pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

pdf (22.8 MB) - METRO Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>METRO</strong> gROUP : ANNUAL REPORT 2011 : BUsiNEss<br />

→ noTes : oTHeR noTes<br />

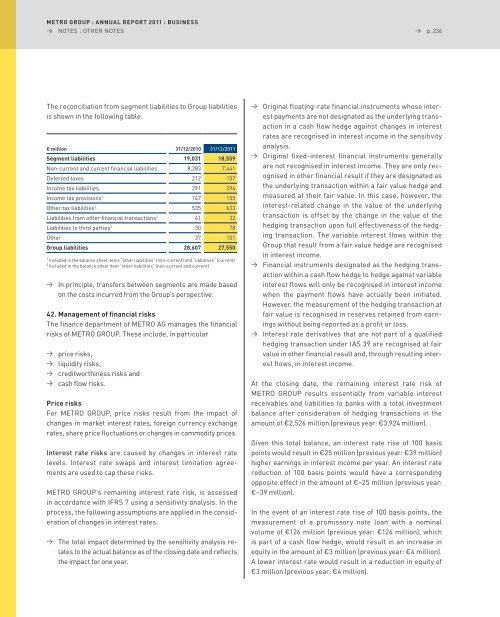

The reconciliation from segment liabilities to <strong>Group</strong> liabilities<br />

is shown in the following table:<br />

€ million 31/12/2010 31/12/2011<br />

segment liabilities 19,031 18,559<br />

non-current and current financial liabilities 8,283 7,441<br />

Deferred taxes 212 157<br />

Income tax liabilities 291 394<br />

Income tax provisions1 147 155<br />

other tax liabilities2 535 633<br />

liabilities from other financial transactions2 41 32<br />

liabilities to third parties2 30 78<br />

other 37 101<br />

group liabilities 28,607 27,550<br />

1 Included in the balance sheet items “other liabilities” (non-current) and “liabilities” (current)<br />

2 Included in the balance sheet item “other liabilities” (non-current and current)<br />

→ In principle, transfers between segments are made based<br />

on the costs incurred from the <strong>Group</strong>’s perspective.<br />

42. Management of financial risks<br />

The finance department of MeTRo aG manages the financial<br />

risks of MeTRo GRoUp. These include, in particular<br />

→ price risks,<br />

→ liquidity risks,<br />

→ creditworthiness risks and<br />

→ cash flow risks.<br />

Price risks<br />

For MeTRo GRoUp, price risks result from the impact of<br />

changes in market interest rates, foreign currency exchange<br />

rates, share price fluctuations or changes in commodity prices.<br />

Interest rate risks are caused by changes in interest rate<br />

levels. Interest rate swaps and interest limitation agreements<br />

are used to cap these risks.<br />

MeTRo GRoUp’s remaining interest rate risk, is assessed<br />

in accordance with IFRs 7 using a sensitivity analysis. In the<br />

process, the following assumptions are applied in the consideration<br />

of changes in interest rates:<br />

→ The total impact determined by the sensitivity analysis relates<br />

to the actual balance as of the closing date and reflects<br />

the impact for one year.<br />

→ p. 236<br />

→ original floating-rate financial instruments whose interest<br />

payments are not designated as the underlying transaction<br />

in a cash flow hedge against changes in interest<br />

rates are recognised in interest income in the sensitivity<br />

analysis.<br />

→ original fixed-interest financial instruments generally<br />

are not recognised in interest income. They are only recognised<br />

in other financial result if they are designated as<br />

the underlying transaction within a fair value hedge and<br />

measured at their fair value. In this case, however, the<br />

interest-related change in the value of the underlying<br />

transaction is offset by the change in the value of the<br />

hedging transaction upon full effectiveness of the hedging<br />

transaction. The variable interest flows within the<br />

<strong>Group</strong> that result from a fair value hedge are recognised<br />

in interest income.<br />

→ Financial instruments designated as the hedging transaction<br />

within a cash flow hedge to hedge against variable<br />

interest flows will only be recognised in interest income<br />

when the payment flows have actually been initiated.<br />

However, the measurement of the hedging transaction at<br />

fair value is recognised in reserves retained from earnings<br />

without being reported as a profit or loss.<br />

→ Interest rate derivatives that are not part of a qualified<br />

hedging transaction under Ias 39 are recognised at fair<br />

value in other financial result and, through resulting interest<br />

flows, in interest income.<br />

at the closing date, the remaining interest rate risk of<br />

MeTRo GRoUp results essentially from variable interest<br />

receivables and liabilities to banks with a total investment<br />

balance after consideration of hedging transactions in the<br />

amount of €2,526 million (previous year: €3,924 million).<br />

Given this total balance, an interest rate rise of 100 basis<br />

points would result in €25 million (previous year: €39 million)<br />

higher earnings in interest income per year. an interest rate<br />

reduction of 100 basis points would have a corresponding<br />

opposite effect in the amount of €–25 million (previous year:<br />

€–39 million).<br />

In the event of an interest rate rise of 100 basis points, the<br />

measurement of a promissory note loan with a nominal<br />

volume of €126 million (previous year: €126 million), which<br />

is part of a cash flow hedge, would result in an increase in<br />

equity in the amount of €3 million (previous year: €4 million).<br />

a lower interest rate would result in a reduction in equity of<br />

€3 million (previous year: €4 million).