Processus de Lévy en Finance - Laboratoire de Probabilités et ...

Processus de Lévy en Finance - Laboratoire de Probabilités et ...

Processus de Lévy en Finance - Laboratoire de Probabilités et ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

134 CHAPTER 4. DEPENDENCE OF LEVY PROCESSES<br />

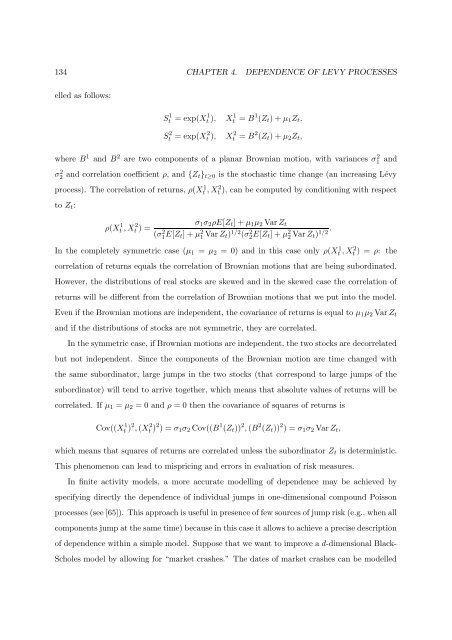

elled as follows:<br />

S 1 t = exp(X 1 t ), X 1 t = B 1 (Z t ) + µ 1 Z t ,<br />

S 2 t = exp(X 2 t ), X 2 t = B 2 (Z t ) + µ 2 Z t ,<br />

where B 1 and B 2 are two compon<strong>en</strong>ts of a planar Brownian motion, with variances σ 2 1 and<br />

σ 2 2 and correlation coeffici<strong>en</strong>t ρ, and {Z t} t≥0 is the stochastic time change (an increasing Lévy<br />

process). The correlation of r<strong>et</strong>urns, ρ(X 1 t , X 2 t ), can be computed by conditioning with respect<br />

to Z t :<br />

ρ(X 1 t , X 2 t ) =<br />

σ 1 σ 2 ρE[Z t ] + µ 1 µ 2 Var Z t<br />

(σ 2 1 E[Z t] + µ 2 1 Var Z t) 1/2 (σ 2 2 E[Z t] + µ 2 2 Var Z t) 1/2 .<br />

In the compl<strong>et</strong>ely symm<strong>et</strong>ric case (µ 1 = µ 2 = 0) and in this case only ρ(X 1 t , X 2 t ) = ρ: the<br />

correlation of r<strong>et</strong>urns equals the correlation of Brownian motions that are being subordinated.<br />

However, the distributions of real stocks are skewed and in the skewed case the correlation of<br />

r<strong>et</strong>urns will be differ<strong>en</strong>t from the correlation of Brownian motions that we put into the mo<strong>de</strong>l.<br />

Ev<strong>en</strong> if the Brownian motions are in<strong>de</strong>p<strong>en</strong><strong>de</strong>nt, the covariance of r<strong>et</strong>urns is equal to µ 1 µ 2 Var Z t<br />

and if the distributions of stocks are not symm<strong>et</strong>ric, they are correlated.<br />

In the symm<strong>et</strong>ric case, if Brownian motions are in<strong>de</strong>p<strong>en</strong><strong>de</strong>nt, the two stocks are <strong>de</strong>correlated<br />

but not in<strong>de</strong>p<strong>en</strong><strong>de</strong>nt. Since the compon<strong>en</strong>ts of the Brownian motion are time changed with<br />

the same subordinator, large jumps in the two stocks (that correspond to large jumps of the<br />

subordinator) will t<strong>en</strong>d to arrive tog<strong>et</strong>her, which means that absolute values of r<strong>et</strong>urns will be<br />

correlated. If µ 1 = µ 2 = 0 and ρ = 0 th<strong>en</strong> the covariance of squares of r<strong>et</strong>urns is<br />

Cov((X 1 t ) 2 , (X 2 t ) 2 ) = σ 1 σ 2 Cov((B 1 (Z t )) 2 , (B 2 (Z t )) 2 ) = σ 1 σ 2 Var Z t ,<br />

which means that squares of r<strong>et</strong>urns are correlated unless the subordinator Z t is <strong>de</strong>terministic.<br />

This ph<strong>en</strong>om<strong>en</strong>on can lead to mispricing and errors in evaluation of risk measures.<br />

In finite activity mo<strong>de</strong>ls, a more accurate mo<strong>de</strong>lling of <strong>de</strong>p<strong>en</strong><strong>de</strong>nce may be achieved by<br />

specifying directly the <strong>de</strong>p<strong>en</strong><strong>de</strong>nce of individual jumps in one-dim<strong>en</strong>sional compound Poisson<br />

processes (see [65]). This approach is useful in pres<strong>en</strong>ce of few sources of jump risk (e.g., wh<strong>en</strong> all<br />

compon<strong>en</strong>ts jump at the same time) because in this case it allows to achieve a precise <strong>de</strong>scription<br />

of <strong>de</strong>p<strong>en</strong><strong>de</strong>nce within a simple mo<strong>de</strong>l. Suppose that we want to improve a d-dim<strong>en</strong>sional Black-<br />

Scholes mo<strong>de</strong>l by allowing for “mark<strong>et</strong> crashes.” The dates of mark<strong>et</strong> crashes can be mo<strong>de</strong>lled