Processus de Lévy en Finance - Laboratoire de Probabilités et ...

Processus de Lévy en Finance - Laboratoire de Probabilités et ...

Processus de Lévy en Finance - Laboratoire de Probabilités et ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

126 CHAPTER 3. NUMERICAL IMPLEMENTATION<br />

5<br />

4.5<br />

4<br />

3.5<br />

11 May 2001, 8 days<br />

11 June 2001, 4 days<br />

11 July 2001, 9 days<br />

Prior<br />

4<br />

3.5<br />

3<br />

11 May 2001, 36 days<br />

11 June 2001, 39 days<br />

11 July 2001, 37 days<br />

Prior<br />

3<br />

2.5<br />

2.5<br />

2<br />

2<br />

1.5<br />

1.5<br />

1<br />

1<br />

0.5<br />

0.5<br />

0<br />

−0.5 −0.4 −0.3 −0.2 −0.1 0 0.1 0.2 0.3 0.4<br />

0<br />

−1 −0.8 −0.6 −0.4 −0.2 0 0.2<br />

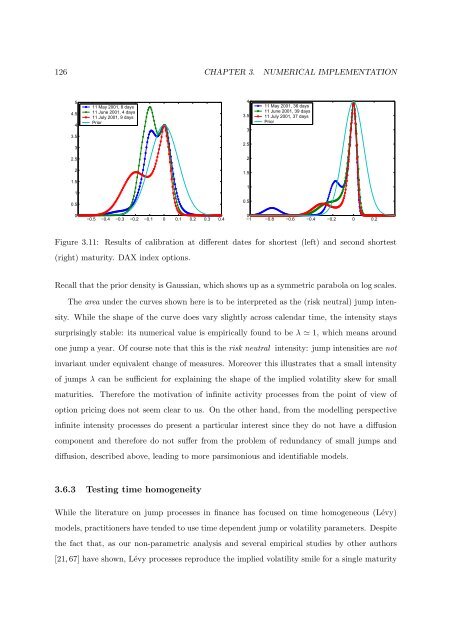

Figure 3.11: Results of calibration at differ<strong>en</strong>t dates for shortest (left) and second shortest<br />

(right) maturity. DAX in<strong>de</strong>x options.<br />

Recall that the prior <strong>de</strong>nsity is Gaussian, which shows up as a symm<strong>et</strong>ric parabola on log scales.<br />

The area un<strong>de</strong>r the curves shown here is to be interpr<strong>et</strong>ed as the (risk neutral) jump int<strong>en</strong>sity.<br />

While the shape of the curve does vary slightly across cal<strong>en</strong>dar time, the int<strong>en</strong>sity stays<br />

surprisingly stable: its numerical value is empirically found to be λ ≃ 1, which means around<br />

one jump a year. Of course note that this is the risk neutral int<strong>en</strong>sity: jump int<strong>en</strong>sities are not<br />

invariant un<strong>de</strong>r equival<strong>en</strong>t change of measures. Moreover this illustrates that a small int<strong>en</strong>sity<br />

of jumps λ can be suffici<strong>en</strong>t for explaining the shape of the implied volatility skew for small<br />

maturities. Therefore the motivation of infinite activity processes from the point of view of<br />

option pricing does not seem clear to us. On the other hand, from the mo<strong>de</strong>lling perspective<br />

infinite int<strong>en</strong>sity processes do pres<strong>en</strong>t a particular interest since they do not have a diffusion<br />

compon<strong>en</strong>t and therefore do not suffer from the problem of redundancy of small jumps and<br />

diffusion, <strong>de</strong>scribed above, leading to more parsimonious and i<strong>de</strong>ntifiable mo<strong>de</strong>ls.<br />

3.6.3 Testing time homog<strong>en</strong>eity<br />

While the literature on jump processes in finance has focused on time homog<strong>en</strong>eous (Lévy)<br />

mo<strong>de</strong>ls, practitioners have t<strong>en</strong><strong>de</strong>d to use time <strong>de</strong>p<strong>en</strong><strong>de</strong>nt jump or volatility param<strong>et</strong>ers. Despite<br />

the fact that, as our non-param<strong>et</strong>ric analysis and several empirical studies by other authors<br />

[21, 67] have shown, Lévy processes reproduce the implied volatility smile for a single maturity