pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : noTes To THe BalanCe sHeeT<br />

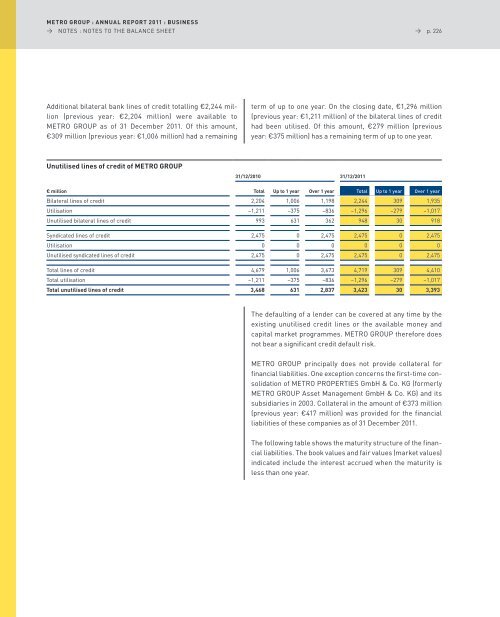

additional bilateral bank lines of credit totalling €2,244 million<br />

(previous year: €2,204 million) were available to<br />

MeTRo GRoUp as of 31 December 2011. of this amount,<br />

€309 million (previous year: €1,006 million) had a remaining<br />

Unutilised lines of credit of <strong>METRO</strong> gROUP<br />

→ p. 226<br />

term of up to one year. on the closing date, €1,296 million<br />

(previous year: €1,211 million) of the bilateral lines of credit<br />

had been utilised. of this amount, €279 million (previous<br />

year: €375 million) has a remaining term of up to one year.<br />

31/12/2010 31/12/2011<br />

€ million Total Up to 1 year Over 1 year Total Up to 1 year Over 1 year<br />

Bilateral lines of credit 2,204 1,006 1,198 2,244 309 1,935<br />

Utilisation –1,211 –375 –836 –1,296 –279 –1,017<br />

Unutilised bilateral lines of credit 993 631 362 948 30 918<br />

syndicated lines of credit 2,475 0 2,475 2,475 0 2,475<br />

Utilisation 0 0 0 0 0 0<br />

Unutilised syndicated lines of credit 2,475 0 2,475 2,475 0 2,475<br />

Total lines of credit 4,679 1,006 3,673 4,719 309 4,410<br />

Total utilisation –1,211 –375 –836 –1,296 –279 –1,017<br />

Total unutilised lines of credit 3,468 631 2,837 3,423 30 3,393<br />

The defaulting of a lender can be covered at any time by the<br />

existing unutilised credit lines or the available money and<br />

capital market programmes. MeTRo GRoUp therefore does<br />

not bear a significant credit default risk.<br />

MeTRo GRoUp principally does not provide collateral for<br />

financial liabilities. one exception concerns the first-time consolidation<br />

of MeTRo pRopeRTIes GmbH & Co. KG (formerly<br />

MeTRo GRoUp asset Management GmbH & Co. KG) and its<br />

subsidiaries in 2003. Collateral in the amount of €373 million<br />

(previous year: €417 million) was provided for the financial<br />

liabilities of these companies as of 31 December 2011.<br />

The following table shows the maturity structure of the financial<br />

liabilities. The book values and fair values (market values)<br />

indicated include the interest accrued when the matur ity is<br />

less than one year.