />

assets held for sale<br />

value less costs to sell<br />

Liabilities<br />

provisions<br />

pension provisions projected unit credit method<br />

at discounted settlement value<br />

other provisions<br />

(highest probability of occurrence)<br />

Financial liabilities<br />

“at fair value through profit<br />

or loss” (“held for trading”) at fair value through profit or loss<br />

“other financial liabilities” at (amortised) cost<br />

other liabilities at settlement value or fair value<br />

Trade liabilities at (amortised) cost